The Consumer Confidence Survey® reflects prevailing business conditions and likely developments for the months ahead. This monthly report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates. Data are available by age, income, 9 regions, and top 8 states.

US Consumer Confidence tumbled again in March

Latest Press Release

Updated: Tuesday, March 25, 2025

Consumers’ expectations for the future at a 12-year low

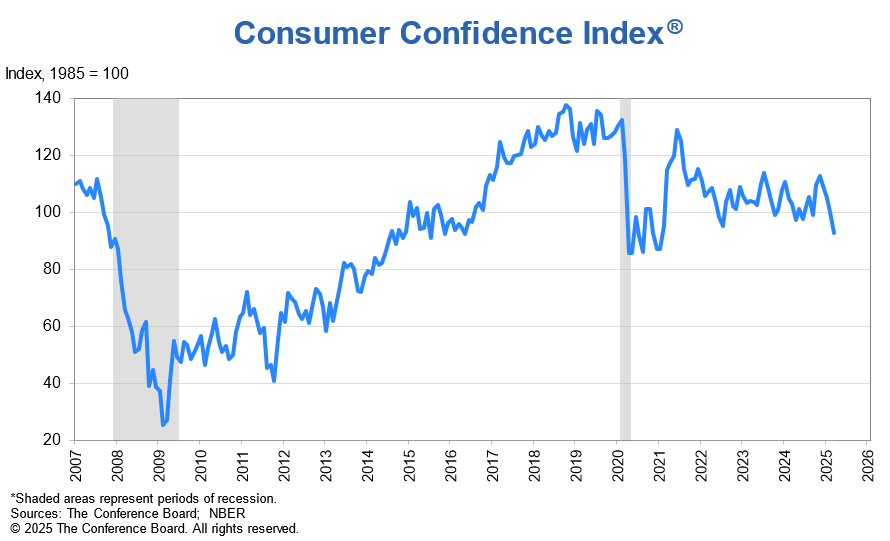

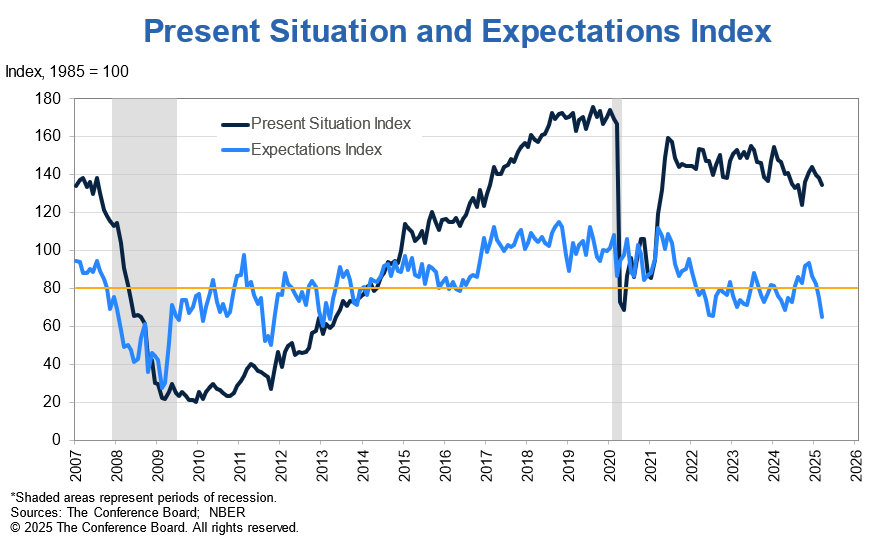

The Conference Board Consumer Confidence Index® fell by 7.2 points in March to 92.9 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased 3.6 points to 134.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead. The cutoff date for preliminary results was March 19, 2025.

“Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “Of the Index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly. Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low. Meanwhile, consumers’ optimism about future income—which had held up quite strongly in the past few months—largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.”

March’s fall in confidence was driven by consumers over 55 years old and, to a lesser extent, those between 35 and 55 years old. By contrast, confidence rose slightly among consumers under 35, as an uptick in their assessments of the present situation more than offset gloomier expectations. The decline was also broad-based across income groups, with the only exception being households earning more than $125,000 a year.

Guichard added: “Likely in response to recent market volatility, consumers turned negative about the stock market for the first time since the end of 2023. In March, only 37.4% expected stock prices to rise over the year ahead—down nearly 10 percentage points from February and 20 percentage points from the high reached in November 2024. On the flip side, 44.5% expected stock prices to decline (up 11 ppts from February and over 22 ppts more than November 2024). Meanwhile, average 12-month inflation expectations rose again—from 5.8% in February to 6.2% in March—as consumers remained concerned about high prices for key household staples like eggs and the impact of tariffs.”

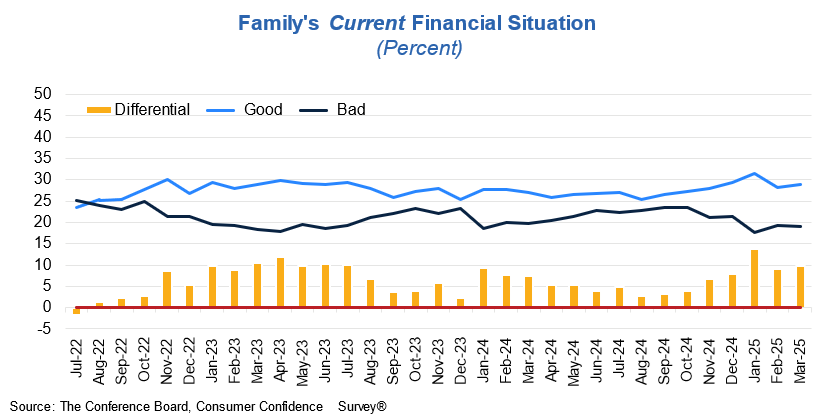

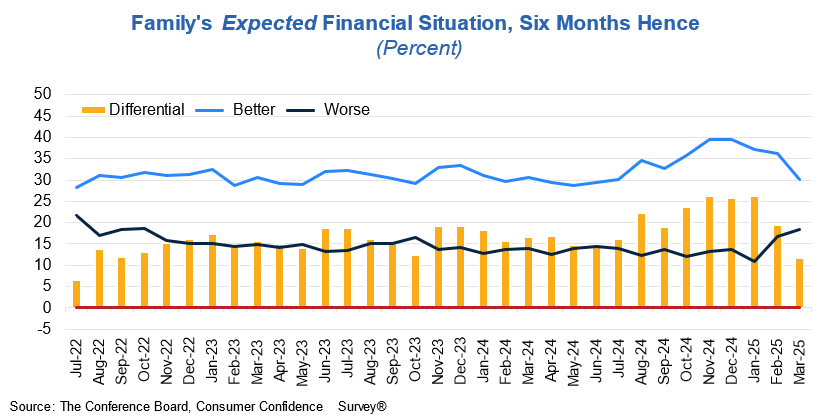

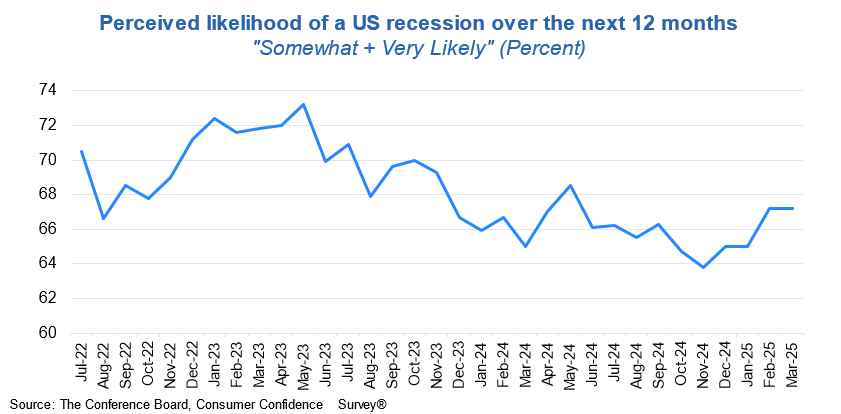

Consumers’ views of their Family’s Current Financial Situation improved slightly but their expectations for future finances declined to the lowest level since July 2022. The proportion of consumers anticipating a recession over the next 12 months remained steady at a nine-month high. (These measures are not included in calculating the Consumer Confidence Index®). The share of consumers expecting higher interest rates over the next 12 months increased to 54.6% from 52.6% in February, while the share of consumers expecting lower interest rates dropped further to 22.4% from 24.1%.

A special question about how easy it is for consumers to form expectations about the future found considerable self-confidence among consumers in assessing their own future income prospects and family financial situation, with over 45% finding it easy and only about 20% finding it difficult. However, forming expectations about broader economic trends appeared more challenging: over one-third found it difficult to assess future employment and business conditions while 38.8% found it difficult to predict inflation.

On a six-month moving average basis, purchasing plans for both homes and cars declined. Surprisingly, given the anxiety about the future, intentions to buy big-ticket items—including appliances and electronics—ticked up, which may reflect plans to buy before impending tariffs lead to price increases. Consumers’ overall intentions to purchase additional services in the months ahead were little changed, but their priorities shifted. Fewer consumers planned to spend more on movies and live entertainment or sports, and more planned to spend on outdoor activities and travel. Vacation plans also increased.

Comments on the current Administration and its policies, both positive and negative, dominated consumers’ write-in responses on what is affecting their views of the economy. Write-in responses also showed that inflation is still a major concern for consumers and that worries about the impact of trade policies and tariffs in particular are on the rise. There were also more references than usual to economic and policy uncertainty.

Present Situation

Consumers’ assessments of current business conditions were significantly less positive in March.

- 17.7% of consumers said business conditions were “good,” down from 19.1% in February.

- 16.6% said business conditions were “bad,” up from 14.8%.

Consumers’ views of the labor market improved slightly in March.

- 33.6% of consumers said jobs were “plentiful,” unchanged from February.

- 15.7% of consumers said jobs were “hard to get,” down from 16.0%.

Expectations Six Months Hence

Consumers’ outlook for business conditions worsened in March.

- 17.1% of consumers expected business conditions to improve, down from 20.8% in February.

- 27.3% expected business conditions to worsen, up from 25.5%.

Consumers’ outlook for the labor market outlook also deteriorated.

- 16.7% of consumers expected more jobs to be available, down from 18.8% in February.

- 28.5% anticipated fewer jobs, up from 26.6% in February

Consumers were more pessimistic about their income prospects in March.

- 16.3% of consumers expected their incomes to increase, down from 18.8% in February.

- 15.5% expected their income to decrease, up from 12.8%.

Assessment of Family Finances and Recession Risk

- Consumers’ assessments of their Family’s Current Financial Situation improved slightly in March.

- Consumers’ assessments of their Family’s Expected Financial Situation weakened to a 2½-year low.

- Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months held steady in March.

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was March 19.

Source: March 2025 Consumer Confidence Survey®

The Conference Board

The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month. Subscription information and the technical notes to this series are available on The Conference Board website: https://www.conference-board.org/data/consumerdata.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org.

The next release is Tuesday, April 29th at 10 AM ET.

© The Conference Board 2025. All data contained in this table are protected by United States and international copyright laws. The data displayed are provided for informational purposes only and may only be accessed, reviewed, and/or used in accordance with, and the permission of, The Conference Board consistent with a subscriber or license agreement and the Terms of Use displayed on our website at www.conference-board.org. The data and analysis contained herein may not be used, redistributed, published, or posted by any means without express written permission from The Conference Board.

COPYRIGHT TERMS OF USE All material on Our Sites are protected by United States and international copyright laws. You must abide by all copyright notices and restrictions contained in Our Sites. You may not reproduce, distribute (in any form including over any local area or other network or service), display, perform, create derivative works of, sell, license, extract for use in a database, or otherwise use any materials (including computer programs and other code) on Our Sites ("Site Material"), except that you may download Site Material in the form of one machine readable copy that you will use only for personal, noncommercial purposes, and only if you do not alter Site Material or remove any trademark, copyright or other notice displayed on the Site Material. If you are a subscriber to any of the services offered on Our Sites, you may be permitted to use Site Material, according to the terms of your subscription agreement.

Trademarks "THE CONFERENCE BOARD," the TORCH LOGO, "CONSUMER CONFIDENCE SURVEY", "CONSUMER CONFIDENCE INDEX", and other logos, indicia and trademarks featured on Our Sites are trademarks owned by The Conference Board, Inc. in the United States and other countries ("Our Trademarks").

You may not use Our Trademarks in connection with any product or service that does not belong to us nor in any manner that is likely to cause confusion among users about whether The Conference Board is the source, sponsor, or endorser of the product or service, nor in any manner that disparages or discredits us.