Employment Report Shows Continued Solid Job Growth

06 May. 2022 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

Today’s jobs report showed further job gains in April, following months of solid growth in the first quarter of 2022. The labor market continues to expand, especially in in-person services and in other industries that have yet to fully recover job losses incurred since the pandemic. Severe labor shortages continue to drive up wages, adding additional pressure on inflation. The labor market remains strong while the Federal Reserve maintains its focus on stabilizing prices with increasing interest rates and a commitment to shrinking their asset portfolio.

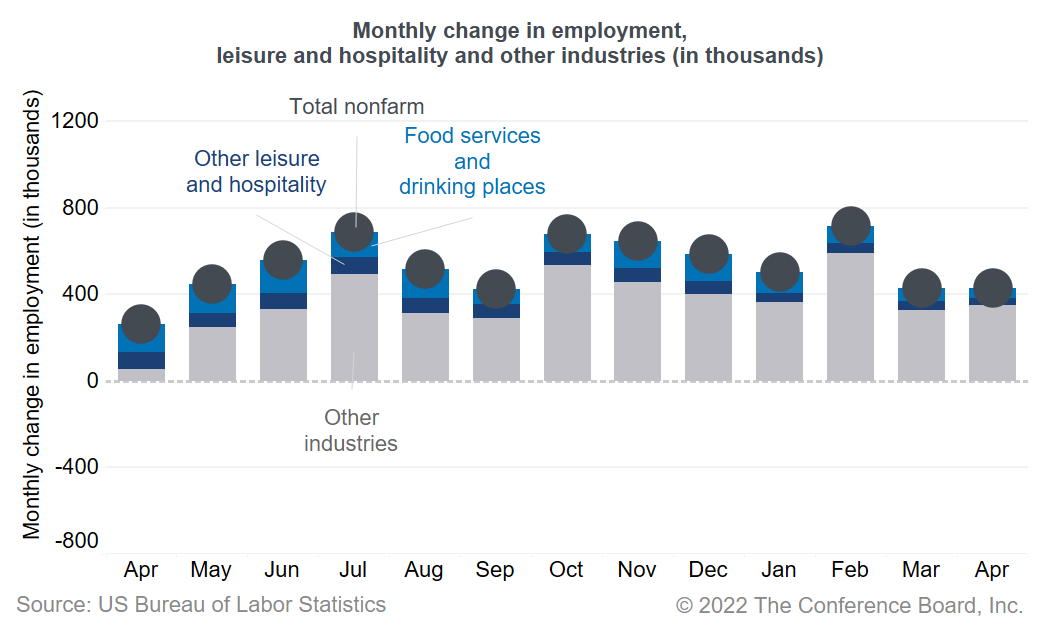

Nonfarm payroll employment increased by 428,000 in April, after a slight downwardly revised increase of 428,000 in March. The labor force participation rate decreased slightly to 62.2 percent, compared to 62.4 percent in March, while the unemployment rate remained unchanged at 3.6 percent. Overall, employment is still down 0.8 percent compared to pre-pandemic (February 2020) levels, representing 1.2 million jobs. Job recovery has been slower for women, with employment still 1.1 percent below pre-pandemic levels, compared to 0.5 percent for men.

Job growth continued to be strong in leisure and hospitality, which added 78,000 jobs in April. Transportation and warehousing added 52,000 jobs and manufacturing added 55,000 jobs. Compared to February 2020, however, employment is still down 19.1 percent in accommodation and 6.4 percent in food services and drinking places, indicating that in-person services industries have room to see additional job gains in 2022.

Average hourly earnings rose 5.5 percent over the past 12 months, with an 11.0 percent increase in leisure and hospitality and a 7.1 percent increase in transportation and warehousing. Wages will continue to rise steadily, especially in industries most impacted by labor shortages.

Severe labor shortages continue to impact recruiting and retention, with the March quits rate matching last year’s historical high of 3 percent. Labor force participation rates are not expected to rise significantly in 2022, especially among older workers, and there will continue to be more jobs than workers to fill them. Lingering fears of COVID-19 infection, lack of childcare options, early retirements, and other issues are all preventing more workers from re-joining the labor force.

The unemployment rate is expected to get close to 3 percent by the end of the year, with labor shortages showing no signs of alleviating. We also continue to expect 2.1 million more payroll employment gains this year. Wage growth will likely continue to accelerate as a result, adding further pressure on inflation.

-

About the Author:Agron Nicaj

Agron Nicaj is a former Associate Economist with The Conference Board’s Help Wanted OnLine (HWOL)© and Labor Markets programs. He was responsible for the production and analysis of the HWOL…

0 Comment Comment Policy