Q4 ECI Wage Deceleration Slows

07 Feb. 2025 | Comments (0)

The Employment Cost Index (ECI) showed that wage growth continued to slow through the end of 2024. Yet, the pace of further deceleration remains uncertain, consistent with reports of continuing high labor costs from c-suite executives.

Trusted Insights for What’s Ahead®:

- Private-sector wage growth slowed to 3.6% year-over-year in Q4 2024 , from 3.8% in Q3 2024.

- Despite slower annual ECI growth, quarterly growth accelerated to 0.9% over Q4 from 0.8% in Q3, which is quite solid.

- Wage pressures remain strongest in transportation, warehousing, and in-person services, while pressures across the finance and technology sectors have softened more substantially.

- Tight labor supply, minimum wage increases, larger union contracts, and immigration limitations will likely sustain elevated wage growth into 2025, particularly in frontline services.

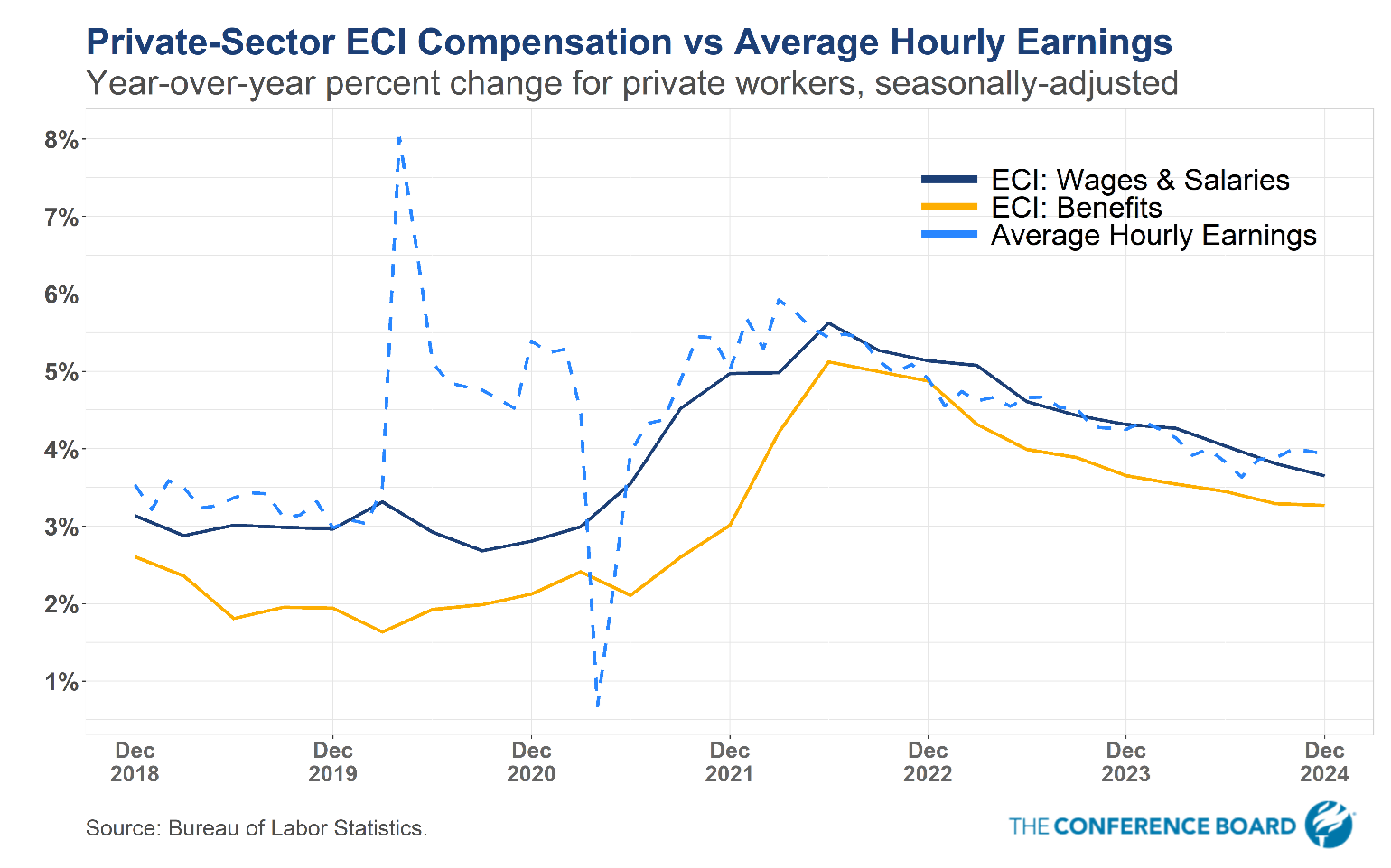

Figure 1. Pace of deceleration in wage growth is slowing

Report Highlights:

ECI Wage Deceleration Continues, Pace Slowing

The Employment Cost Index (ECI) for Q4 2024 showed that private wage growth continued to slow, easing to 3.6% year-over-year from 3.8% in Q3 (Figure 1). This partially reflects reduced rates of job-switching—a key driver of past wage acceleration—which have remained below pre-pandemic rates for more than a year. Despite moderation over 2024, the pace of wage growth remains above the 3.0% rate in 2019 and is not yet consistent with the Federal Reserve’s 2% inflation target.

The US labor market remains tight with the unemployment rate holding at 4.1% in December. Employers continue to report challenges in hiring and retention, despite slowing rates of hiring and worker turnover over the past year. An aging US workforce is weighing on labor supply growth, while access to foreign-born workers faces new policy uncertainty. We anticipate these trends together will continue to put upward pressure on wage inflation.

Also concerning for businesses, wage growth rose on a quarterly basis from 0.8% in Q3 to 0.9% in Q4. This aligns with other indicators, including monthly average hourly earnings, which plateaued over the back half of 2024 at a still-elevated level. The strong 4Q ECI number was partially driven by sales occupations and incentive-related pay to close the year. We posit that the pace of wage growth may not return to pre-pandemic levels and may be higher going forward.

Where is Wage Pressure Most Persistent?

