2023 Starts with Strong Job Gains

03 Feb. 2023 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

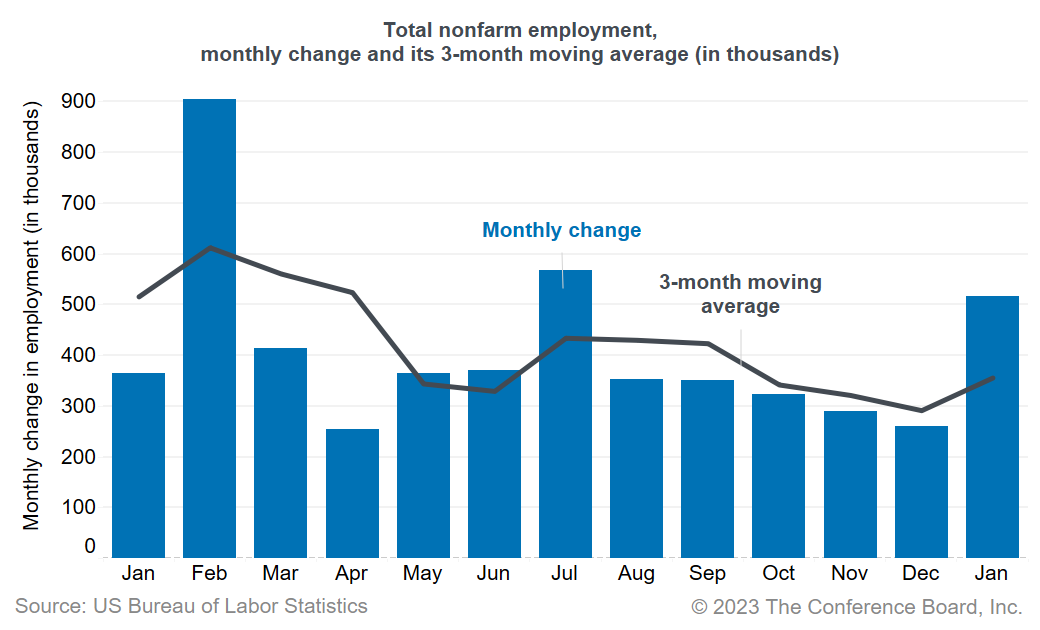

Today’s jobs report showed that the US labor market remains on solid footing, with a whopping 517,000 jobs added in January 2023, after an increase of 260,000 jobs (an upward revision) in December 2022. Labor shortages are still severe and layoffs across the US labor market continue to be low. Voluntary quits and job openings are elevated and—after declining from their highest point a year ago—have not changed much since last Summer. Wage growth is also still strong (4.4 percent growth over the past year) and, although it has come down from its peak in early 2022 (5.9 percent growth), wages continue to be growing at well above their prepandemic rate (2-3 percent growth). Altogether, today’s data underscore that the labor market is still very strong. This jobs report supports our expectation that the Federal Reserve may raise interest rates two more times by 25 basis points each over the coming months.

The unemployment rate dropped to a historically low 3.4 percent in January (from 3.5 percent in December 2022), the lowest rate since the late 1960s. The labor force participation rate for people aged 16 and older ticked up to 62.4 percent in January (from 62.3 percent in December), but this increase was driven by adjustments to population estimates in the household survey. Over the past year, no significant change in participation has been reported.

Similar to previous months, strong job gains were made in health care and social assistance (79,200), leisure and hospitality (128,000), and personal and repair services (18,000). These industries have been responsible for almost 60 percent of total job gains over the last three months. Other notable increases were reported in professional and business services (82,000), government (74,000), manufacturing (19,000), construction (25,000), retail trade (30,100), and transportation and warehousing (22,900). Temporary help services—a leading indicator for hiring—gained 25,900 jobs. In November and December this industry shed jobs, but this reversed in January. Information—which represents a larger share of tech companies—was one of the few industries that shed jobs (-5,000). However, there is little evidence that weakness in this industry is spreading to other parts of the US economy.

Job growth in 2022 appears to have been stronger than initially reported following annual benchmark revisions, updated seasonal factors, and industry classification conversion in the establishment survey. During 2022, 311,000 additional jobs than previously estimated were created, highlighting that the US labor market was even more robust over the past year. In 2021, another 524,000 more jobs were created following the revisions.

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy