-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

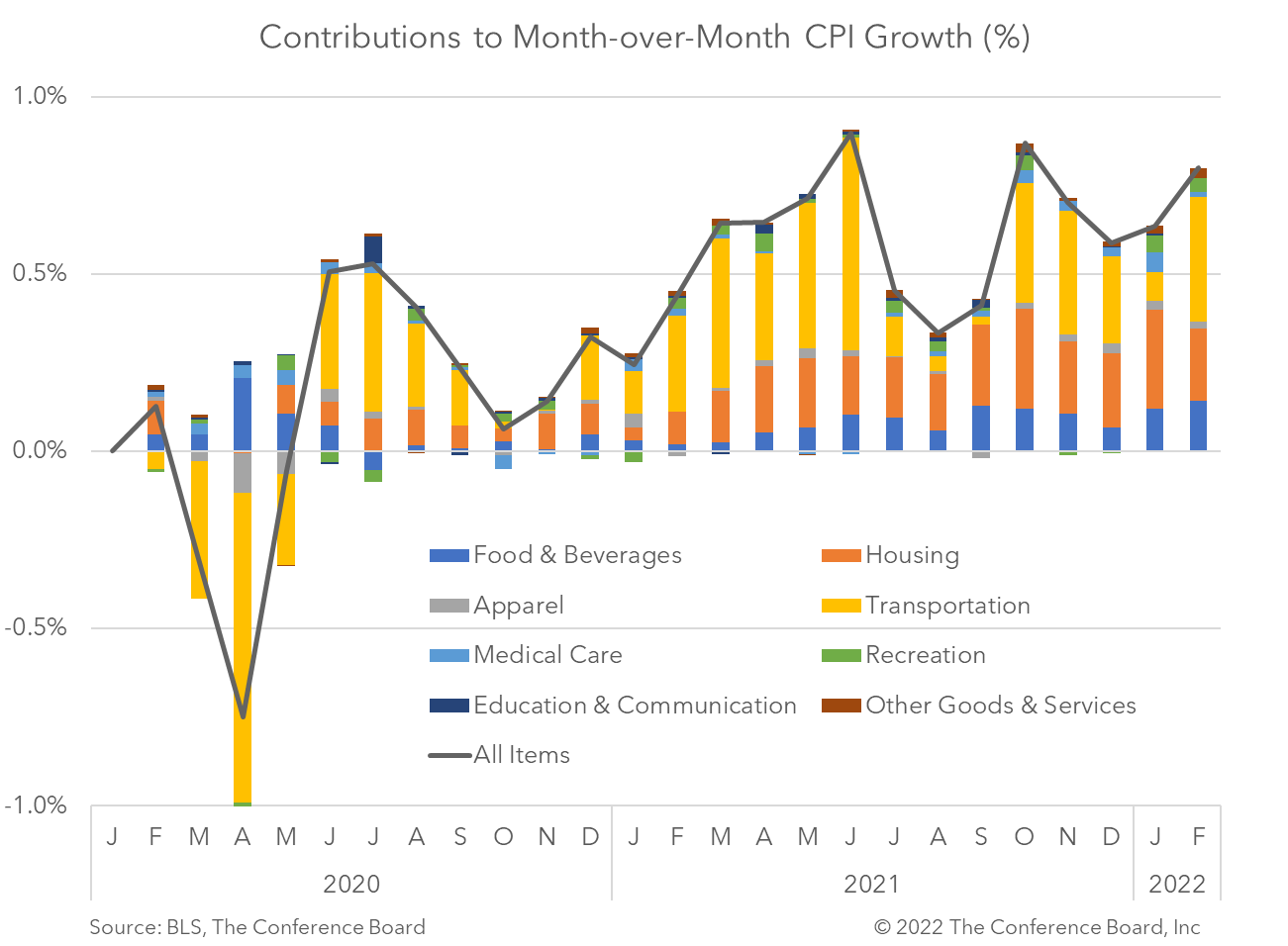

The Consumer Price Index (CPI) rose to 7.9 percent year-over-year in January, vs. an increase of 7.5 percent year-over-year in January. This key measure of consumer price inflation is now at the highest rate recorded since January 1982. Core CPI, which excludes volatile food and energy prices, rose by 6.4 percent year-over-year, vs. 6.0 percent in January. On a month-over-month basis, February CPI rose 0.8 percent, vs. 0.6 percent January. Meanwhile, February Core CPI rose 0.5 percent, vs. 0.6 percent in January. This divergence in increases shows that food and energy prices are becoming key drivers of inflation. Indeed, according to the BLS, increases in gasoline, shelter and food prices were the largest contributors to inflation in February. Gasoline prices rose by 6.6 percent from the previous month and accounted for nearly a third of the increase in the monthly CPI. Meanwhile, food prices rose 1.0 percent from the previous month – the largest monthly increase since the initial COVID-19 lockdown in April 2020. These February data do not fully incorporate the disruptions to global energy and agricultural commodities associated with Russia’s invasion of Ukraine. Following the start of the war on February 24, prices for crude oil, grains and various metals have skyrocketed on concerns about shortages. As the conflict continues these prices will likely continue to rise. With pandemic-induced disruptions moderating we had expected to see inflationary pressures moderate as we approached the Spring, but this conflict changes that view. We now expect price increases to intensify, especially in food and energy, and to see inflation rates rise until at least this summer. Our forecast for PCE inflation, which is similar to CPI, rises from a reported 5.5 percent year-over-year in Q4 2021 to a high of 6.6 percent in Q2 2022 and then falls to 4.2 percent in Q4 2022. We project that Core PCE inflation, which is similar to Core CPI, rises from a reported 4.6 percent year-over-year in Q4 2021 to a high of 5.9 percent in Q2 2022 and then falls to 4.4 percent in Q4 2022. For more information about the economic disruptions associated with the Ukraine Crisis please see our March US forecast statement and the Conference Board’s new Geopolitics hub.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Recession and growth trackers are analytical tools to visualize where the economy is and where it is headed.

LEARN MORECharts

Getting to net zero requires technologies that are not currently commercially available. Use the power of markets to help companies make further innovation.

LEARN MORECharts

Results of operational resilience survey of 147 resilience professionals

LEARN MORECharts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MORECharts

Infographic: US dependence on China remains high in some key sectors.

LEARN MORECharts

China’s Consumption Slump May Be Bottoming Out, But Downside Risks Remain

LEARN MORECharts

Since Russia’s invasion of Ukraine, global CEOs have confronted a new world of extraordinary volatility and uncertainty

LEARN MORECharts

Passing increases downstream, cutting costs, and absorbing price increases into profit margins are the chief ways to manage rising input costs. Few see changing

LEARN MORECharts

While fear of a chaotic collapse of the global oil market sparked by the war in Ukraine has waned, gross imbalances could still resurface

LEARN MOREPRESS RELEASE

CED Provides Plan to Reach Net Zero While Ensuring Economic Growth

May 16, 2024

PRESS RELEASE

US CEOs Rank National Debt as the Top Geopolitics Threat

January 11, 2024

IN THE NEWS

A critical-moment-to-evaluate-US-China-ties-Raimondo's Trip

August 29, 2023

PRESS RELEASE

CEOs Can View Operational Resilience as an Advantage

August 16, 2023

PRESS RELEASE

CED Maps Out 2023 Policy Priorities and Solutions

January 18, 2023

IN THE NEWS

Sustainability Is the Pathway to Supply Chain Resilience

May 17, 2022