Job Growth Remains Strong

02 Dec. 2022 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

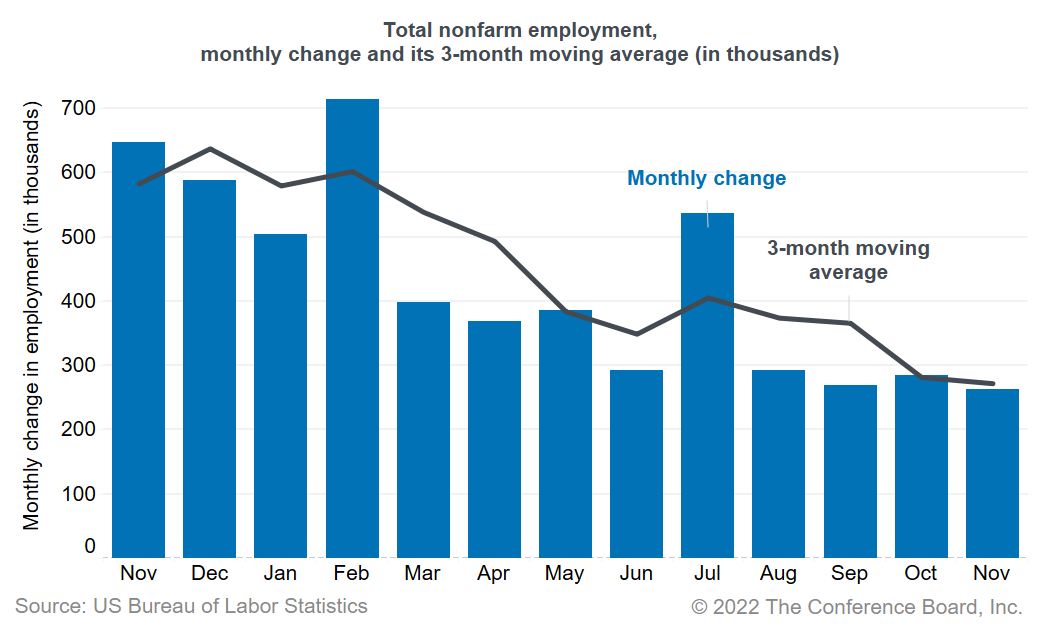

Today’s jobs report showed another strong month of job growth, with 263,000 jobs added in November 2022, after an increase of 284,000 jobs (an upward revision) in October. This report underscores that the US labor market remains robust. The strong pace of hiring reflects continued and resilient demand for workers. Labor shortages may have eased compared to earlier in 2022, but recruitment and retention difficulties remain high. While layoffs are not widespread, temporary help services jobs—a leading indicator for hiring—have now declined for four consecutive months, signaling slower job growth ahead.

With no significant slowdown in the labor market visible yet, the Fed is likely to further raise its target interest rate by 50 basis points at its upcoming December meeting. Job growth is likely to decelerate in 2023, when a slowing US economy and higher interest rates are expected to start having a stronger negative impact on hiring.

The unemployment rate remained at 3.7 percent in November 2022. The labor force participation rate for people aged 16 and older ticked down to 62.1 percent, from 62.2 percent in October 2022.

Leisure and hospitality reported another strong month of employment gains, with 88,000 jobs added in November (after adding 60,000 jobs last month). Other noteworthy gains were reported in health care and social assistance (68,100), construction (20,000), and manufacturing (14,000). On the other hand, after applying seasonal adjustment, today’s report showed the third consecutive month of job losses in retail and transportation and warehousing. This may reflect weakness in these industries. Alternatively, it could also mean that companies may be upstaffing less for the holiday season compared to previous years as inflation weighs on consumer spending. Without seasonal adjustment, retail and transportation and warehousing gained jobs over the last two months.

Currently, labor shortages are still a significant problem for employers. Wage growth is not accelerating, but growth rates remain elevated. Average hourly earnings grew 5.1 percent over the past year, only slightly down from an average of 5.4 percent in the first half of 2022. The job openings rate (6.3 percent) and quits rate (2.6 percent) are lower compared to earlier this year, but still high.

Labor shortages are a result of robust demand for workers, but limited labor supply. The aging of the US population is the main driver of shortages, but labor supply is being further squeezed because of stagnant labor force participation rates. Participation for people aged 25 to 54 is at 82.4 percent in November 2022—still below its prepandemic rate of 83 percent in February 2020. The gap in participation rates for people aged 55 and over is even larger—38.6 percent in November 2022 compared to 40.3 percent in February 2020.

On the other hand, there is still a large cohort who are marginally attached to the labor force—people currently not in the labor force, but who want a job and have looked for work in the past 12 months although not recently. At around 1.5 million, this group is slightly bigger than it was before the pandemic (1.4 million in 2019). This group could potentially be an additional source of labor, although the projected upcoming recession—which would result in fewer job opportunities—may discourage some of these people from entering the labor force in 2023.

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy