Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

02 November 2022 | Press Release

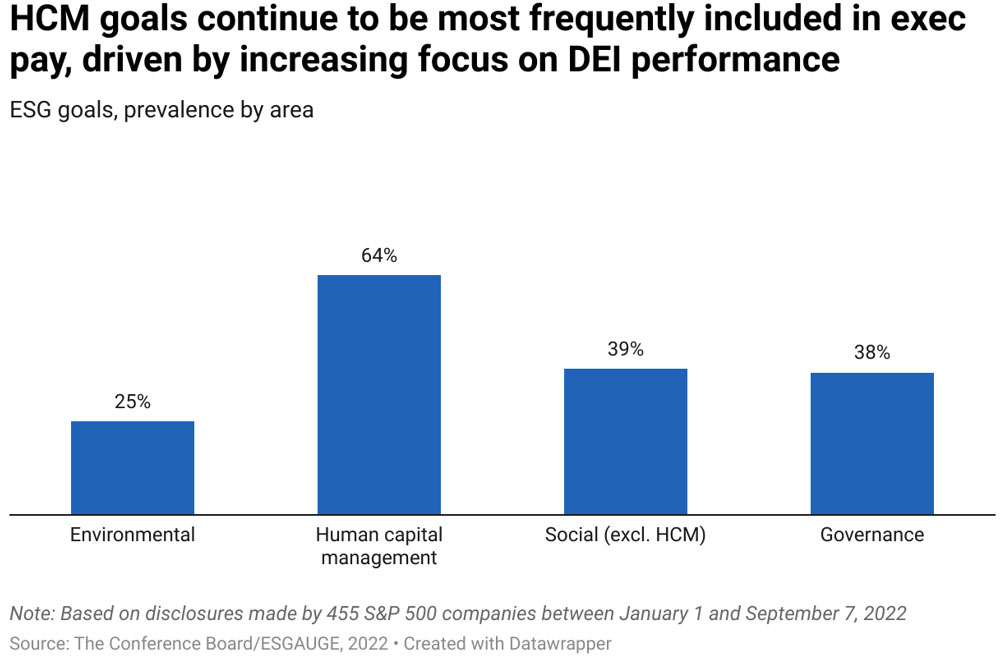

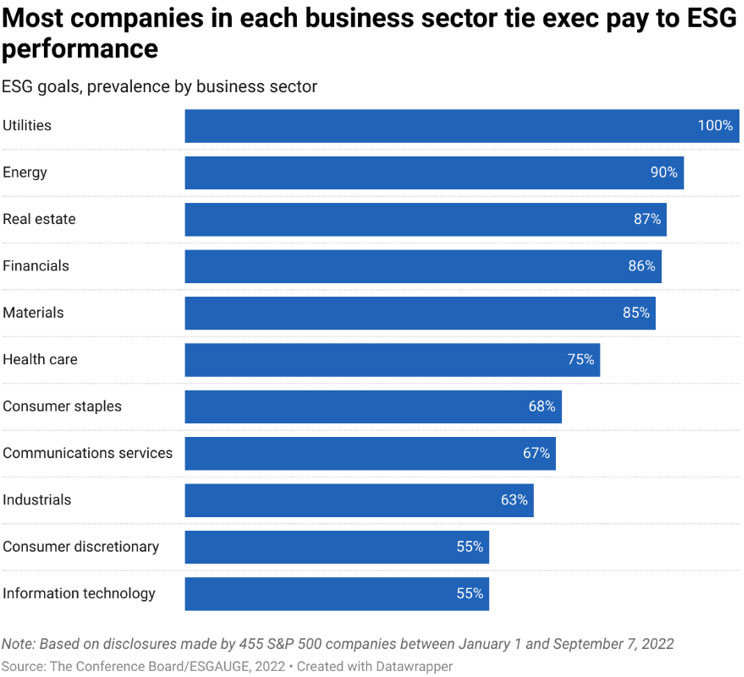

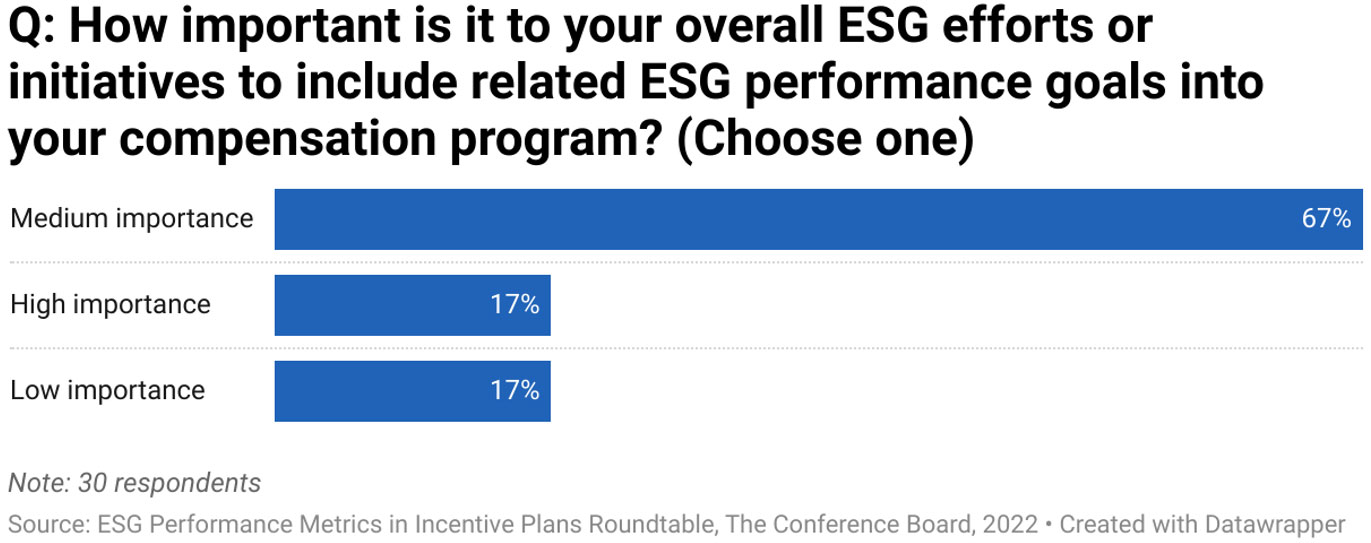

Large US companies are increasingly linking executive compensation to some form of ESG performance, with the share growing from 66 percent in 2020 to 73 percent in 2021. At the same time, just a minority of polled corporate executives say including ESG (environmental, social, and governance) performance goals in executive pay is very important in achieving their ESG goals. Most view such measures as being of medium importance, which indicates that incorporating ESG measures into compensation is just part of companies’ broader efforts to achieve their objectives.

The findings come from a new report by The Conference Board, produced in collaboration with Semler Brossy and ESG data analytics firm ESGAUGE. The study includes various trends—and highlights lessons learned—relating to companies tying executive pay to ESG performance.

In addition to the analysis showing an overall increase in the adoption of such goals, some ESG topics have gained considerably more traction than others: From 2020 to 2021, the share of S&P 500 companies incorporating DE&I (diversity, equity and inclusion) goals in executive compensation grew from 35 percent to 51 percent. And carbon footprint and emission goals nearly doubled, increasing from 10 percent to 19 percent.

To understand the opportunities and challenges companies have in implementing ESG performance goals in executive compensation programs, The Conference Board convened a roundtable with executives in compensation, ESG, governance, and sustainability. Participants said the top reason to link executive pay to ESG performance goals is signaling ESG as a priority, followed by responding to investor expectations. The top two reasons for not tying executive compensation to ESG is the challenge of defining specific goals, followed by skepticism about their effectiveness.

“Companies should consider using ESG operating goals for one to two years before including them in compensation,” said Merel Spierings, author of the report and Researcher at The Conference Board Governance & Sustainability Center. “That allows time to see if those goals are truly relevant for the business and develop strong buy-in from management and employees. It is especially important for companies to both validate and broadly communicate ESG goals before rolling them out as part of compensation plans for a broader management or employee base.”

The report offers the following findings and insights:

Note: Some companies use multiple approaches, which explains why the sum of the percentages exceeds 100 percent.

The insights below come from a recent Governance & Sustainability Center roundtable with executives in compensation, ESG, governance, and sustainability. Participants discussed lessons learned and the road ahead in linking executive compensation to ESG.

“Compensation committees and senior executives will want to carefully consider whether they have a compelling business rationale for adopting, adjusting, or expanding the use of ESG goals in executive compensation,” said Blair Jones, Managing Director of Semler Brossy. “The ESG component of executive compensation should do more than send a signal to investors or other stakeholders about the importance of ESG; it should help drive the company’s business strategy and ESG program.”

“It takes time to develop and compile reliable, meaningful data that companies can use to measure and report actual performance against ESG goals,” said Umesh Chandra Tiwari, Executive Director of ESGAUGE. “They can start by putting together a steering committee with representatives from various functions who are engaged in the company ’s strategy and can understand and access the data needed to measure and report on ESG performance.”

Media Contact:

Daniela Banos

dbanos@tcb.org