-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

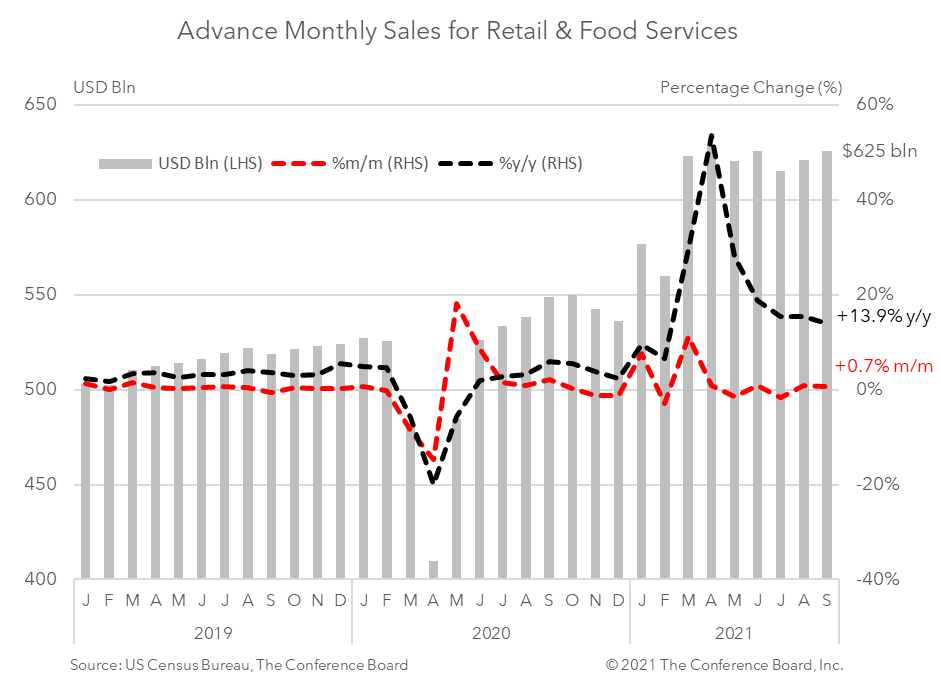

Retail spending in September rose $4.6 billion to $625.4 billion for the month – up 0.7 percent from the previous month and up 13.9 percent from a year earlier. These improvements were not merely a function of rising prices: adjusted for inflation, sales were up 0.3 percent month-over-month and 8.1 percent year-over-year. As the severity of the Delta wave continues to abate, these data suggest that American consumers still have an appetite to spend as we enter the last quarter of the year. Spending on goods was the primary driver of consumer demand in September. While spending on motor vehicles and parts continued to be held back by supply chain disruptions, retail sales excluding this category grew 0.8 percent. Retail control, which excludes motor vehicles, gasoline, and building supplies was also up 0.8 percent from the previous month. Interestingly, spending at sporting goods, hobby, book & music stores was among the strongest categories for the month – rising 3.7 percent from August. Meanwhile, spending on in-person services was also up. Spending at food services and drinking places rose 0.3 percent from a month earlier. Following a period of lackluster growth related to the Delta variant, spending on in-person services appears to be picking up speed once again. We expect this trend to continue over the coming months. Overall, these data show a sustained increase in spending following a challenging period. While recent data on consumer sentiment suffered due to the spread of the Delta variant it appears that American spending remains resilient.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Consumer Confidence Declined for Second Consecutive Month in February

LEARN MORECharts

Omicron, Inflation, and Fed Dampen US Growth Prospects

LEARN MORECharts

Almost two years after the COVID-19 pandemic plunged the United States and the world into economic and social disruption, the nation is recovering.

LEARN MORECharts

High demand for labor is resulting in rapid hiring of the unemployed.

LEARN MORECharts

The Conference Board’s Salary Increase Budget Survey indicates that the average annual raise for current employees is accelerating.

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORECharts

America’s recent decline in global competitiveness raises concerns about the nation’s future economic stability and national security

LEARN MORECharts

Firms are struggling mightily to hire workers.

LEARN MORECharts

Crypto tokens--or cryptocurrencies---have a notional market value of more than $2.5 trillion today and are on pace to expand exponentially.

LEARN MOREFilter By Center

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

PRESS RELEASE

Stagnant Productivity Growth Returns

April 29, 2022