Strong job growth, tight labor markets

04 Mar. 2022 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

Today’s jobs report showed strong job growth in February. While Omicron disruptions are now behind us, severe recruitment and retention difficulties persist. Wages continue to rise and this will put more pressure on already elevated price inflation.

Nonfarm payroll employment increased by 678,000 in February, after an upwardly revised increase of 481,000 in January. The unemployment rate ticked down to 3.8 percent and the labor force participation rate increased slightly from 62.2 percent to 62.3 percent in February. Overall, jobs still number 2.1 million below prepandemic (February 2020) levels, representing a loss of 1.4 percent. For women, the job recovery has been slower with employment still 1.9 percent from prepandemic levels, compared to 0.9 percent for men.

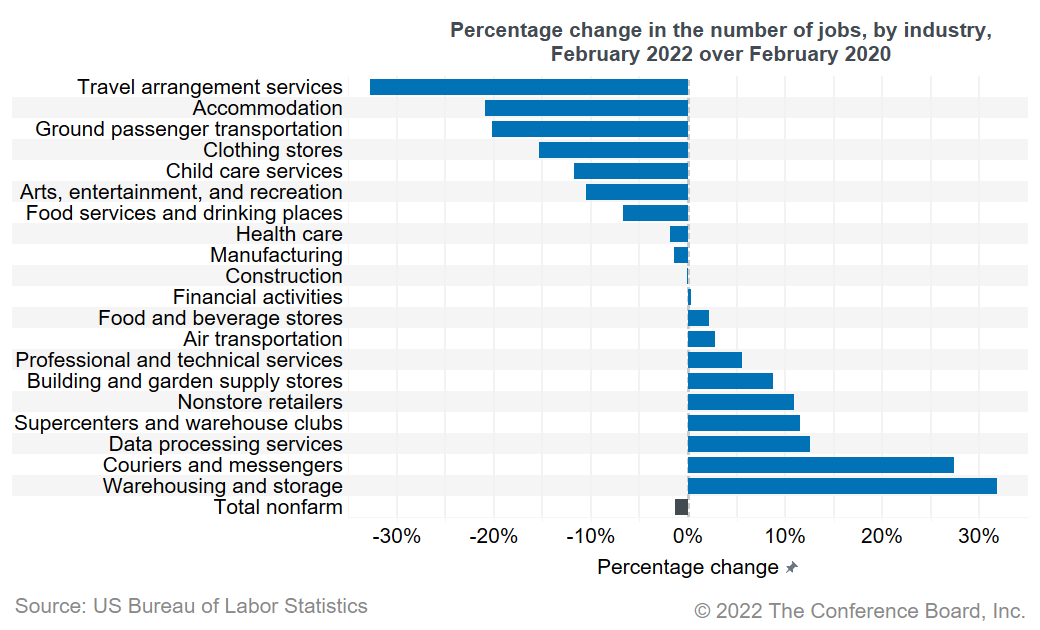

Job growth was again strong in leisure and hospitality, which added 179,000 jobs in February. Jobs were also added across most other industries, including 63,500 in health care and 60,000 in construction. Compared to February 2020, however, employment is still down 20.9 percent in accommodation and 6.7 percent in food services, signaling that many more jobs may be gained in these in-person services industries during 2022. Some jobs may not return, however, as job demand has shifted, especially to ecommerce related industries.

After gaining about 1.2 million jobs in January and February combined, we expect about 3 million more jobs to be added in the remainder of the year. This will be lower than the 6.7 million jobs gained in 2021, but still higher than the 2.0 million in 2019. Slower job growth is expected as the economy is decelerating towards its long-run growth rate and more industries have already recovered. On top of that, recruitment difficulties are hampering job growth. The unemployment rate is expected to get close to 3 percent by the end of the year.

Average hourly earnings rose 5.1 percent over the past 12 months, and in leisure and hospitality even by 11.2 percent. At the same time, rising inflation is eating into these wage gains. We expect wage growth to remain elevated as labor shortages will persist going forward. The inflation outlook is less certain. The recent invasion of Ukraine by Russian forces may drive up highly volatile food and energy prices. On the other hand, easing supply-chain issues and the Fed’s plans to raise interest rates may somewhat offset rising inflation during 2022.

This jobs report underscores that the labor market is healthy and continues to improve. As such, we expect that the Fed will start raising interest rates in March.

-

About the Author:Frank Steemers

The following is a bio or a former employee/consultant Frank Steemers is a Senior Economist at The Conference Board where he analyzes labor markets in the US and other mature economies. Based in New …

0 Comment Comment Policy