Labor Shortages Are Becoming More Severe

08 Jun. 2021 | Comments (0)

Three new reports suggest that labor shortages are becoming more extreme, having material implications for labor market recovery and short-term inflation prospects. The jobs report from last Friday, today’s Job Openings and Labor Turnover Survey (JOLTS), and the National Federation of Independent Business (NFIB) monthly survey all suggest that labor shortages may slow down job growth and raise the short-term inflation trajectory.

Why is the labor market so tight? The combination of a surge in demand with stagnant labor supply created historic recruiting difficulties in April and May of 2021. Usually, businesses form and expand gradually during periods of economic growth, creating a steady demand for workers. Now, however, as the in-person economy re-opens all at once, the demand for workers is surging, especially in the leisure and hospitality sector (chart 1). Several industries need to double their workforce in a matter of months. This is uncharted territory that we are getting to know for the first time.

On the supply side, many working-age adults have been slow to re-enter the workforce because of lingering factors driven by the pandemic (including fear of infection, the need to take care of young children during school closures/remote learning, elder care, or high federal unemployment benefits) that have reduced the incentive to rejoin the labor force.

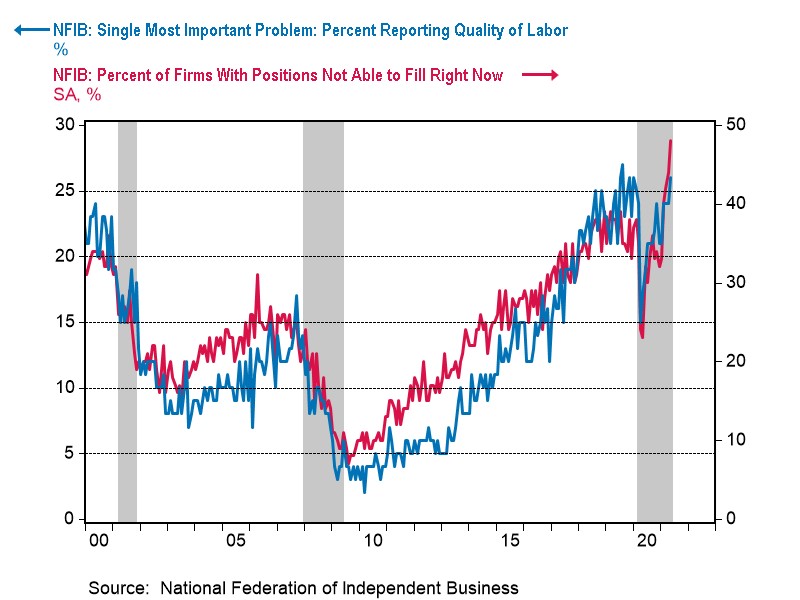

Employers have been deeply impacted. Qualified workers are once again hard to find. According to the NFIB May survey, almost half of all employers, 48 percent, have job openings they are unable to fill. The highest since the survey began in 1973. In addition, 26 percent of employers report that the quality of labor is their single most important problem.

The ratio between job openings and hires is a proxy for the average time to fill a job opening in the economy. It is now the highest since the survey began in 2000 and has been rising sharply in recent months. Recruiting difficulties may partly explain lower-than-expected employment growth in April and May.

