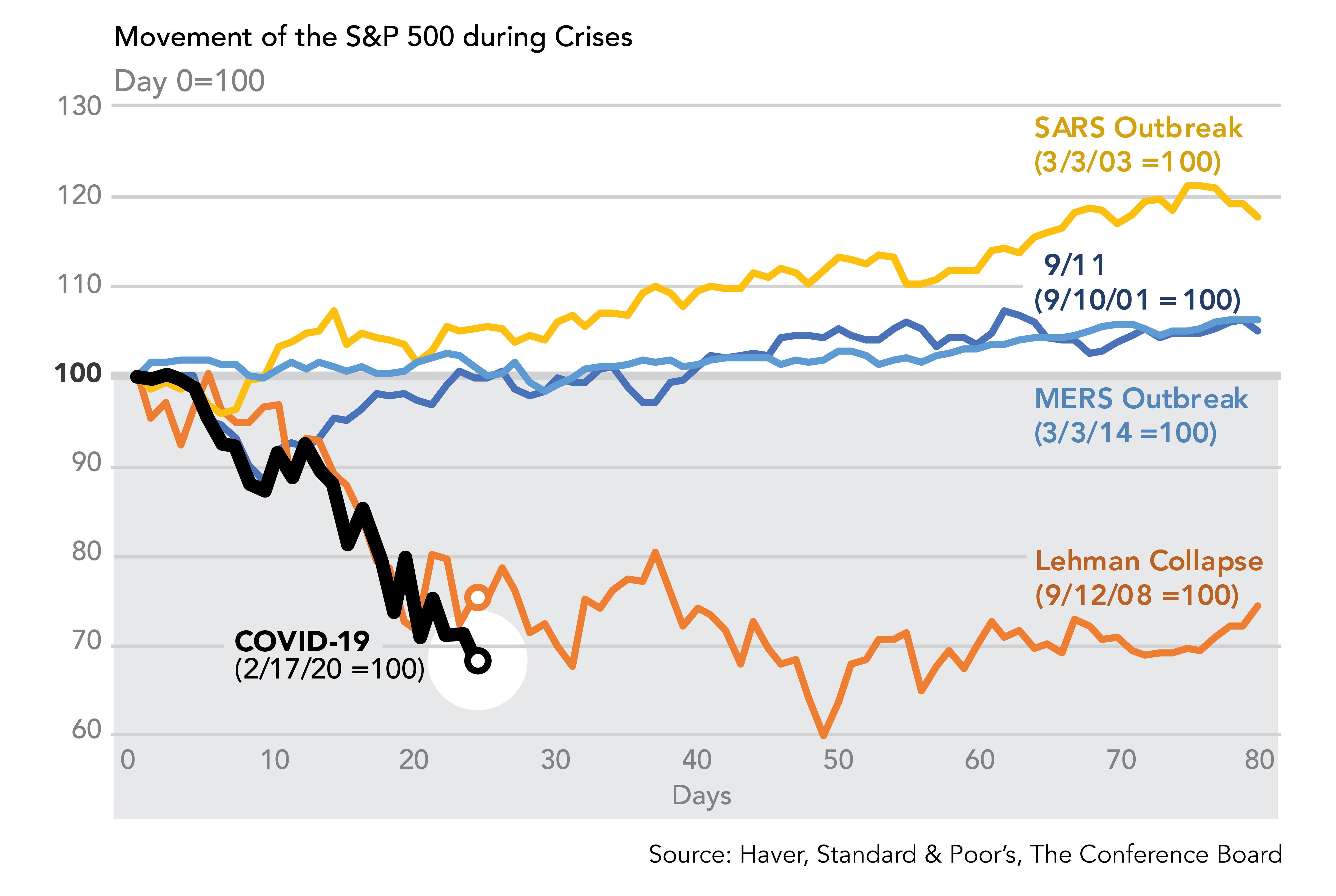

March 20, 2020 | Chart

Today, 24 days into the COVID-19 sell-off, the S&P 500 is down 32 percent. In 2008, at the equivalent point in the Lehman Brothers collapse, the index was down 24 percent. It appears the current climate is worse because fear of the unknown is lasting longer. These unknowns include extreme lack of clarity on the ultimate duration and spread of the virus and how to mitigate its economic impact. The declaration of a national emergency, massive support from the US Federal Reserve (as in 2008), and an immense fiscal stimulus package making its way through the US Congress (also as in 2008) haven’t stopped the slide. For stock prices to stabilize and eventually recover, money alone won’t do it. Greater clarity about how governments will manage the crisis is badly needed.

July 27, 2022 | Newsletters & Alerts