Job Growth Moderates in September; Further Cooling Expected

07 Oct. 2022 | Comments (0)

Job Growth Moderates in September, with Further Cooling Expected

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

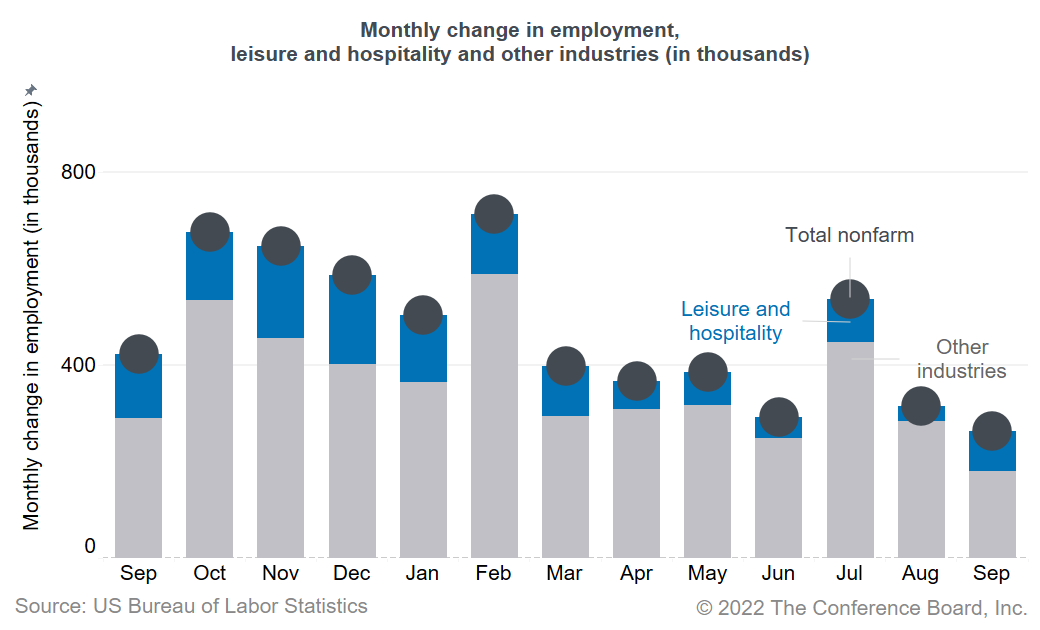

Today’s jobs report showed moderating job gains, with 263,000 jobs added in September 2022, after an increase of 315,000 jobs in August. While this is still a robust rate of employment growth, it is well below the average of 420,000 added per month so far in 2022. Softer job gains were expected amid a weakening economy, the Federal Reserve’s rapid interest rate hikes, and the recovery most industries have already seen from pandemic-induced job losses. With the number of job openings—an important leading indicator of hiring—already on the decline, September’s softer jobs report is another sign that the labor market is cooling. The pace of hiring is expected to slow further as the end of 2022 approaches.

The unemployment rate fell to 3.5 percent in September 2022, down from 3.7 percent in August. The labor force participation rate ticked down to 62.3 percent, from 62.4 percent in August.

Job gains were visible in most industries. Leisure and hospitality added another 83,000 jobs, with notable gains also seen in health care and social assistance (75,400), professional and business services (46,000), manufacturing (22,000), and construction (19,000). Temporary help services—a leading indicator for hiring—continued to add jobs (27,200), signaling that there may still be potential further, albeit slower, job gains ahead.

The labor market remains very tight with average hourly earnings still elevated at 5 percent growth over the past year. However, there are signs that the labor market is cooling. The number of job openings has fallen 15.2 percent since its peak in March 2022; quits remain high but are also down by 6.5 percent since March 2022. The worst of labor shortages may be behind us for now. Further easing of recruitment and retention difficulties can be expected over the next months if the labor market indeed continues to cool.

At the same time, there are no clear signs yet of increasing layoffs. This could change in 2023 with the growing likelihood that the US will fall into recession. Still, the unemployment rate is currently projected to only rise to about 4.5 percent in 2023, still quite low in historical context. With the recession projected to be short, job losses may be relatively small. Furthermore, companies have had difficulties over the past year attracting and retaining workers and may therefore avoid implementing layoffs. Altogether, this means that labor shortages may ease over the coming year but are unlikely to disappear.

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy