-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

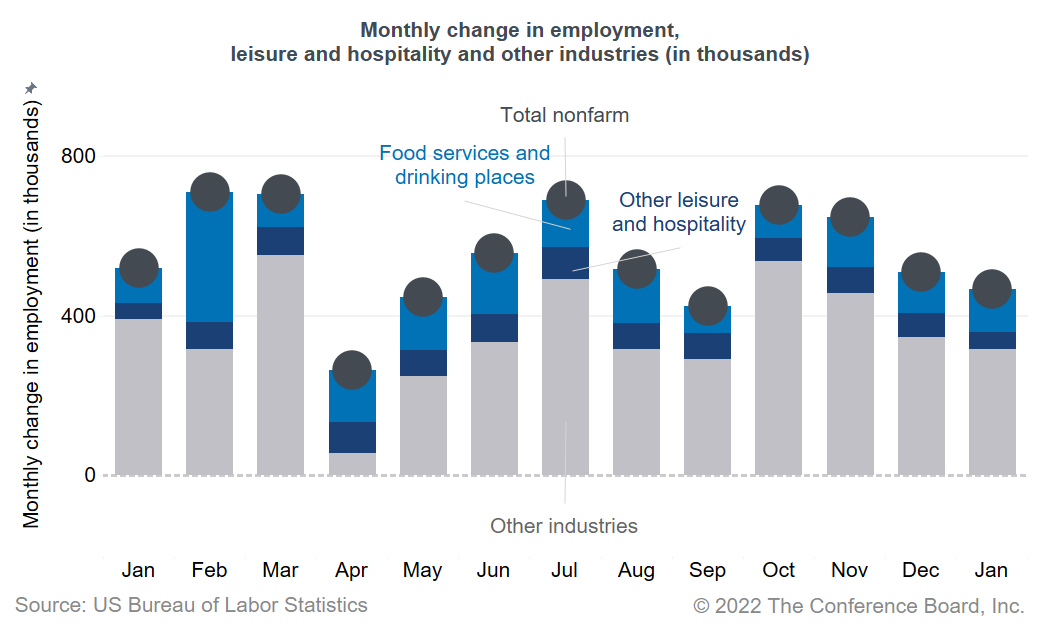

Today’s jobs report showed a better-than-expected increase in the number of jobs in January. Disruptions related to the Omicron variant do not seem to have derailed continued progress in the labor market. However, headwinds for employers persist, as labor shortages are still severe and economic activity remains healthy. Nonfarm payroll employment increased by 467,000 in January, after an upwardly revised increase of 510,000 in December. The unemployment rate ticked up slightly to 4.0 percent, as the number of job-leavers and those on temporary layoffs increased; the labor force participation rate remained essentially the same at 62.2 percent in January after taking the new population controls into account. Overall, jobs still number 2.9 million below prepandemic (February 2020) levels, with women representing 63 percent of these employment losses. Note that this month’s release incorporates larger revisions to the Establishment Survey (used for nonfarm payroll employment) and Household Survey (used for the unemployment rate). Revisions to payroll employment were especially large over the past year. Leisure and hospitality gained 151,000 jobs in January—a possible signal that businesses have become better at continuing operations amid a surge in COVID-19 infections. A majority of other industries also added new jobs, except for construction and mining, where small job losses were recorded. On the other hand, many businesses still experienced disruptions. For example, 6 million people reported that they had been unable to work because their employer closed or lost business due to the pandemic at some point in the past four weeks, up from 3.1 million in December. Wages continued to rise rapidly. Average hourly earnings increased 5.7 percent over the past 12 months, signaling that recruitment and retention difficulties remain high. With the unemployment rate expected to fall to near 3 percent by the end of the year, labor markets will remain tight in 2022 and likely beyond. The US working-age population is projected to barely grow over the next decade. Employers hiring manual labor and services workers (such as transportation, construction, food services, and personal care) will face an especially hard time finding qualified workers. In such an environment, wage growth will likely remain elevated, which in turn would put more pressure on price inflation. Some relief could come for employers if more people would return to the labor force, but the labor force participation rate is still at 62.2 percent—more than 1 percentage point below its prepandemic rate. Continued improvements in the labor market and higher wages should attract some people back to the job market, and participation rates may improve slightly during 2022. On the other hand, workers retiring early during the pandemic explain part of the gap in participation, and few of these older workers are expected to return. Job growth in November and December was revised up by 709,000, implying job growth did not slow towards the end of 2021. This jobs report supports the Fed’s increasingly hawkish guidance, and we are currently expecting at minimum four 25-basis-point interest-rate hikes in 2022.Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Storms and Strikes Muddy October Jobs Report

November 01, 2024

Charts

Consumer Confidence Declined for Second Consecutive Month in February

LEARN MORECharts

Omicron, Inflation, and Fed Dampen US Growth Prospects

LEARN MORECharts

Almost two years after the COVID-19 pandemic plunged the United States and the world into economic and social disruption, the nation is recovering.

LEARN MORECharts

High demand for labor is resulting in rapid hiring of the unemployed.

LEARN MORECharts

The Conference Board’s Salary Increase Budget Survey indicates that the average annual raise for current employees is accelerating.

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORECharts

America’s recent decline in global competitiveness raises concerns about the nation’s future economic stability and national security

LEARN MORECharts

Firms are struggling mightily to hire workers.

LEARN MORECharts

Crypto tokens--or cryptocurrencies---have a notional market value of more than $2.5 trillion today and are on pace to expand exponentially.

LEARN MOREFilter By Center

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

PRESS RELEASE

Stagnant Productivity Growth Returns

April 29, 2022