Strong Payrolls and Lofty Wages to Keep Fed Waiting for Cuts

08 Mar. 2024 | Comments (0)

Trusted Insights for What’s Ahead®

- Nonfarm payrolls continued to reveal strength in the labor market in February.

- Job gains were still very much concentrated among sectors with major labor shortages, but there was still some broadening out of monthly gains to other industries.

- A healthy labor market supports the Fed’s goal of subduing inflation without major damage to the economy or labor markets, but gains are still outsized.

- Additionally, persistent wage inflation and its passthrough to consumer prices remains a key challenge to the Fed achieving its 2-percent target.

- The February data suggest that the Fed will likely wish to wait longer for more data before it is convinced that rate cuts should ensue.

- We continue to anticipate interest rate cuts will begin around mid-year, with potential for 100 to 125 basis points of cuts this year.

Highlights

Nonfarm payrolls rose by 275,000 in February following downwardly revised additions of 229,000 (vs. 353,000) and 290,000 (vs. 333,000) in December and January, respectively. Downward revisions over the past two months summed to 167,000, but the three-month average payrolls of 265,000 was still outsized.

The unemployment rate rose from 3.7 percent in January to 3.9 percent in February but remained relatively low. Labor force participation was unchanged at 62.5 percent for a third consecutive month but held below the February 2020 level as Baby Boomer retirements continue to weigh on the measure.

Hours worked edged up slightly by 0.1 hours to 34.3 after collapsing in January but remained below the 2019 level. While firms have been generally raising wages, these decisions have come at the cost of fewer hours.

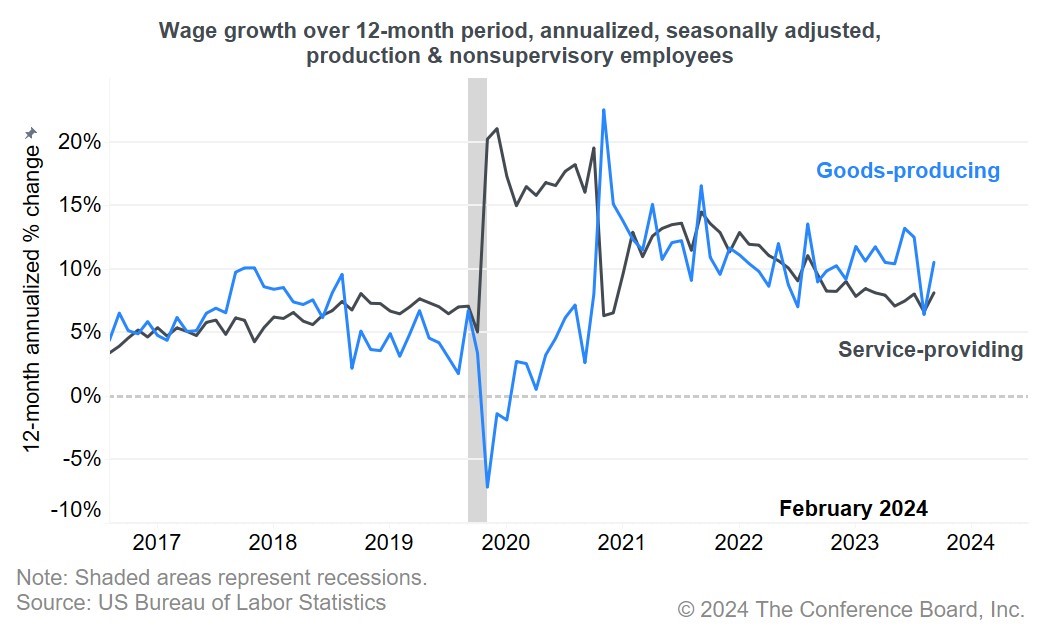

Average hourly earnings slowed a tad from 4.4 to 4.3 percent year-on-year but remained quite elevated compared to the prepandemic period reflecting ongoing labor shortages across a variety of sectors. Sticky wages are a lingering threat to the Fed lowering consumer inflation back to its 2-percent inflation target.

