The drop in spending of older Americans and its regional impact

31 Mar. 2020 | Comments (0)

One of the striking features of COVID-19 is that it appears to be much more dangerous for older people than for younger people. As a result, older people are more likely to stay at home and avoid having other people enter their home. As older Americans will experience a longer and more extreme social distancing, they are likely to cut back on spending more than younger people.

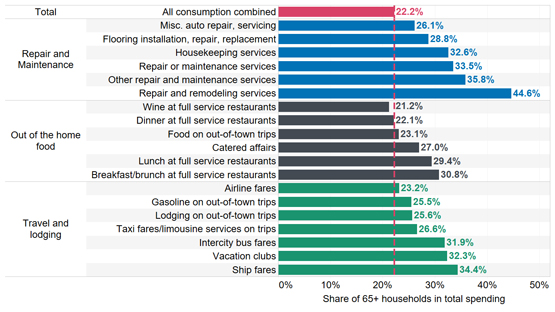

Households where the head of the household is 65 years old or older (referred to below as “older households”), are responsible for 22 percent of total household expenditures in the US. In many consumption categories, they are responsible for a much higher share.

In Chart 1 we show several consumption categories where 1) older people are responsible for an above average share of spending and 2) where older people are more likely to cut spending on due to social distancing.

These consumption categories most impacted can be divided into three groups:

- Travel and lodging. Older people spend more on vacationing. For example, older households’ fondness of cruises makes them responsible for over a third of all expenditure on ship fares.

- Full-service restaurants. Older households have an outsized share in restaurant spending. For example, about 30 percent of spending on breakfast and lunch in full-service restaurants comes from older households.

- Repair and maintenance. Social distancing may impact not just on outdoor activities, but also activities that will require other people to enter their home. Older people will be more reluctant letting people enter their home. In some of these categories older households tend to spend more than younger ones. For example, 45 percent of the spending on repair and remodeling services is spent by older households.

In sum, in many of the consumption categories that are especially sensitive to social distancing, older households are responsible for a large share of spending. Other things equal, these categories will experience a larger drop in spending because of the more extreme social distancing of older Americans.

Chart 1: Older households make up an especially large share of spending in repair and maintenance, full-service restaurants, and travel and lodging

Share of spending coming from households with a household head 65 years or older

Source: Consumer Expenditure Survey from the US Bureau of Labor Statistics

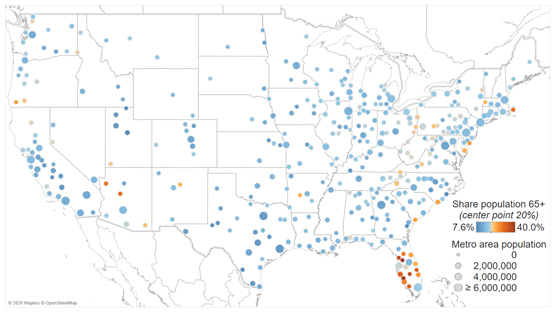

Since older people are more likely to cut spending, areas with a higher share of older people are also likely to see a bigger drop in consumer spending. Chart 2 shows the share of population 65+ across metro areas. The metro areas with the highest share of older people are typically:

- Retirement destinations. Florida, the shore of the Atlantic Ocean, and Arizona stand out. Many of these metro areas will suffer from a double whammy. Not only they have many older consumers, they also are vacation destinations that in a period of social distancing will lose a lot of business.

- Metro areas with declining industries. Metro areas in states such as Ohio, Pennsylvania, and West Virginia had a strong concentration of declining industries such as steel and coal, leading to out-migration of younger people.

Businesses should expect a large variation in the impact of COVID-19 across metro areas, partly due to the large variation in the share of older households. With the share of older Americans rapidly growing in the US, businesses, especially in the hard-hit metro areas, should do everything they can to accommodate a safe consumer experience.

Chart 2: The share of older people is especially large in retirement destinations and metro areas with declining industries

Share of population 65 and above by metro area, 2017

Source: US Census Bureau

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

-

About the Author:Ben Cheng

The following is a biography of former employee/consultant. Ben Cheng is a researcher in the economics department at The Conference Board. He received his undergraduate degree in economics and mathem…

0 Comment Comment Policy