The “Donut Effect” is real

06 Jan. 2022 | Comments (0)

A new trend has emerged since the beginning of the pandemic: demand for goods and services has significantly shifted away from city centers and toward less dense surrounding areas, which has been termed the “donut effect.” This shift in demand has impacted jobs. Below we provide new evidence that shows that since the beginning of the pandemic, employment declined more in city centers, than in other areas. The larger employment drop in city centers was especially notable in food services and retail businesses, because of the large decline in spending in city centers by workers who commute to these areas.

Most of this shift, as well as the increase in remote work, is likely to last for many years. Due to the donut effect, businesses will continue to adjust their employment footprint across geographies. Businesses that are in the forefront of making this shift will have a first-mover advantage.

This shift away from city centers has been largely impacted by remote work. During the pandemic, a large share of office workers has worked primarily from home. Many of them will continue to work from home in the foreseeable future. The rise of remote work will significantly impact where people live and work. The initial impact is made up of two trends: First, Millions more people spend their days in their homes as opposed to in their office in a city center. Second, millions of households may be moving further away from city centers where office employment is concentrated.

Measuring the Donut Effect

The main challenge of measuring the “donut effect” in employment is that the concept of the “city center” is not well defined and is not measured in official statistics. A useful indicator that an area is a city center is a high employment-to-population ratio. Using county level employment and population data, we find that in some metro areas there are single counties that have a much higher employment-to-population ratios, and significantly overlap with what would be considered the city center. In the analysis below, we focus on city center counties in five cities (New York, San Francisco, Washington DC, Atlanta, and Boston) and compare them to other counties in their respective metro areas, which we refer to as periphery counties. In other large metro areas, there were no individual counties that could be accurately used as proxies for city centers.

Less than 15 percent of US workers are employed in these metro areas, so it is not certain that the trends presented below accurately reflect other metro areas. But we do believe that the trends in other large metro areas, that experienced a large shift to remote work, are similar.

We utilized Bureau of Labor Statistics quarterly data on county-level employment to compute employment growth from Q4 of 2019 to Q2 of 2021, the latest available quarter.

The Donut Effect in Employment

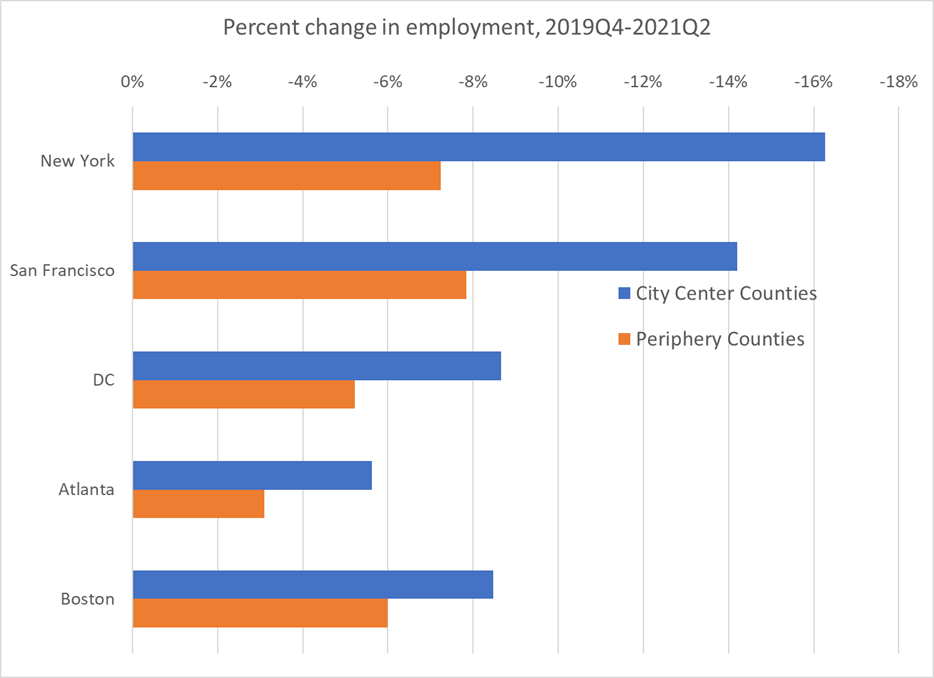

Between 2019 Q4 and 2021 Q2, employment in these five city centers fell by an average of 10.6 percent. However, employment fell by much less in the surrounding counties, at an average of 5.9 percent. The largest difference was in New York City, where employment fell by 16.3 percent in New York County, which is Manhattan, but only 7.2 percent in the surrounding area (the rest of the New York–Newark–Jersey City metropolitan statistical area). Not all the change between city center and periphery counties is just due to decisions made by employers and workers. Part of it may be due to local governments decisions regarding pandemic related restrictions.

Chart 1 - Employment fell more in city center counties

Source: Bureau of Labor Statistics and calculations by The Conference Board

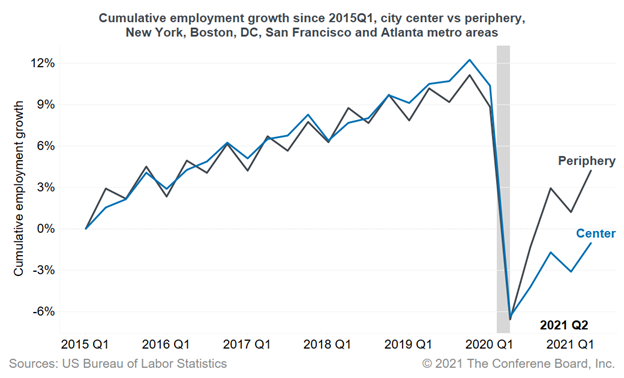

Averaging across these five cities, chart 2 shows that the divergence in employment growth between city centers and other areas is a new trend that did not occur before the pandemic. If anything, employment in city centers grew faster in the years prior to the pandemic.

Chart 2 – The employment recovery in city centers was much weaker

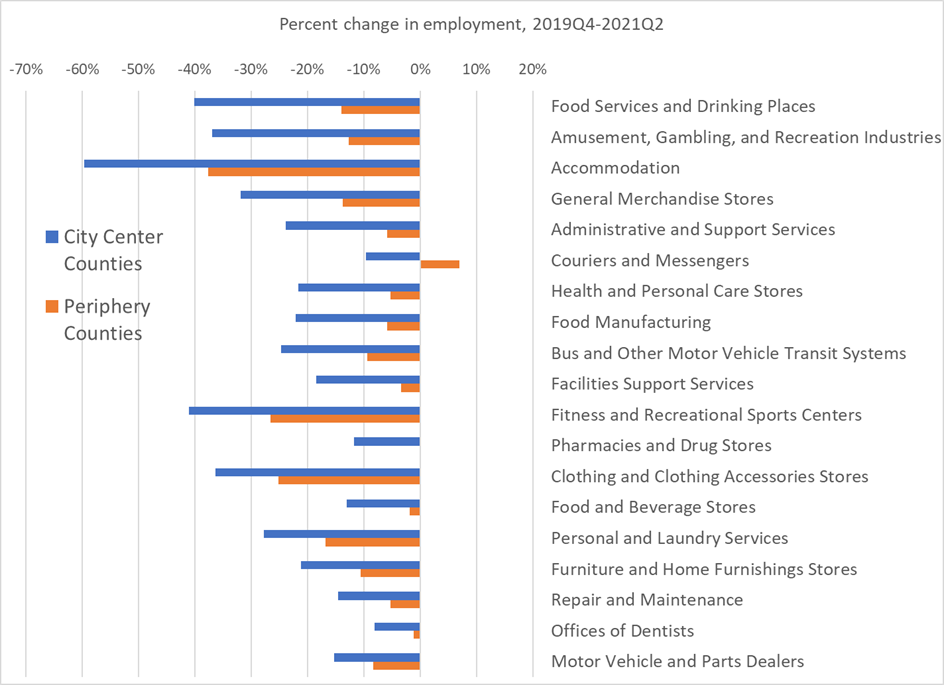

The gap in employment change between city center counties and other counties, has been more notable for low-wage, in-person service jobs (Chart 3). Many of these jobs, like Food Services and Drinking Places, Retail, and Fitness and Recreational Sports Centers are types of jobs that have been affected by the reduction in the number of daily commuters to city centers. Some of these jobs may have shifted to the counties where workers live.

Chart 3 - The industry mix of the city center employment drop was driven by the large decline in spending in city centers by workers who commute to these areas

Source: Bureau of Labor Statistics and calculations by The Conference Board

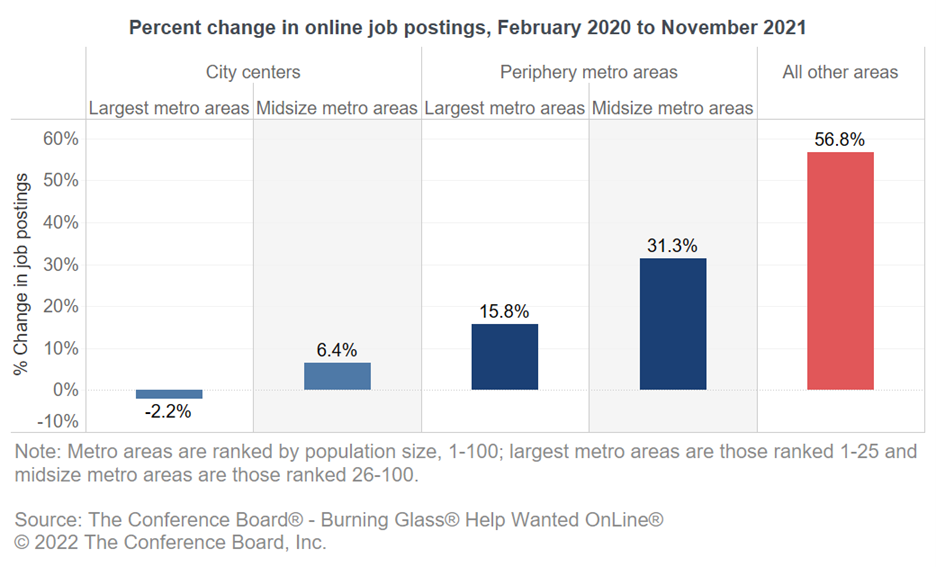

Online job ads also show the “Donut Effect

Help Wanted OnLine data also suggest reduced hiring within city centers as well. Using principal cities of metro areas as a proxy for city centers, Chart 4 shows the percentage change in the number of online job ads between February 2020 to November 2021 for five geographic groups in the United States: (1) principal cities in the largest 25 metro areas (e.g. New York City, Miami, Denver), (2) the principal cities in the next 75 largest metro areas, ranked 26-100 (e.g. Nashville, Milwaukee, Greenville, South Carolina), (3) the largest 25 metro areas excluding their principal cities (e.g. New York-Newark-Jersey City, excluding New York), (4) the next 75 largest metro areas excluding their principal cities, and (5) the rest of the country, which consists of smaller metro areas and non-metro area communities.

Principal cities experienced a much smaller increase in the number of online job ads during the pandemic, especially within large metro areas. Outside of principal cities, the number of online job ads rapidly increased. The weakness of principal cities was especially visible in food services occupations.

Chart 4 – The number of online job ads increased more outside of principal cities

Typically, changes in inter-regional in demand for goods and services and employment are very gradual. However, the evidence presented above suggests that the donut effect is leading to a relatively sharp shift from city centers to other areas.

The “Donut Effect” Moving Forward:

- When the pandemic gradually dies down, some workers are likely to return to the office, but the overall number of daily commuters is likely to be much smaller than in the pre-pandemic period due to the adoption of hybrid work models. These models may also lead to large variation in office attendance across the week, with Fridays and Mondays having less attendance than average.

- Households will continue to migrate to areas further away from city centers as they become more certain about the permanency of remote work options.

- The “donut effect” is likely to be more significant in regions where the prevalence of remote work is higher, such as the West Coast and the Northeast.

- To the extent our results could be generalized beyond the five metro areas used here, the large gap in economic growth between city centers and other areas will require an adjustment to the geographical footprint of many companies’ workforces. Businesses in services such as food services and retail, will have to expand existing operation or open new ones outside of city centers and downsize or close some of their operations in city centers.

- All else equal, the geographical shift described here will make labor shortages more severe in periphery counties in large metro areas.

- Companies that adjust the geographical footprint of their work force before others will have a first-mover advantage, establishing brand recognition, customer loyalty, and early purchase of resources before other competitors enter the region.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

-

About the Author:Michael Papadopoulos

The following is a biography of former employee/consultant Michael is an Associate Economist at The Conference Board with expertise in labor market research, having joined in April 2021. Prior to joi…

0 Comment Comment Policy