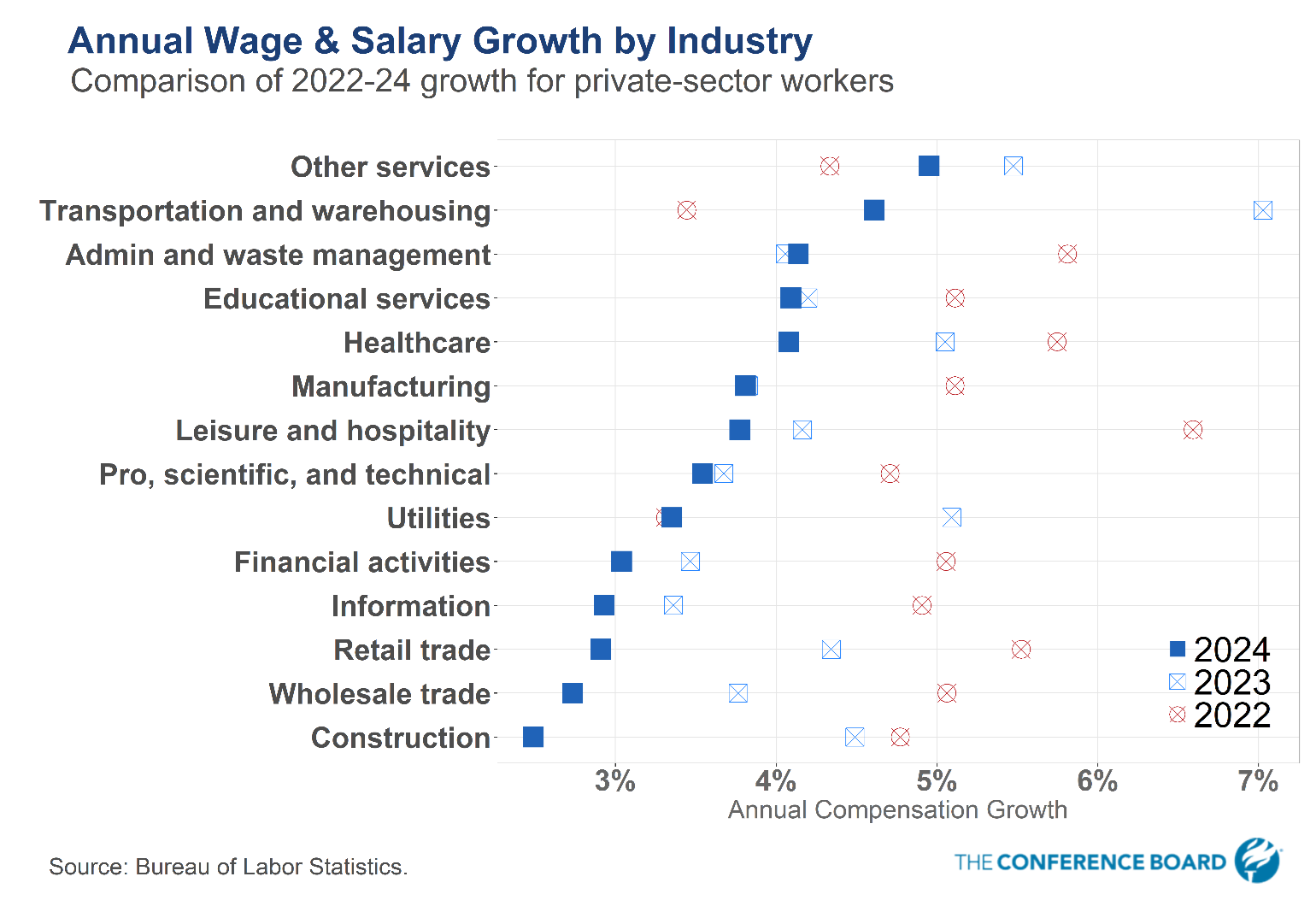

Compensation pressures vary across industries, despite overall wage moderation from 2022-24 (Figure 2). Service-sector wages overall rose 3.8% year-over-year through Q4, versus 3.4% for goods-producers. Companies in the other services category (e.g., maintenance & repair, personal services), followed by transportation & warehousing, educational services, and healthcare, saw the largest wage increases over 2024.

Figure 2. Persistence of wage pressures vary across sectors

Overall, occupations involving manual or in-person service work continued to see faster wage gains than many professional areas. Frontline service jobs showed the fastest annual growth across occupation types at 4.4%, followed by extraction, construction, & maintenance (4.2%), production, transportation, & material moving (4.2%), management & professional (3.5%), and sales & office (3.1%). Union workers also contributed to faster topline wage growth as renegotiated union contracts locked in large multi-year compensation raises to catch up to recent private-sector compensation increases.

Wage Outlook for 2025

Looking into 2025, wage growth is expected to continue moderating slowly but remain elevated above pre-pandemic levels. We anticipate that wage pressures are sustained moving forward given labor shortages and the aging US workforce. Restrictive immigration policies could further exacerbate shortages, particularly in sectors like manufacturing and construction. New minimum wage increases in 21 states took effect on January 1 and will also bolster pay for affected workers next year.

Companies have fully re-staffed since the 2022 re-hiring frenzy and the US labor market remains tight but healthy. With unmet demand for key technical and occupational skills—and with demographic shifts—acquiring and retaining top talent is vital.

-

About the Author:Mitchell Barnes

Mitchell Barnes is an Economist for the Labor Markets Institute within the Economy, Strategy, and Finance Center of The Conference Board. His work focuses on labor market trends, demographics, busines…

0 Comment Comment Policy