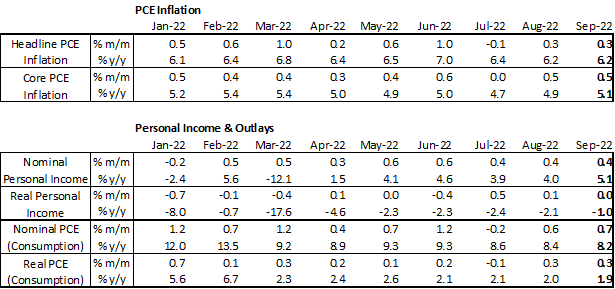

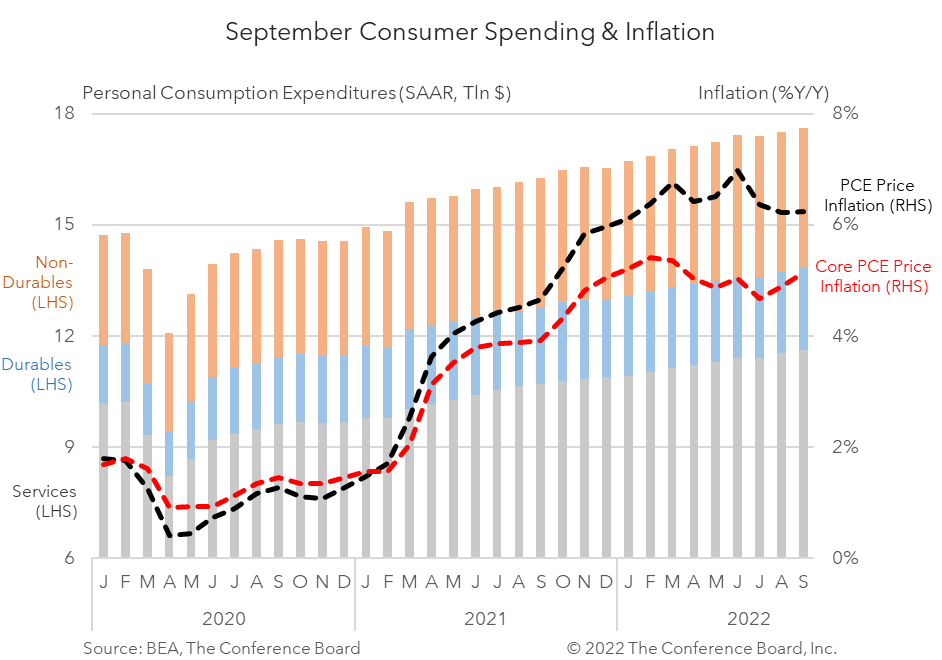

September Personal Income & Outlays data show an economy that continues to grapple with inflation. Month-over-month (m/m) readings for both headline and core PCE inflation were unchanged from August, but year-over-year (y/y) core inflation rose to 5.1 percent (the highest reading since March). These inflation metrics remain far too high. Indeed, according to the BEA the 0.4 percent m/m increase in personal income in September was wiped out when accounting for inflation. Furthermore, increases in consumer spending in September were also partially offset by rising prices. These data will likely encourage the Fed to make another large 75 basis point increase in the Fed Funds rate next week. Looking ahead, the stagflationary characteristics of the US economy are likely to give way to a recession beginning in Q4 and extending into early 2023.

Headline PCE price inflation was flat at 6.2 percent y/y in September, but core PCE price inflation rose to 5.1 percent y/y. However, on a month-over-month basis both inflation metrics remained about the same, with core inflation actually falling slightly to 0.45 m/m percent from 0.54 m/m percent in August. These data show neither a meaningful improvement nor a deterioration in the inflation situation, but it remains quite clear that the readings remain far too high. When the FOMC meets next week we’ll likely see another 75 basis point interest rate hike.

Overall personal income growth rose 0.4 percent m/m (in nominal terms), vs. 0.4 m/m percent in August. However, the increase was more than offset by rising prices. In inflation-adjusted terms, personal income was flat from August. Indeed, eight of the last twelve months have seen either flat or negative real income growth. Thus, while Americans have recently seen their incomes rise in nominal terms, their purchasing power eroded just as quickly.

Personal consumption expenditures rose by 0.7 percent m/m (in nominal terms) in September, vs. 0.6 m/m percent in August. Spending on services rose by 0.8 percent m/m while spending on goods rose 0.3 percent m/m. However, after accounting for inflation, consumer spending rose by just 0.3 percent m/m in September with spending on goods rising 0.4 percent m/m and spending of services rising 0.3 percent m/m. We expect personal consumption expenditures to slow further over the coming months as tighter monetary policy drives interest rates higher.

Personal income and consumer spending will face continued challenges in the months ahead. Headline inflation may have peaked in Q2 2022, but persistence of elevated inflation rates in the face of rising interest rates is troubling. These developments are likely to weigh on consumer spending and should prompt the Federal Reserve to continue hiking interest rates in large increments over the coming months. This environment increases the probability and potential severity of a recession.

Stockpiling Crushes Q1 GDP, Details Show Solid Growth

April 30, 2025

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

Charts

In June*, consumer confidence slipped somewhat even as some spending categories continue to see growth.

LEARN MORECharts

US Inflation Expectations Remain High As Inflation Surges

LEARN MORECharts

A special poll conducted in the March Consumer Confidence Survey focused on the perceived impact of the war in Ukraine on overall inflation in the US.

LEARN MORECharts

March Consumer Confidence Rises Despite Headwinds

LEARN MORECharts

Consumer Confidence Declined for Second Consecutive Month in February

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.

LEARN MORECharts

Global consumer confidence advanced to another record high in the third quarter of 2021..

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined again in September, following decreases in both July and August. The Index now stands at 109.3 (1985=100), do…

LEARN MORECharts

The Conference Board Consumer Confidence Index® (CCI) was relatively unchanged in July, following gains in each of the prior five months. The Index now stands at 129.…

LEARN MORECharts

Consumer confidence for Asia-Pacific declined slightly in the second quarter of 2021.

LEARN MOREPRESS RELEASE

US Consumer Confidence Plunged Again in April

April 29, 2025

IN THE NEWS

Steve Odland on Consumer Confidence

April 29, 2025

IN THE NEWS

Stephanie Guichard on Consumer Confidence

March 25, 2025

IN THE NEWS

Yelena Shulyatyeva: What February consumer confidence says about the labor marke

February 25, 2025

IN THE NEWS

Stephanie Guichard: Consumers are less optimistic about the future in February

January 29, 2025

IN THE NEWS

Yelena Shulyatyeva: January Consumer Confidence drops, inflation still a concern

January 28, 2025

All release times displayed are Eastern Time

Connect and be informed about this topic through webcasts, virtual events and conferences

Social Standing: Current Attitudes About Social Media

April 02, 2025 | Article

Politics Shapes US Consumer Views About 2025

February 10, 2025 | Report

US Consumers Hope for Lower Prices and Taxes in 2025

December 17, 2024 | Article

June CPI data support Fed rate cuts later this year

July 11, 2024 | Brief

Higher Interest Rates Will Force Consumers to Be More Frugal

March 07, 2024 | Quick Take

What’s Behind Conflicting US CEO & Consumer Confidence Readings?

March 12, 2025 11:00 AM ET (New York)

C-Suite Perspectives

The State of the Economy for August 2024

August 27, 2024

C-Suite Perspectives

The State of the Economy for July 2024

July 30, 2024

C-Suite Perspectives

The State of the Economy for June 2024

June 25, 2024

C-Suite Perspectives

The State of the Economy for April 2024

April 30, 2024