November Jobs Report Solidifies Fed Pause

08 Dec. 2023 | Comments (0)

Commentary on today’s US Bureau of Labor Statistics Employment Situation Report

Jobs report supports Fed’s desired slower consumption, inflation, and labor market trifecta

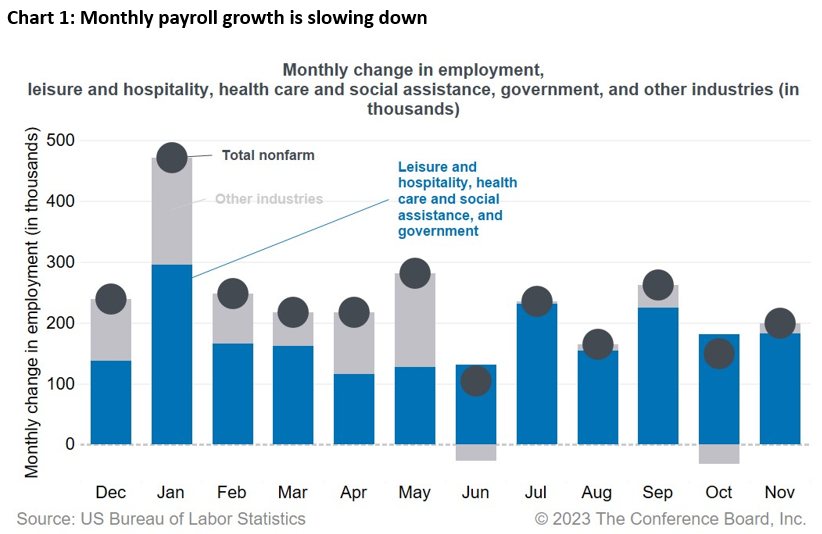

Today’s jobs report revealed that the labor market is cooling, consistent with the Fed’s desire to lower inflation. Nonfarm payroll additions totaled 199,000 in November. Excluding the return of striking workers, payrolls were up by 158,000. The job gain in October was unrevised, but September’s gain was revised down for a third time bringing three-month job growth to 204,000, significantly below its level at the start of the year (334,000 in January) (Chart 1).

Most November job additions continued to come from three sectors experiencing acute labor shortages: healthcare and social assistance, leisure and hospitality, and government. There was also a surge in manufacturing and information jobs following a resolution to the autoworker (UAW) and Hollywood (SAG-AFTRA) strikes. Most other industries were flat or negative in the month. We expect payroll gains to continue to slow and become negative in the first half of 2024.

With consumer spending growth slowing, labor market supply and demand coming into better balance, and slower total and core consumer price inflation, we do not expect the Fed to hike interest rates at the December 13 meeting. Easing may begin in mid-2024.

Jobs report confirms cooling labor market demand

The November payrolls report is consistent with other data released this week indicating that labor demand is slowing. Job openings in the JOLTS data continue to decline. The payrolls report revealed that wage growth slowed from 4.1 to 4.0% year-over-year in November as the quits rate in the JOLTS data is now back at its prepandemic level. Job switching had been a major driver of wage increases.

The payrolls report showed that the unemployment rate ticked down from 3.9 to 3.7%, reflecting more employed persons and fewer unemployed persons. The general uptick in the jobless rate from earlier this year is consistent with the steady rise in continuing jobless claims. Nonetheless, the unemployment rate remains historically low, as few CEOs (13%) of large firms in our US CEO Confidence Survey aim to cut workers and 49% are planning to retain workers. Small firms in the NFIB survey also have few plans to increase employment. Ultimately, the unemployment rate may rise to 4.3% in 2024.

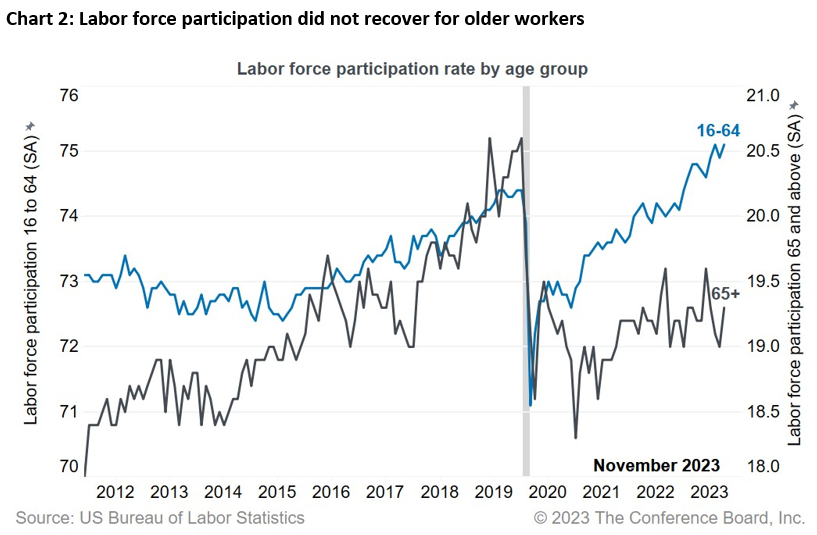

Baby Boomer Retirements Constrain Labor Supply Stoking Pockets of Labor Shortages

The overall labor force participation rate edged up from 62.7% in October to 62.8% in November, notably below the prepandemic rate. Persons ages 16-64 continue to increase their participation in the labor force as the participation rate reached from 74.9% in October to 75.1% in November, 1.4 ppts above February 2020 levels (Chart 2). However, people 65 and over, are staying on the sidelines with the participation rate increased from 19.0% in October to 19.3% in November, still 1.3 ppts below February 2020.

The main reason for continued weakness in labor force participation among the 65+ group is a higher than anticipated level of retirements following the pandemic. There are nearly 4.8 million more people who are not participating in the labor force due to retirement compared to February 2020. Even without accelerated retirements, the exit of a large generation from the labor force is expected to cause labor shortages to persist going forward.

Labor shortages can contribute to faster wage growth and, consequently, higher inflation. Against this backdrop, employers can consider providing incentives for older workers to work longer or to return to the labor force. Older workers tend to prefer part time positions, suggesting flexible hours and work location are important determinants for attracting and retaining workers in the 65+ age group.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

0 Comment Comment Policy