-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

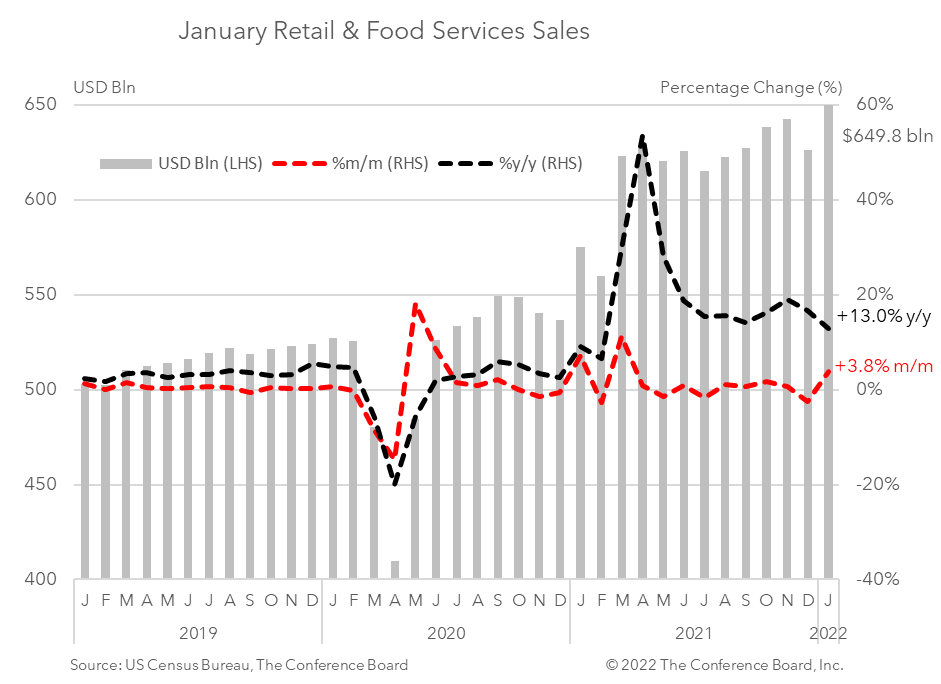

Retail spending in January rose $23.5 billion to $649.8 billion for the month – up 3.8 percent from the previous month and up 13.0 percent from a year earlier. This increase in sales was better than expected and suggests that Omicron was less impactful than feared. Adjusted for CPI inflation, which clocked in at a 40-year high in January, sales were up 3.1 percent month-over-month. This strong report comes on the heels of weaker spending the month prior. In December, sales declined by 2.5 percent amid the initial surge of Omicron and front-loaded holiday spending associated with concerns about shortages*. Lower than normal December sales helped set the stage for a strong reading in January. Looking ahead, the rapid decline in new COVID-19 cases should further bolster consumer spending – especially on services. Spending on goods was the primary driver of growth in January. Spending on motor vehicles and parts rose 5.7 percent from December, while retail sales excluding this important category still rose 4.0 percent month-over-month. Retail control, which excludes motor vehicles, gasoline, and building supplies was up 4.8 percent from the previous month. Spending at department stores rose 9.2 percent month-over-month and spending at non-store retailers jumped 14.5 percent. Meanwhile demand for in-person services fell in January. Spending at food services and drinking places dropped 0.9 percent from a month earlier. The weakness here is most likely due to worries about the Omicron variant of COVID-19. Spending in this category is likely to rebound as new infections continue to decline in the first quarter. The strong consumer demand in January coupled with the supply-side disruptions associated with Omicron help to explain the increase in inflation readings last month. Constrained inventories and fewer post-holiday discounts were also a factor. However, with new cases of COVID-19 falling rapidly we forecast that inflation will peak in the first quarter and then gradually moderate over the course of 2022. We expect retail sales spending to remain healthy through the remainder of the winter. Strong household balance sheets and a desire to spend (especially on in-person services) should support demand as the spring approaches and the threat of Omicron subsides. Recent spending, job and inflation data suggest that the US economy is growing at a robust pace in the first quarter. The Fed’s recently announced policy of monetary tightening should remain on track, or perhaps even intensify. *Concerns about shortages led US consumers to do their holiday shopping earlier than usual in 2021. This “front-load” spending yielded stronger than usual spending in October and November, but weaker spending in December. However, 2021 holiday sales still grew by a robust 17 percent from a year earlier.

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025

February CPI Offers Some Reprieve

March 12, 2025

Replacing EB-5 Visas with “Gold Cards”: Impact on CRE Market

March 07, 2025

Charts

Consumer Confidence Declined for Second Consecutive Month in February

LEARN MORECharts

Omicron, Inflation, and Fed Dampen US Growth Prospects

LEARN MORECharts

Almost two years after the COVID-19 pandemic plunged the United States and the world into economic and social disruption, the nation is recovering.

LEARN MORECharts

High demand for labor is resulting in rapid hiring of the unemployed.

LEARN MORECharts

The Conference Board’s Salary Increase Budget Survey indicates that the average annual raise for current employees is accelerating.

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORECharts

America’s recent decline in global competitiveness raises concerns about the nation’s future economic stability and national security

LEARN MORECharts

Firms are struggling mightily to hire workers.

LEARN MORECharts

Crypto tokens--or cryptocurrencies---have a notional market value of more than $2.5 trillion today and are on pace to expand exponentially.

LEARN MOREFilter By Center

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

PRESS RELEASE

Stagnant Productivity Growth Returns

April 29, 2022