September 17, 2020 | Chart

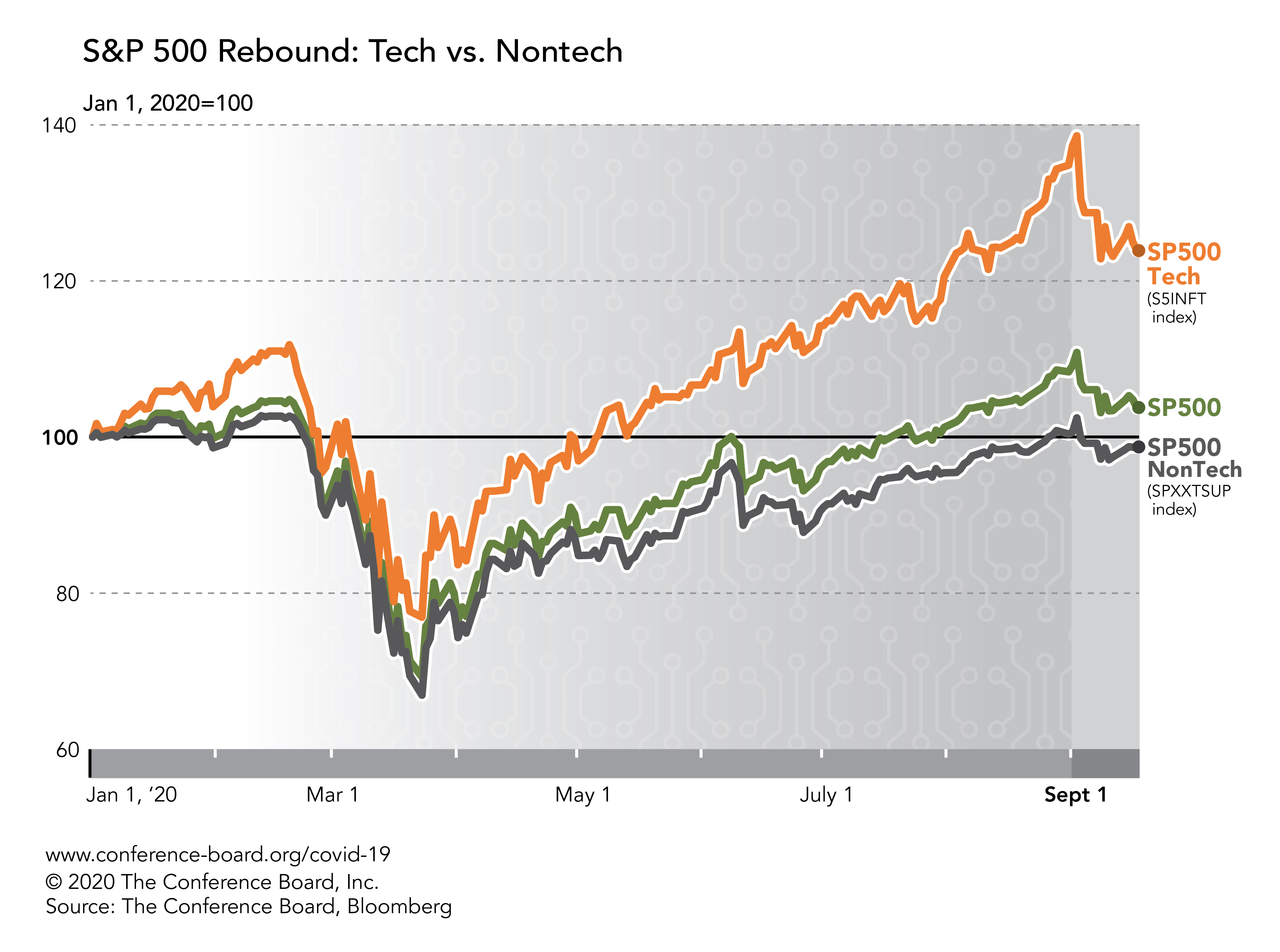

US stock prices have roared back to life following the COVID-19-driven collapse in February and March, but technology stocks are responsible for most of this gain. The rapid adoption of technology among households and businesses in recent months may be a key factor in this ongoing story.

While extreme Fed accommodation, significant fiscal policy support, and better-than-expected earnings in some sectors are contributing to improvements in equity markets, these forces don’t explain the divergence between technology and nontechnology valuations. The S&P 500 (green line) has recovered to its pre-COVID-19 level, but the technology companies in this index have far outperformed the nontechnology ones. Indeed, the S&P 500 IT Index (orange line) is up nearly 24 percent from where it started the year. Meanwhile, S&P 500 Ex-IT Index (grey line) is still about 2 percent below its Jan 1, 2020 level.

Why the large divergence? We suspect that the rapid adoption of various technologies this year, including those related to telework, e-commerce, and distance learning, are fueling investor expectations that these kinds of technology companies are becoming even more important to the economy than they were before the pandemic. The kind of tech adoption that the US has embraced over the last 6 months may have otherwise taken years, were it not for COVID-19 and the lockdown. It is likely because of this that traditional companies have not been able to capture the upside their Silicon Valley peers have. Future gains for nontech firms may hinge on whether adoption of these new technologies delivers better performance.

July 27, 2022 | Newsletters & Alerts