Top Sustainability Features for US Consumers: Socially Responsible Labor Practices and Human Rights

December 13, 2022 | Report

As motivators for purchasing sustainable products, social dimensions continue to be more important for US consumers than environmental ones, according to our survey of more than 2,000 US respondents conducted jointly with The Harris Poll. This confirms the trend that first emerged in our research a year earlier. The shift from environmental to social features as dominant purchase motivators comes despite the increase of extreme weather events. However, as much as people appreciate sustainability features, our research has shown that they are secondary to price and other key product criteria such as quality and functionality. Thus, sustainability characteristics only drive purchases if consumers' price and other product expectations are satisfied.

Insights for What’s Ahead

Social factors remain biggest purchase driver within an ESG framework

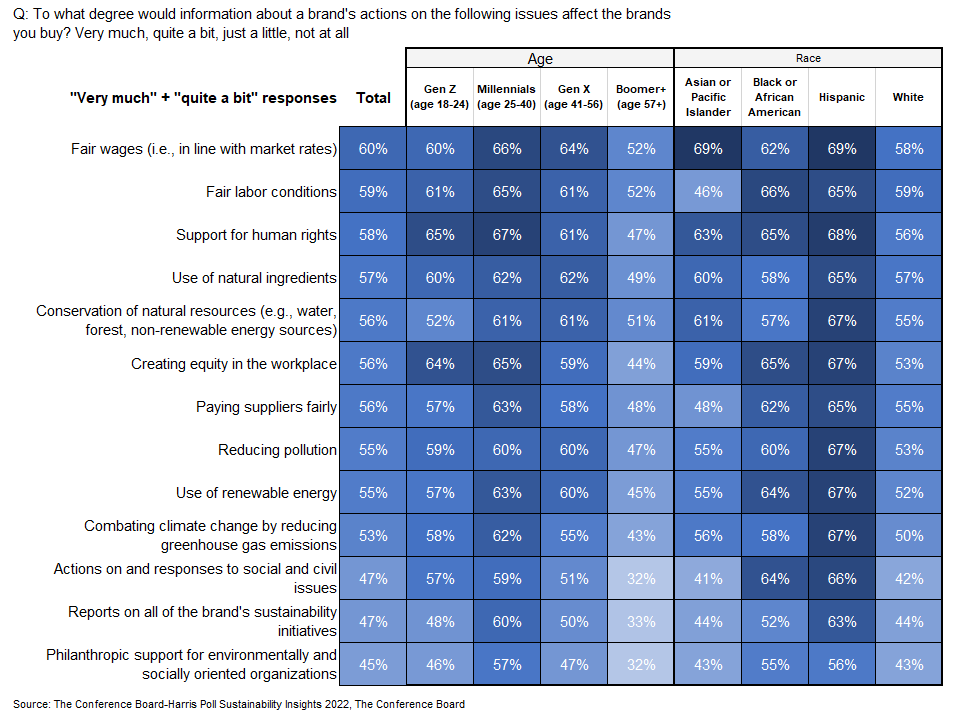

After price and other core brand features, fair labor practices continue to be a leading driver of consumer purchases—among sustainability characteristics. Wages in line with market rates, fair labor conditions, support for human rights, and equity in the workplace rank among the top sustainability features that influence US consumer purchases. Hence, a humanistic orientation for internal and external social matters can be a marketing asset for companies. The key is not just to invest in social initiatives but also to communicate them well to maximize awareness and goodwill with consumers as well as employees and investors. Our prior research has shown that consumers often lack awareness about a brand’s fair labor practices, suggesting an underused potential for brands to communicate their socially responsible labor practices.

Support for human rights is among the top three sustainability features that drive purchases. The pronounced interest in human rights by younger generations and by the growing non-White US population suggests growth potential for brands that emphasize this to these market segments. Younger generations have experienced the Me Too and Black Lives Matter movements, as well as debates about US immigration. These issues are highly relevant to younger generations who are more likely to be non-white, with a significant portion having an immigrant background. Gen Z in particular is swayed more by social than environmental features—unlike millennials who are more balanced on both types. It might reflect how the different focal topics of the time shape generations’ purchasing attitudes and behaviors.

Younger generations are more likely to factor social issues into their purchasing decisions

Dilemma: Sustainability enthusiasm meets high prices and inflation

“Wages in line with market rates” is the leading sustainability feature that drives purchases of sustainable products. However, our current research finds that price matters more to most people, especially in the current inflationary environment. When shoppers have to trade “wages in line with market rates” against price, the latter is more important to 62 percent of them, according to our findings. This emphasizes the crucial role that price plays for purchases, especially in the current envirnment, including for sustainable products. It also suggests that reasonable wages in combination with competitive prices could be a powerful differentiator for brands, for sales as well as talent recruitment and retention. It could also mitigate reputational risk caused by strikes or adverse publicity amidst increasing worker unionization in the US in various sectors.

Sustainability features hold the most sway over purchase decisions by Hispanic, urban, and millennial consumers. But it’s these same segments who are most sensitive to the typically higher prices of sustainable products, especially during this time of inflation. Our current research has found these consumer groups’ interest in buying sustainable products suffer the most due to ongoing inflation. To avoid losing inflation-battered sustainability enthusiasts as customers and “influencers” of peer consumers, companies could consider special promotions such as loyalty and quantity discounts or rewards for gaining new customers.Such special offers could also create long-term goodwill with these segments by signaling a brand’s appreciation of and commitment to their customers during tougher economic times.

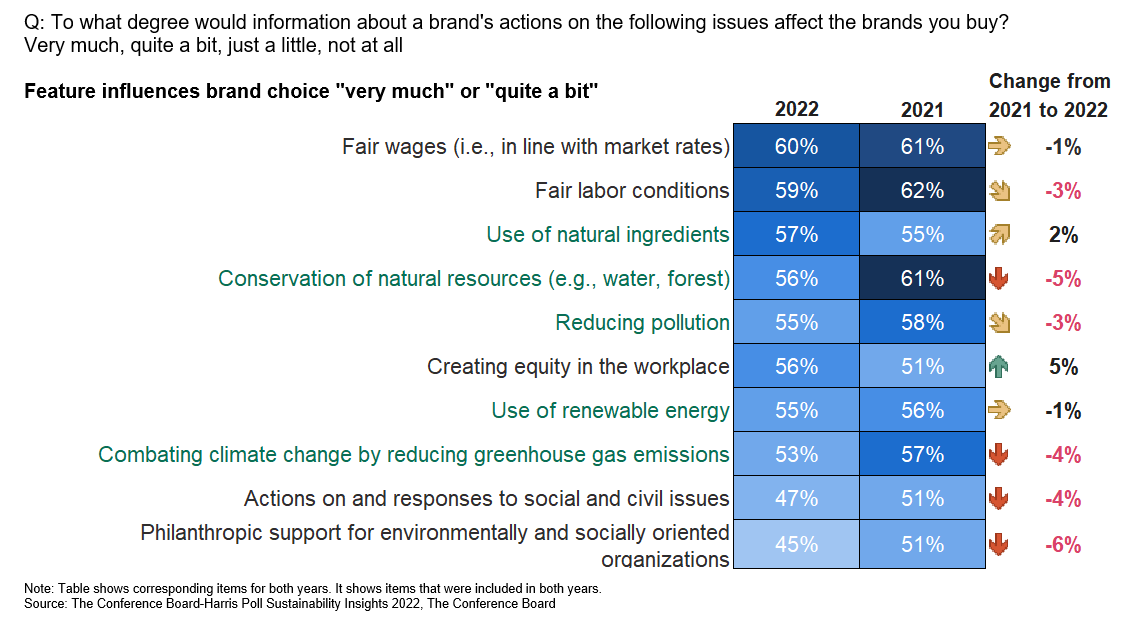

Equity in the workplace is the sustainability feature that gained the most appeal

Compared to last year, features of sustainable products generally seem to have less power to motivate purchases. Our findings suggest that environmental features in particular seem to have lost some of their clout to sway shoppers’ purchases (see graphic below). Brand characteristics such as “conservation of natural resources,” “combating climate change,” and “reducing pollution” all now have less influence on consumer brand choice. The same holds for brands’ responses to social and civil issues. In addition, people might associate sustainable features with higher prices, a barrier even for consumers who are enthusiatic about sustainability, especially during this time of inflation and economic volatility, as our research has found. Still, consumers (and employees) care about sustainability, so even if sustainability features are not a primary motivator, companies can gain market share by offering them.

Slightly fewer consumers say sustainable features drive purchases

“Creating equity in the workplace” has risen as a purchasing motivator in the past year. Compared to other segments, the boomer generation seems to be less inspired to puchase brands with a focus on job equity. Employers can expect this to remain an important topic for employees, especially since the younger generations care about it greatly. Recently established laws such as the mandatory disclosure of salary ranges for newly posted jobs in New York and transparency laws in other states may only be one piece of the equity puzzle.

Methodology & The Conference Board + Harris Poll Collaboration

This report is the third of four reports from our survey of US consumer perceptions on corporate sustainability. The other reports are Changes in Consumers' Habits Related to Climate Change; Economic Downturn Creates Additional Hurdle for Purchasing Sustainable Products, Requiring a Rethink of Pricing Approach; and Labor Practices and Greenwashing.

The survey is a collaboration between The Conference Board and The Harris Poll. It builds on related research in 2021, as covered in Sustainability Features That Sway US Consumers Are Changing and US Consumers Want Business to Do More on Sustainability. The current survey ran in the US from September 2 to 4, 2022, and yielded responses from 2,025 adults. Results are weighted to represent the US adult population.

We greatly appreciate the ongoing partnership with Rob Jekielek, Managing Director at The Harris Poll, who made this research possible.