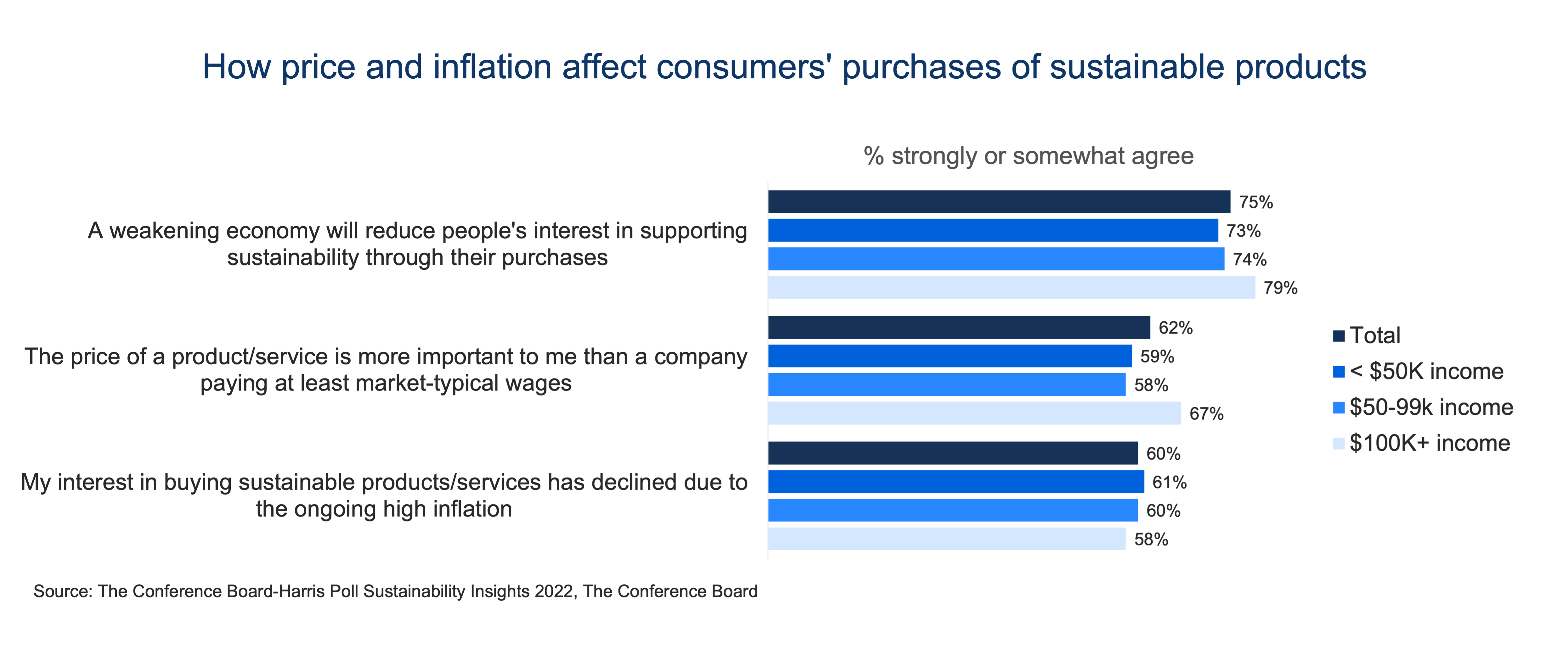

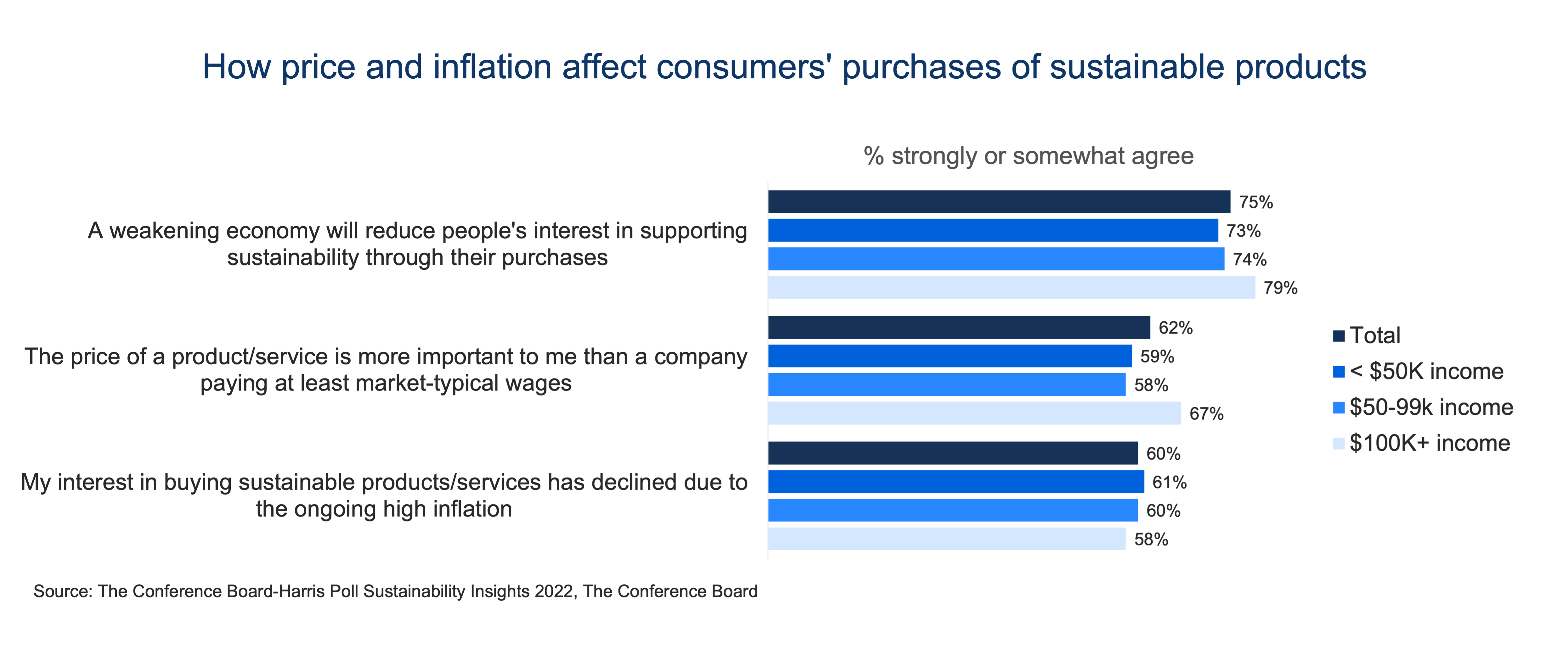

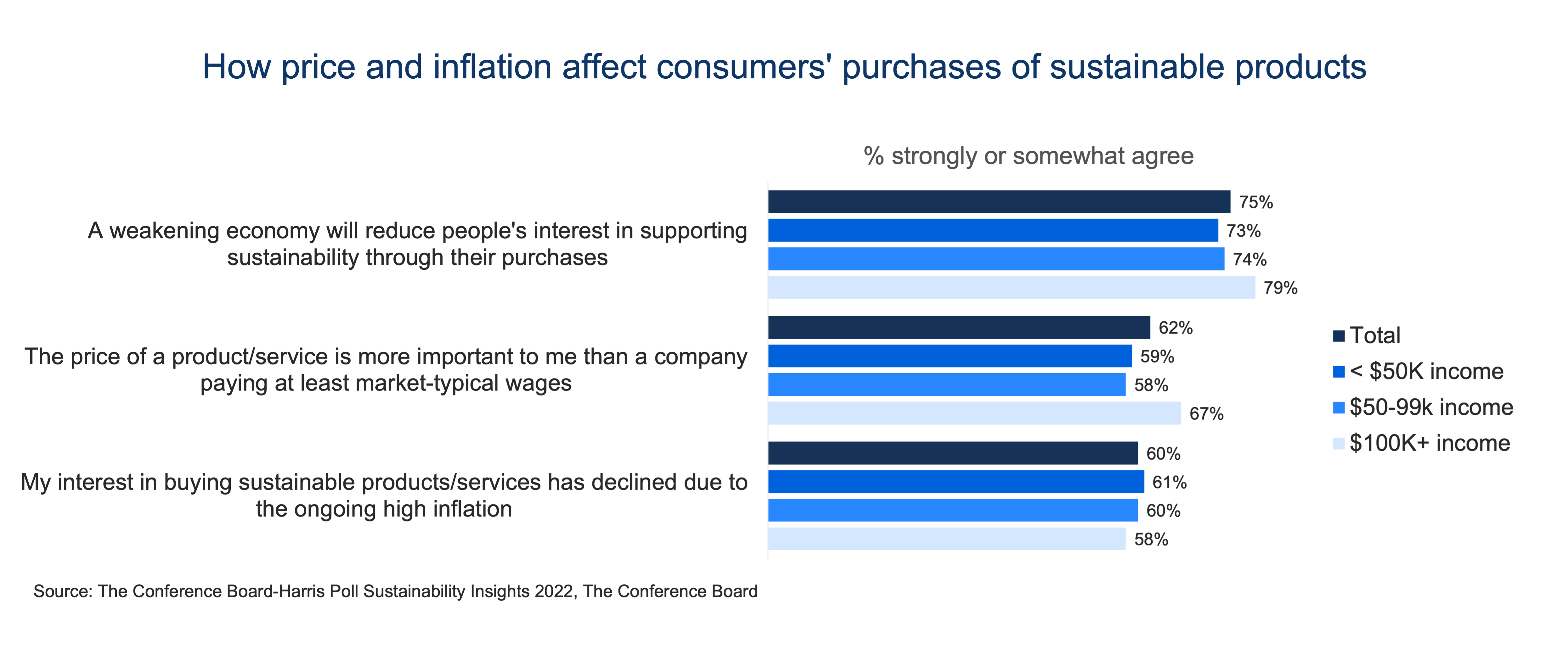

According to our survey of more than 2,000 US respondents conducted jointly with The Harris Poll, 60 percent of respondents—and 58 percent of people with $100,000+ incomes—report a declining propensity to buy sustainable products because of inflation. An even larger share (75 percent) believe people’s interest in buying sustainable products will wane in an economic decline.

Insights for What’s Ahead

- Record inflation—especially in the energy and food categories—is shifting consumer preference toward less pricey alternatives and away from more expensive sustainable products. Products with environmental or social sustainability benefits are usually priced higher than traditional versions—by almost 30 percent in 2021 and the first half of 2022. Although this substitution effect—as a product’s price rises, its sales fall as people switch to cheaper alternatives—is not unique to the current downturn, it does pose marketing and pricing challenges for sustainable goods and services.

