October 11, 2021 | Report

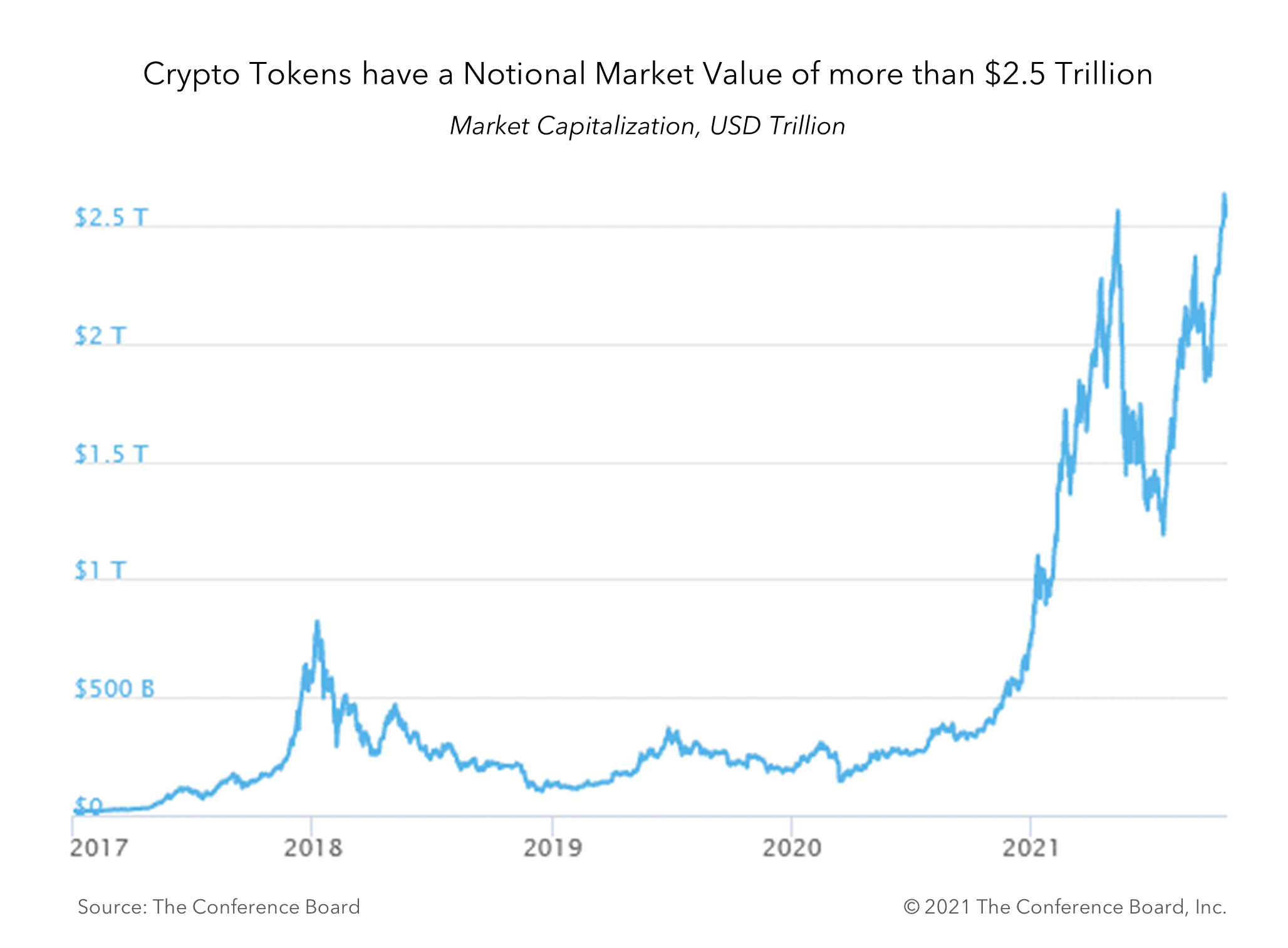

Crypto tokens–—often referred to as cryptocurrencies by originators–—have a notional market value of more than $2 trillion today and are on pace to expand exponentially. But what are they? Where did they come from? What is the technology that supports them? Is it a fad, or like the internet, is it here to stay? How do governments and central banks view these technologies? How might businesses use the technology and/or the assets? What are the risks and benefits of adopting them? We answer these questions and more to help firms weigh how they might enjoy the fruits but also avoid the pitfalls of this burgeoning new phenomenon.

Key Questions Answered

This publication is exclusive to members of The Conference Board.

For information about membership click here.