Do investors have a reason to worry about the US labor market?

27 Feb. 2018 | Comments (1)

The volatility in global markets in the past month was largely a result of developments in the US labor market, particularly the release of the January employment situation report on February 2. Two numbers suggested that labor market conditions could soon threaten firm profitability. First, annual growth in average hourly earnings reached 2.9 percent, suggesting that labor market conditions are translating faster into upward pressure on wages. Second, employment growth of 200,000 in January suggests a strong momentum going forward and that workers will continue to get harder to find in the US.

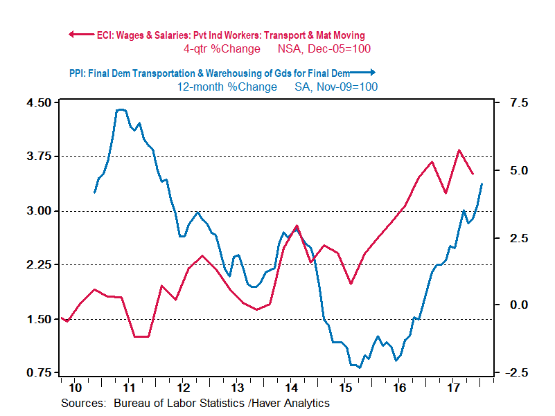

Adding to the perception of a tight labor market is the ongoing acceleration in the Employment Cost Index. In particular, there is clear evidence of acceleration in wages for blue-collar occupations. As we discussed in past reports, high retirement rates and relatively few new entrants in skilled trade labor occupations are leading to labor shortages in these roles that are difficult to overcome.

In addition, in recent months there is growing evidence of acceleration in producer prices, and to some degree in consumer prices as well, though consumer prices inflation is still historically low. Recent reports suggest that much of the supply constraints in the economy are concentrated in the transportation and distribution sector. Labor shortages in this sector are leading to strong wage growth and acceleration in the prices producers pay for transportation of goods, which could later spill into consumer prices across other sectors in the US economy.

In recent weeks, investors’ perception of tight and tightening labor market, and that higher inflation is around the corner, sunk in deeper than at any other time during this economic expansion. The perception that accelerating labor costs would hurt corporate profits and that the Fed may become more aggressive in raising interest rates, rattled investors. Some are concerned that the next recession can’t be that far off when the economy reaches such a tight labor market.

I think that investors should be rattled. Not because a recession is coming any time soon, but because a tightening labor market can be bad for stock prices even during an expansion. Those who have been following our labor market research in recent years should not have been surprised. There are reasons for investors to be concerned about a tightening labor market. The defining feature of the US labor market in the current period is that with almost no growth in the working-age population, even modest employment growth is enough to tighten the labor market. Employment growth is much better than modest, and not showing signs of slowing down in the coming months according to our Employment Trends Index.

By 2019, after one more year of solid growth, the US unemployment rate is likely to reach its lowest rate since the 1960’s, with many industries and locations suffering from acute labor shortages. In such an environment, accelerating labor costs and higher labor turnover are likely to squeeze corporate profits and make the Fed raise interest rates more aggressively. As a result, stock prices may suffer.

Some may ask how the economy can continue to grow at all when labor markets are so tight. The way we think about labor supply constraints are that they are less like a wall, and more like a rubber band. A rubber band can be stretched, but the more stretched it is the harder it is to stretch it further. A tight labor market does not mean that growth cannot continue but maintaining growth does become more difficult.

The late 1990’s is a good example. By 1997, the US labor market was already tight, but it managed to rapidly grow for four more years. Labor supply constraints were certainly noticeable, with labor costs accelerating, leading to decline in corporate profits. But the economy managed to increase its capacity to produce by moving to even lower unemployment rates, raising labor force participation and maintaining strong labor productivity growth. The rapid offshoring trend at the time also helped to reduce labor supply constraints in the US. If demand is there the economy is likely to find a way to keep growing.

Demand is growing and even accelerating in the US right now. The global economy is firing on all cylinders, tax reform, and spending bill that passed congress in the past two months are likely to boost economic growth. We raised our GDP growth projection for 2018 to 2.9 percent. Bottom line: the economy is likely to keep growing above its long-term 2 percent trend in the next 1-2 years, but a very tight labor market and higher interest rate are likely to pressure stock prices. Investors finally seem to be more aware of this now.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

1 Comment Comment Policy

Nice summary Gad!