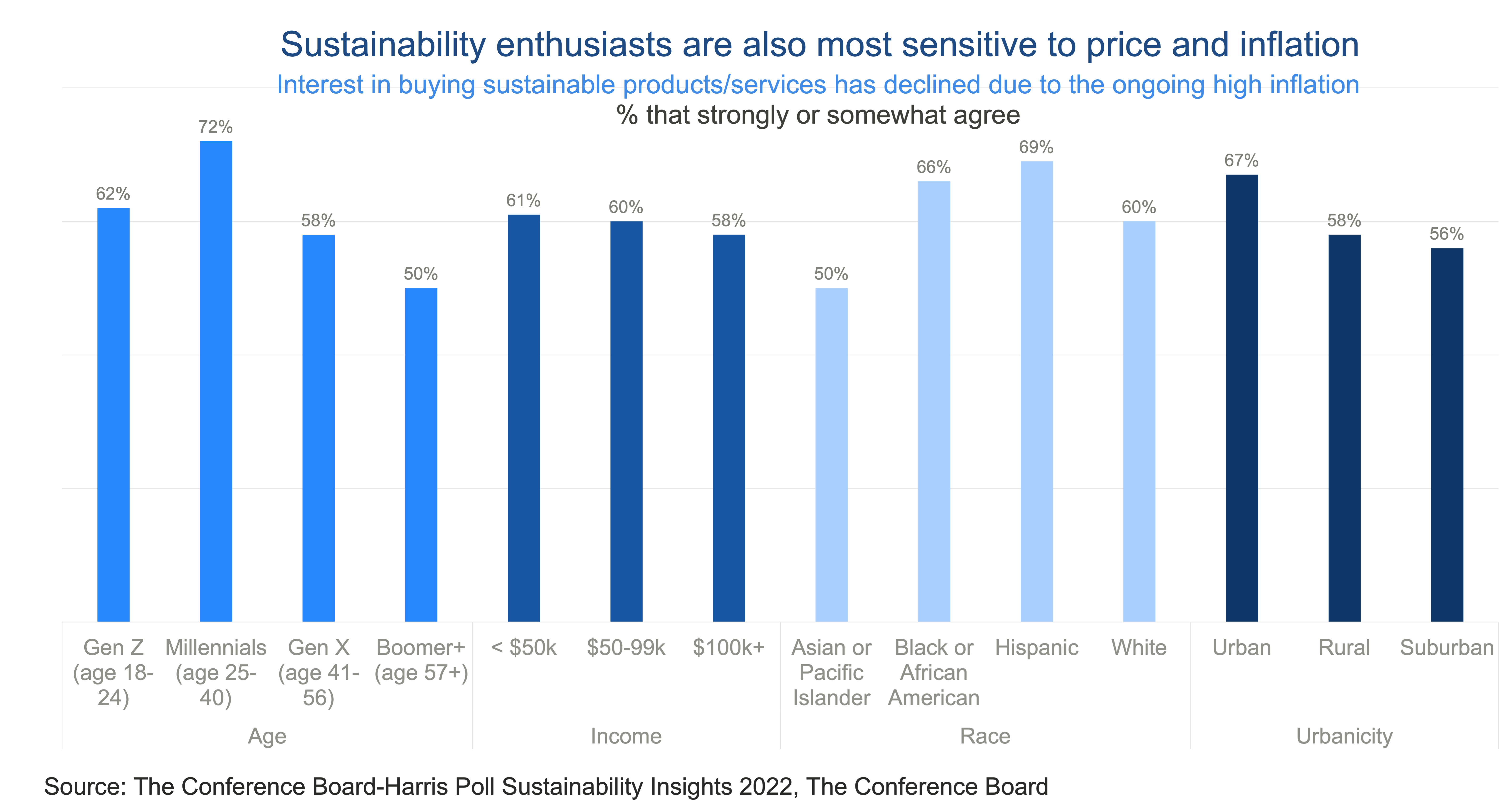

- The segments of the population that tend to be most enthusiastic about sustainability (such as consumers who are millennial, urban, or Hispanic) are also very sensitive to price inflation. To avoid losing inflation-battered sustainability enthusiasts as customers and “influencers,” companies could consider special promotions such as loyalty and quantity discounts or rewards for gaining new customers.They could keep these customers loyal and maintain their potential positive impact on peer consumers in economically challenging times. In addition, such special offers could create long-term goodwill with these segments by signaling a brand’s appreciation of and commitment to them as customers during tougher economic times.

- Providing incentives to customers to promote sustainable behaviors and to help the company save operational costs can serve the dual goals of sustainability and more customer-friendly prices. Customers could be rewarded with discounts or vouchers for behaviors that help companies save costs and contribute to sustainable operations. Examples are price-off rewards for bringing one’s own bag to the store or one’s own coffee mug to a café, reusing towels and linens during a hotel stay, or accepting a flexible delivery date for an online order to make a retailer’s delivery schedule more efficient.

- Novel pricing approaches are needed if companies want to promote demand for sustainable products, especially during this inflationary and recessionary time. This may mean not just passing higher input costs onto consumers but setting prices in a way that takes into account longer-term, multistakeholder benefits of sustainable products and services such as greater employee commitment, longer tenure, and more interest from investors. Ultimately, a wide adoption of sustainable products and services can only be achieved if they are offered at the same price as their nonsustainable equivalents.