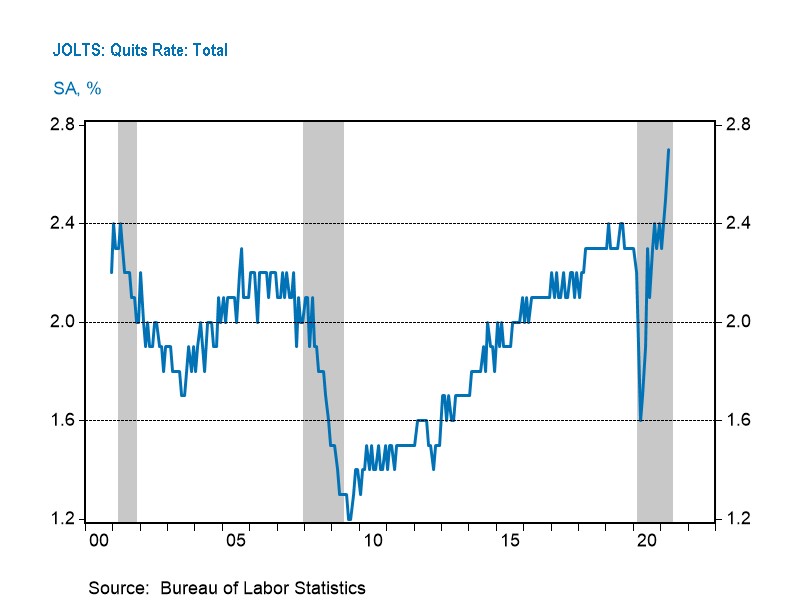

In addition, according to the Job Openings and Labor Turnover Survey, the share of workers voluntary quitting their jobs, usually for another job, is also at a record high.

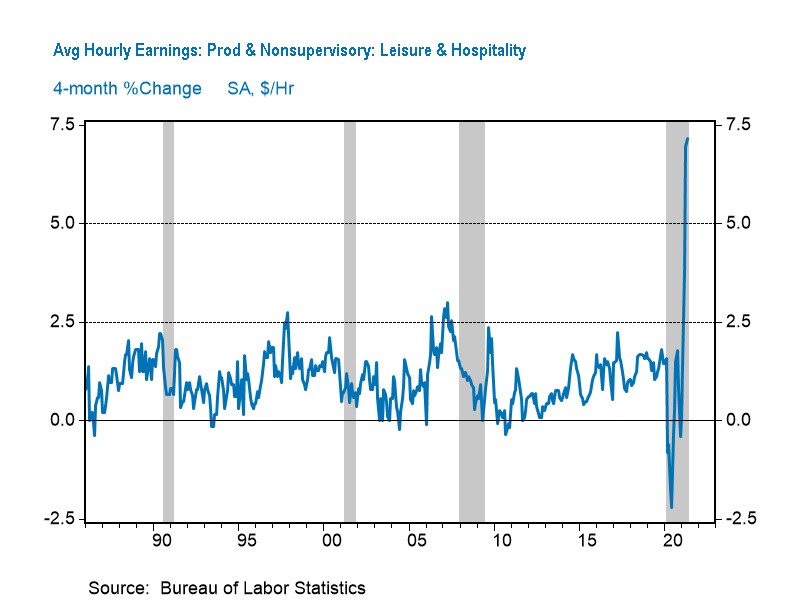

When it is hard to recruit and retain workers, it is not surprising that wages are accelerating. According to the Bureau of Labor Statistics May’s jobs report, average hourly earnings in April-May rose by 7.4 percent, annual rate. This is 2-3 times the typical growth rate in recent decades. And according to an NFIB survey in May, an historically high share of employers raised worker compensation over the past 3 months.

Recruiting and retention difficulties are more pronounced in blue-collar and manual services jobs. A large share of workers in the in-person service sector that is now rapidly expanding, are relatively low pay workers who face high infection risk. In addition, the elevated unemployment benefits are an especially attractive option for workers with relatively low wages. And indeed, the acceleration in wages was partly driven by a stunning jump in wages in the leisure and hospitality sector, growing by seven percent in the past four months.

If the current wage growth is sustained for several more months, it could have a significant impact on inflation and monetary policy. If a year from now, labor costs are 2-3 percent higher than previously expected the impact on consumer prices could be significant.

The labor shortage is likely to ease in the fourth quarter, as some of the pandemic-related supply constraints will moderate and after companies have been able to fill more job openings, tempering the immediate need for new hires. It will be easier to recruit and wage pressures will be weaker, but not for long.

During 2022, or by 2023 at the latest, the unemployment rate will have returned to its pre-pandemic rate and the labor market may be as tight as it was before the pandemic. Such a tight labor market will generate significant new wage pressures.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

0 Comment Comment Policy