February Employment Report Details

The Usual Suspects Continued to Bolster Payrolls

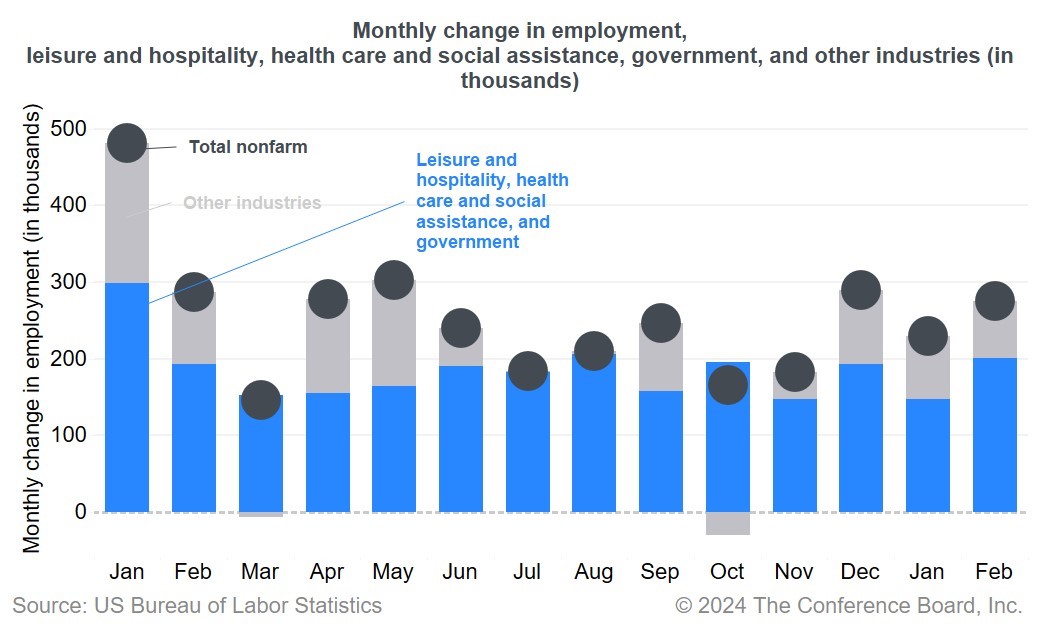

The major drivers of payroll gains in February continued to be in sectors experiencing the worst labor shortages as suggested by JOLTs data. Health care and social services payrolls rose by 91,000, leisure and hospitality by 58,000, and government by 52,000. While total job openings edged lower in recent months, openings remain notably above 2019 levels in government (especially state and local government away from education), education and health services, and leisure and hospitality. Unsurprisingly, these sectors accounted for 201,000 or 73 percent of total payroll additions in February.

Job Gains Broadened for a Third Consecutive Month

Job gains were also apparent in other sectors, including construction (23,000), retail (19,000), and transportation and warehousing (20,000). This is notable as sectors away from the key drivers noted above added few if any jobs in 2023. The slight broadening of employment gains suggests somewhat greater confidence among firms to hire more workers. Notably, industrial policies encouraging reshoring of supply chains in critical products like high tech, chemicals, defense, and pharmaceuticals, as well as in infrastructure, continue to stoke employment growth in nonresidential construction subsectors.

Temp Help Employment Weighed Down by Labor Hoarding

Professional business services, which include temporary employment agencies, rose again in February. Professional and business services also had a surplus of job openings in the JOLTS data, which look like they are being slowly filled. However, this industry continued to be weighed down in February by temporary help services, which have cut jobs every month for the last 23 months. The weakness in the temporary help sector last year largely reflected the fact that many companies, as revealed in The Conference Board CEO Confidence Survey for the US, retained workers despite concerns about an economic downturn. Ongoing labor shortages and the desire to avoid further increases in labor costs associated with rehiring after shedding workers is the cause for continued labor hoarding among employers.

Right-sizing Among Former Pandemic Darlings Persisted

However, there was some weakness in the report as former “pandemic darling” industries continued to right-size payrolls. The financial, tech and residential construction sectors either added few jobs or were flat in February. The transportation and warehousing sector added about 20,000 jobs but gains were all concentrated among couriers while all other subsectors were down or flat. Pandemic darling sectors thrived early in the COVID-19 era as consumers mainly purchased goods needing to be shipped and technology was in high demand. Additionally, super low interest rates bolstered financial and housing sectors and kept borrowing costs low for the tech sector. Over the course of 2023 and now into 2024, these sectors continue to shed workers or hire sparingly to protect margins as demand for their products and services soften, high interest rates keep the cost of capital high, and, in the case of the tech sector, employers seek to right-size after a period of over-hiring.

The Unemployment Rate Remained Low

The unemployment rate rose to 3.9 in February from 3.7 in January. It is currently only 0.5 percentage point above the post-pandemic low of 3.4 achieved in early 2023. While we continue to anticipate some continued uptick in the unemployment rate, likely to 4.2 percent by yearend as real GDP growth flattens over Q2 and Q3 2024, it will remain near historical lows. One reason for the relatively modest unemployment rate is a limited number of layoffs expected as companies continue to struggle attracting and retaining talent. Indeed, labor issues were the most cited internal concern among CEOs in the US according to The Conference Board C-Suite Outlook 2024. A second reason for a low unemployment rate is retirements: as older workers drop out of the labor force a smaller number of people are potentially looking for a job.

Labor Force Participation Capped by Retirements

The Labor Force Participation Rate (LFPR) was unchanged for a third consecutive month at 62.5 percent in February. The overall measure remains well below the 63.3 rate reported in February 2020, just before the pandemic was declared in the US in March 2020. The LFPR for persons ages 16 through 64 at 74.6 percent in February was somewhat lower than what was reported in late 2023 but still above the 2019 range. Still, the overall LFPR gauge continues to be weighed down by LFPR among workers 65 years and older. Many in this cohort dropped out of the labor market during the worst of the pandemic and declined to return. Additionally, overall LFPR likely will continue to be depressed by ongoing Baby Boomer retirements.

Wage Inflation Remained Elevated Compared to Prepandemic Norm

Average hourly earnings slowed a tad from 4.4 to 4.3 percent year-on-year in February but remained quite elevated reflecting ongoing labor shortages across a variety of sectors. Goods wages are still generally rising year-over-year and are notably above the average experienced between the Great Recession and the pandemic. Services wages are slowing, but also are materially elevated compared to before the pandemic. Sticky wages are a lingering threat to the Fed lowering consumer inflation back to its 2-percent inflation target.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global …

0 Comment Comment Policy