Price above all

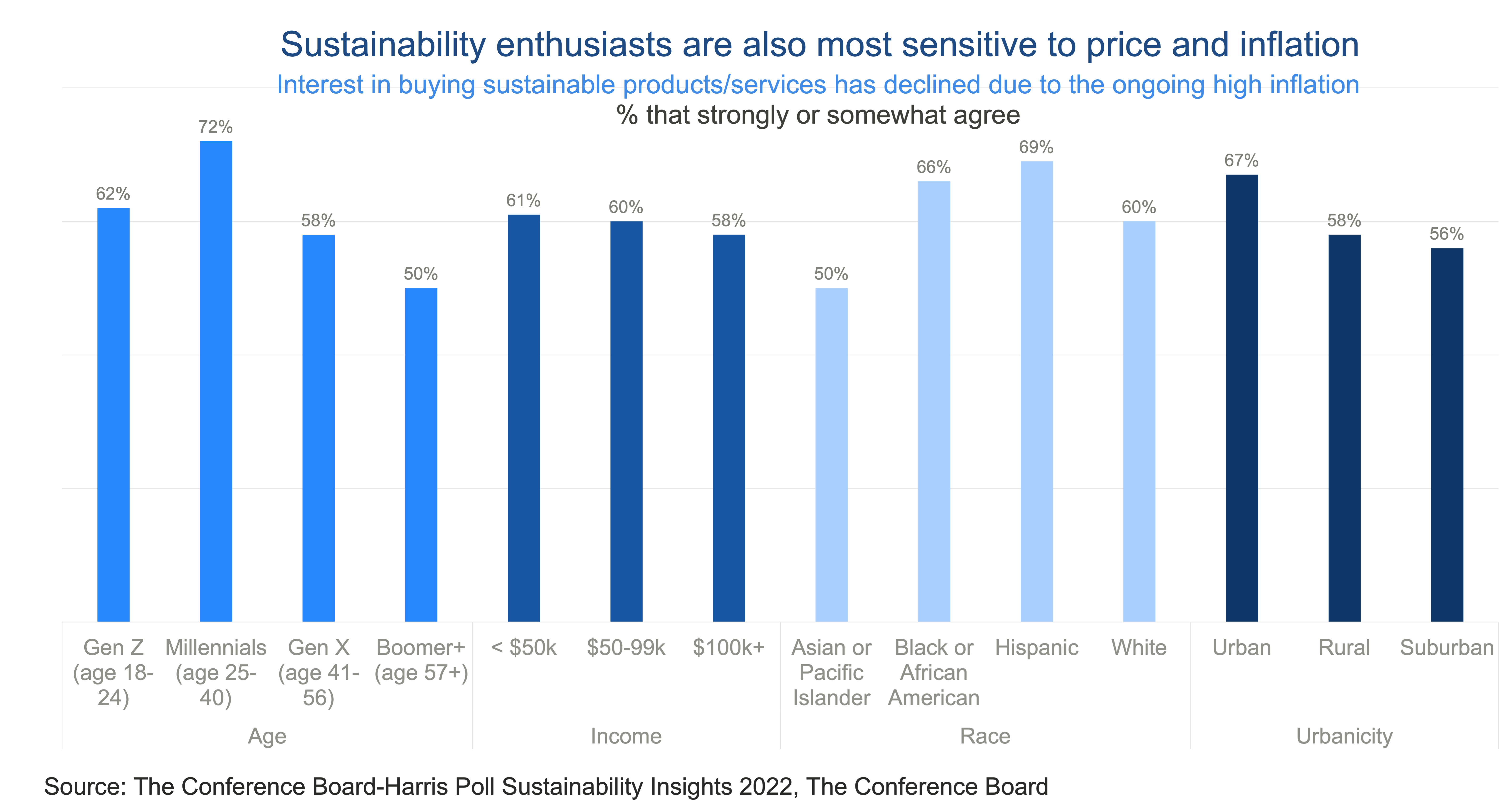

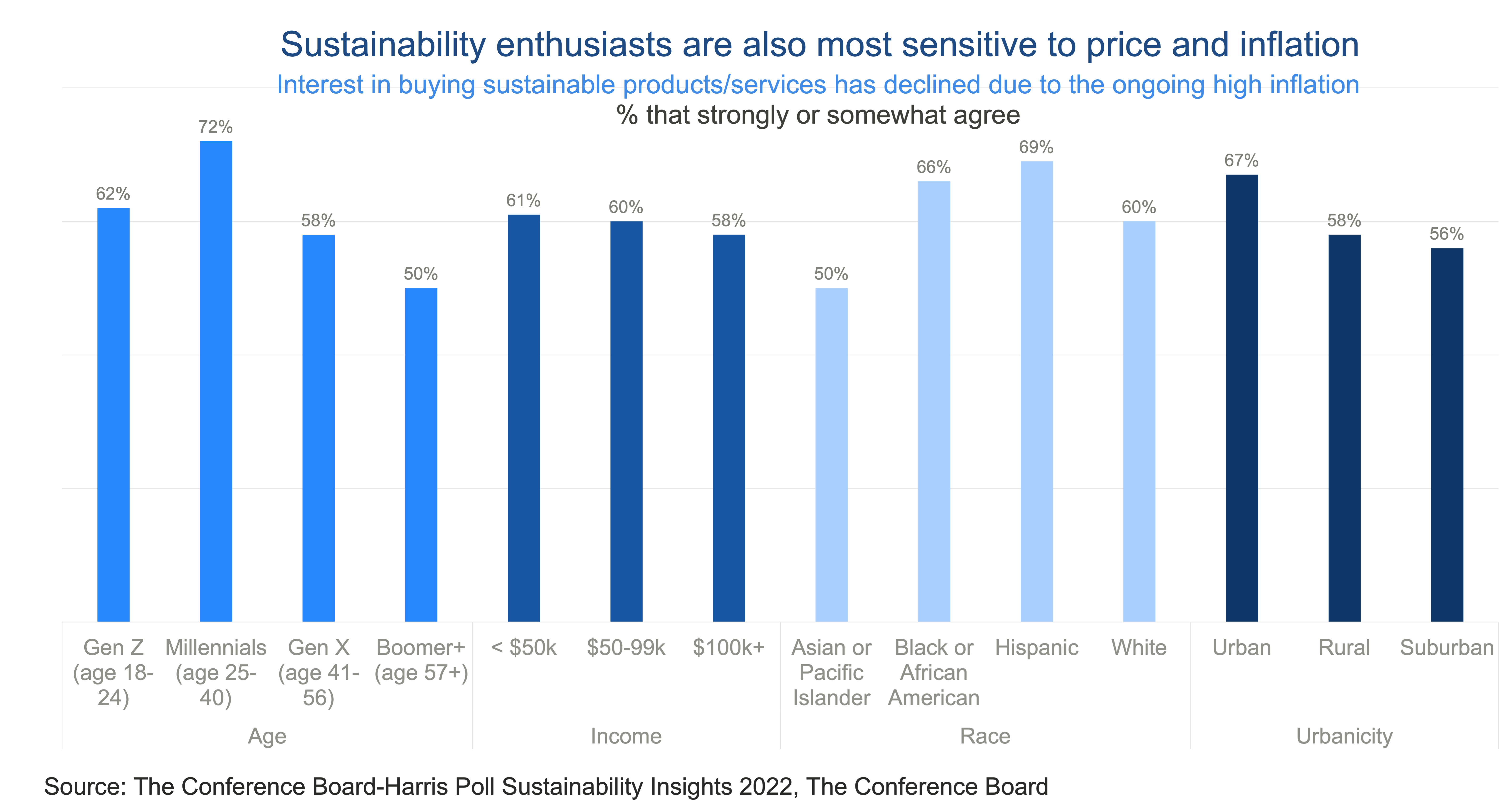

Price has always been a significant obstacle for sustainable products to gain market share. Our research shows how much more of an impediment price can be in financially challenging times. Notably, even consumer segments that our prior research has identified as most enthusiastic about sustainability such as millennial, urban, and Hispanic consumers now seem to be buying sustainable products less because of inflation.

