Survey: CEOs in the US, Europe, and China Brace for Tougher Times Ahead

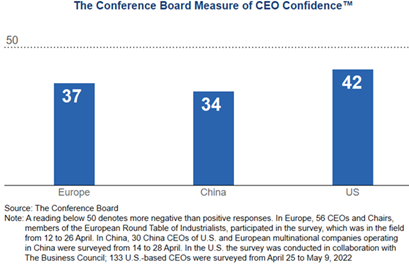

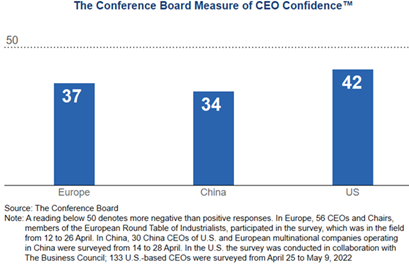

BRUSSELS and NEW YORK, May 24, 2022…The Conference Board Measure of CEO Confidence™ declined sharply in both the U.S and Europe in recent readings. In the US, the Measure of Confidence fell to 42 in the second quarter of 2022, while confidence levels in Europe dropped to 37 in the first half of the year. At 34, confidence levels were lowest among CEOs of multinational companies in China in the first half of 2022, where the measure was taken for the first time. The surveys give a picture of how economic conditions are being perceived by chief executives in different parts of the world and provide insight as to what is top of mind in these key economies. A reading below 50 points reflects more negative than positive responses.

“Unsurprisingly, CEO confidence is low across the board, as the geopolitical landscape becomes more fraught,” said Sara Murray, Managing Director–International, The Conference Board. “It is clear from our results that CEOs expect the world to divide into competing economic blocs. Yet, they are not moving to reshore their operations on home soil. Instead, in order to maintain their global footprint, they appear to follow a strategy of localisation in the markets in which they operate.”

Additional insights from the surveys include:

Hiring and investment intentions remain mildly positive in Europe and the U.S.

- Despite the deteriorating economic outlook, CEOs in Europe and in the U.S remain upbeat about employment prospects.

- The picture is rosiest in the U.S., where 63 percent of CEOs still expect to expand their workforce. In Europe, surprisingly, hiring intentions did not decline compared to six months ago. In China, instead, negative views outweigh positive ones.

- The picture is also relatively positive for capital investment plans. In both the U.S. and Europe, CEOs expect to increase their capital investments in the short run.

Geopolitical challenges come to the fore with the global economy expected to divide

- CEOs predict that the global business environment will look different in five years.

- Four out of five CEOs in Europe expect an acceleration in the division of the world into competing economic blocs. Along similar lines, 60 percent of CEOs in the U.S. say geopolitical tensions will likely result in the?globe dividing?into Western/democratic and China/Russian spheres.

- Interestingly, however, when asked how they think the war in Ukraine will impact decoupling from China over the next five years, 48 percent of CEOs in Europe think decoupling from China will accelerate. 46 percent expect decoupling to proceed at about the same speed as now—that is, slowly.

Elevated energy prices will accelerate climate action in Europe

- With April year-over-year inflation at 7.4 percent in the Euro Area—and producer prices growing at double-digit rates—the impact of the war in Ukraine is already being felt by consumers and producers, especially through the increase in energy prices.

- A large proportion of CEOs surveyed in Europe (40 percent) believe energy prices will return to pre-pandemic levels from 2024 onwards. More than a third (38 percent) do not expect energy prices to drop back to prepandemic levels at any point in time.

- Despite challenges associated with the current energy crisis, two-thirds of respondents say they do not expect any significant slowing of Europe’s efforts to reduce greenhouse gas emissions by 55 percent in 2030. In fact, many feel that corporate and government climate actions are more likely to accelerate than decelerate over the medium term.

Many firms are passing on rising costs to consumers

- As inflation accelerates, 84 percent of responding CEOs in Europe—and 60 percent in China—say they are passing part of their rising costs onto consumers.

- Opinions are split on whether producer price pressures should be absorbed into profit margins. In Europe, 51 percent of business leaders say they are planning to also absorb price increases into profit margins in Europe, compared to 40 percent in China. However, a large share—40 percent in Europe, 47 percent in China—say this option is not part of their strategy.

- Likewise, among U.S. respondents, the strategy to pass rising costs to consumers dominates over absorbing higher costs into profit margins.

About the Survey

The Conference Board Measure of CEO Confidence™ is a barometer of the health of the economy from the perspective of chief executives from leading global companies. The Measure is based on CEOs' perceptions of current and expected business and industry conditions.

- In Europe, the Measure is conducted in collaboration with the European Round Table for Industry (ERT). A total of 57 ERT members were surveyed between April 12 and 26 2022.

- In China, the Measure is based on responses from 30 China CEOs of U.S. and European multinational companies operating in China; the China survey was fielded from April 14 to 26, 2022.

- In the U.S., The Conference Board Measure of CEO Confidence™ in collaboration with The Business Council was conducted from April 25 to May 9, 2022. The U.S. survey is conducted on a quarterly basis, whereas the surveys in Europe and China are conducted bi-annually.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.