It’s sustainability enthusiasts, such as millennial, urban, and Hispanic consumers, who seem to be most sensitive to price and inflation

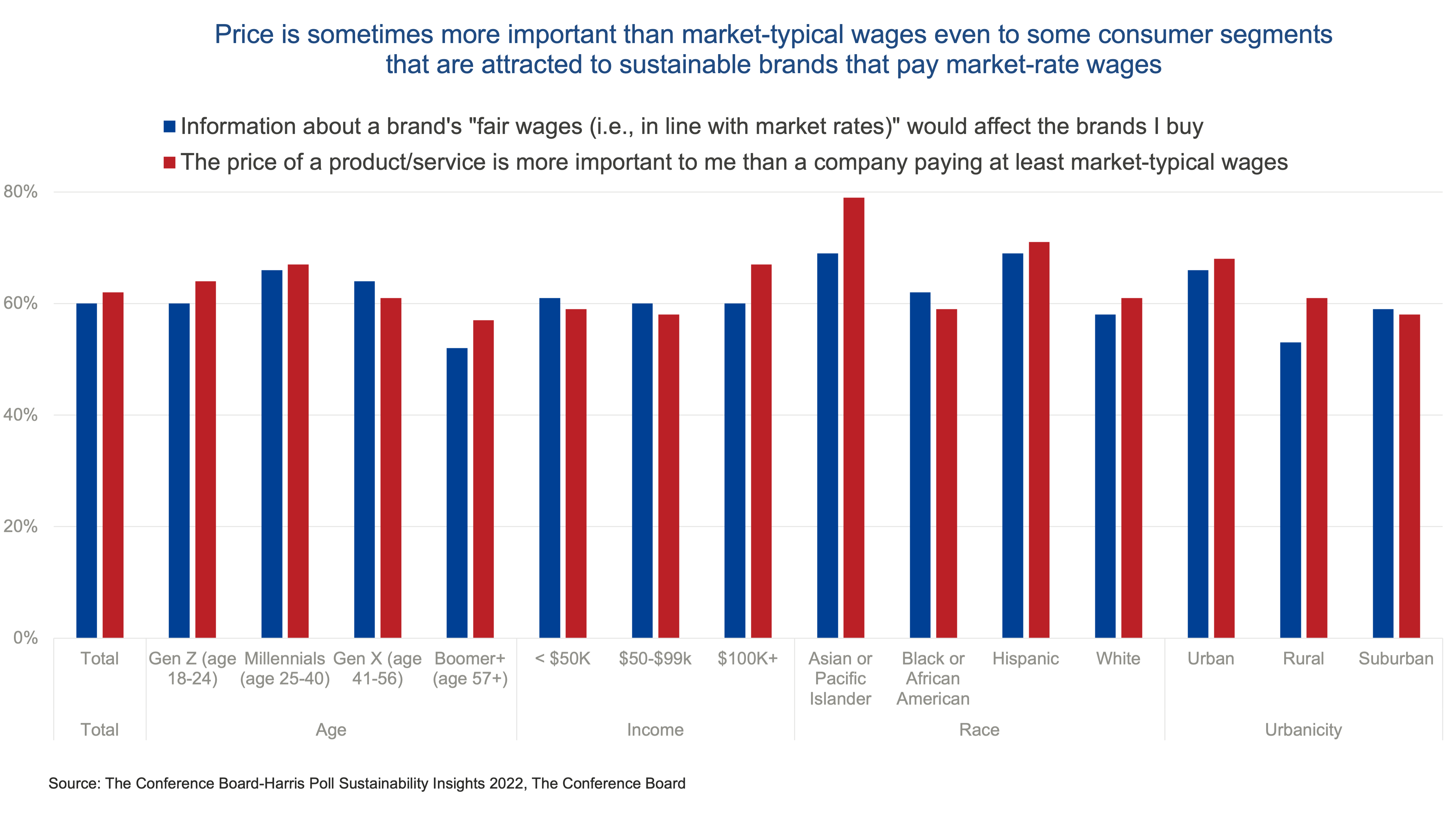

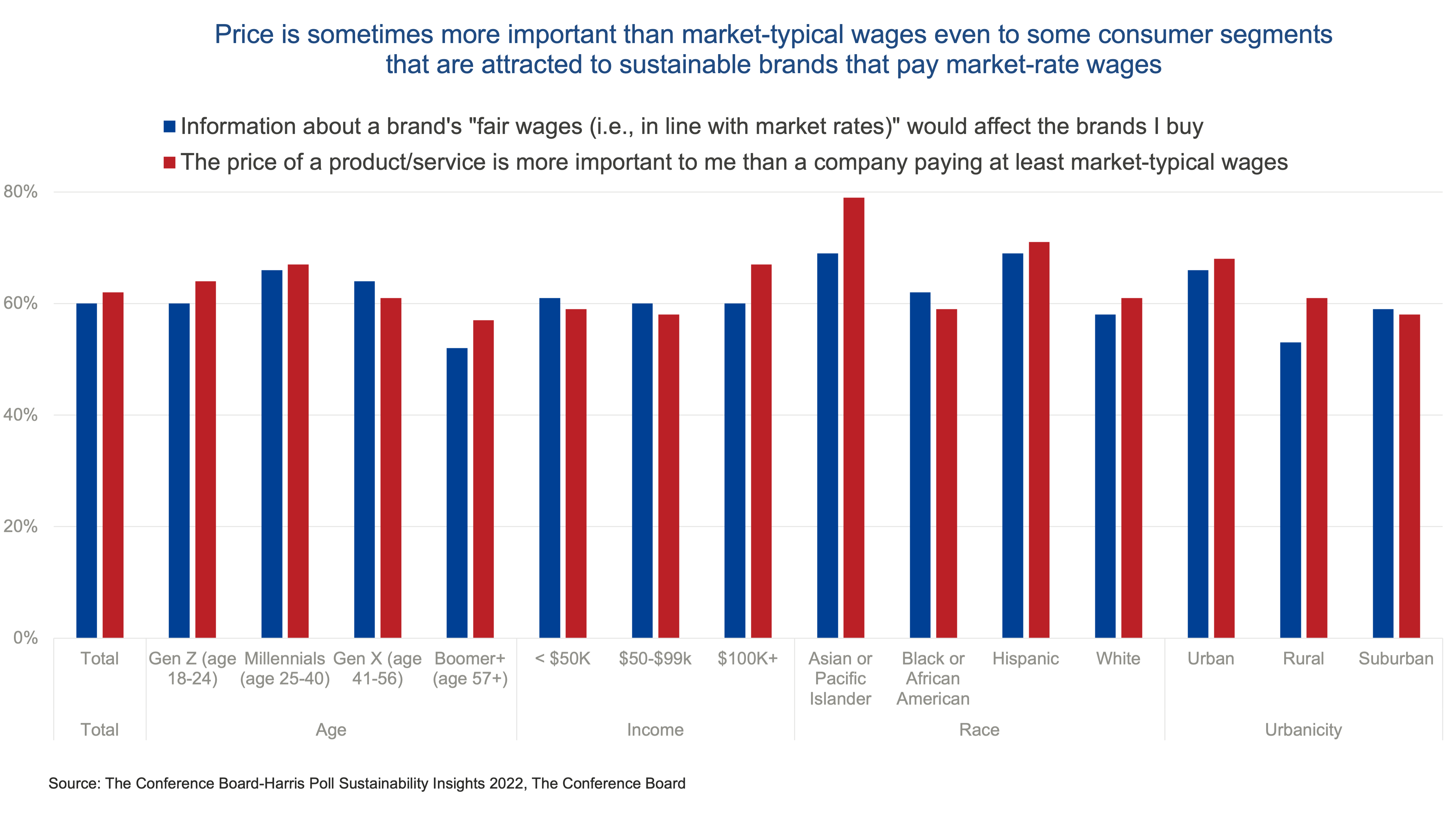

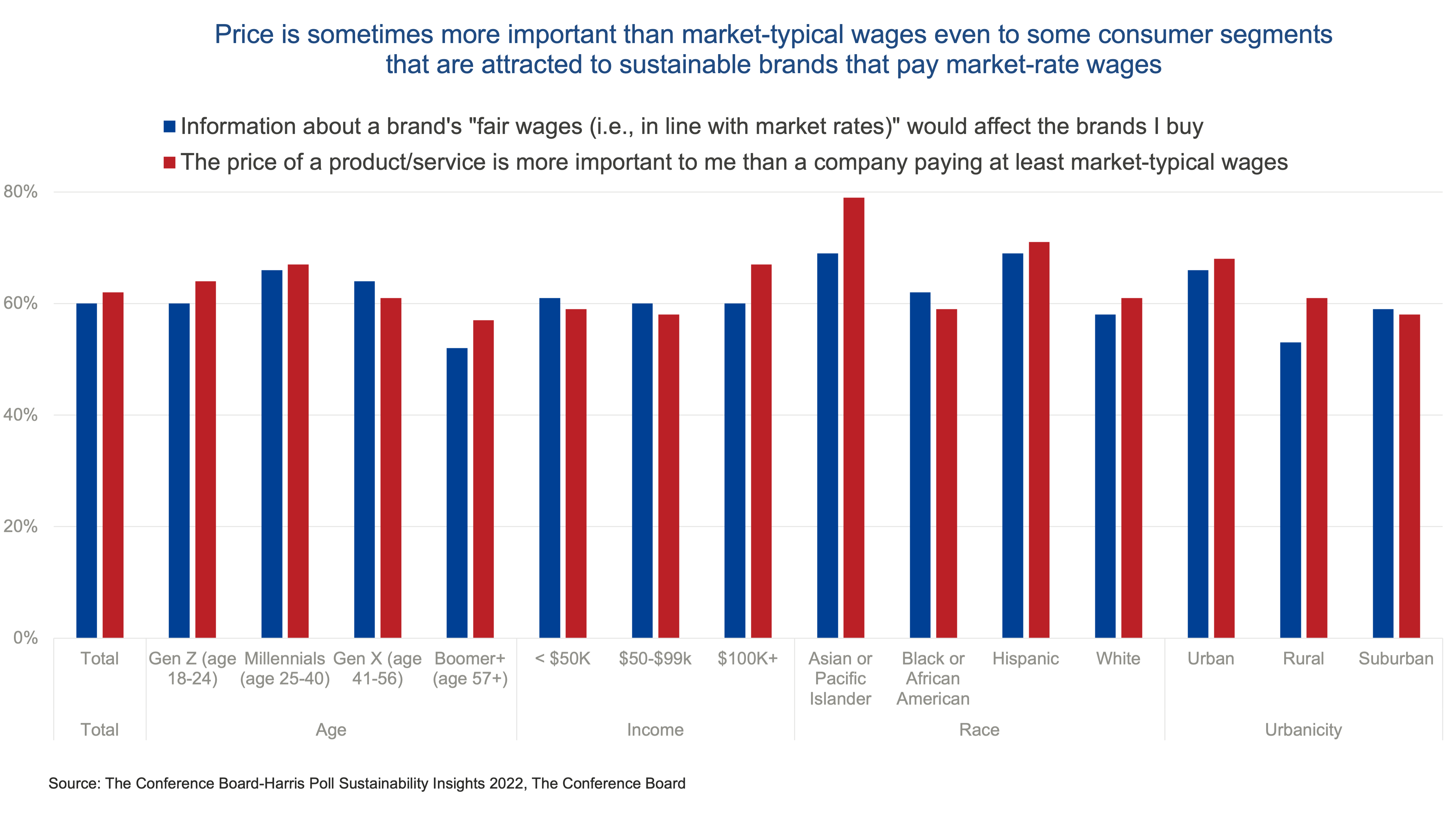

- While key consumer segments favor products and services from companies that pay wages in line with market rates, price is often still more important in decision-making for those same consumer groups. Ultimately, while people want sustainability, price can outweigh the appeal of sustainability features: our research shows that the segments most attracted to brands paying wages in line with market rates (see the red bars in the chart below) are also those who prioritize price over market rate wages the most. This includes US Asian, Hispanic, urban, higher-income, and millennial consumers—again, segments that tend to be more supportive of sustainability, including its social dimensions. This shows just how important the price is, especially during economically challenging times.

Even consumer segments that are most attracted to sustainable products for their fair wages for employees still focus on price in their purchase decisions

How the economic downturn could spur innovations to save both cost and the environment—and enable more accessible prices

- Innovative production and delivery processes and policies can increase eco-friendliness and reduce cost. For example, recycling remnants of older products to create new ones, making operationsmore efficient, using wastewater for heating and cooling, replacing virgin with recycled materials, and using less packaging can save money—and even add revenue by reaching additional buyers to whom such products and practices appeal. If passed on, these cost reductions could help keep prices down for customers.

- Novel business models such as renting, sharing, and secondhand provide consumers with more price points, while benefiting sustainability. These consumption models help reduce production by increasing the use and reuse of existing items and objects, including cars, home and garden tools, electronics, furniture, apparel, and accessories. Secondhand sales in the US grew 15 percent in 2021 and are projected to grow by 80 percent over the next five years, with higher-income shoppers contributing to the growth. In Japan, where tech devices are popular and the secondhand smartphone penetration is at only 5 percent compared to 20 percent in the US, secondhand sales rose by 15 percent last year with further growth projected. This is partly due to increasing iPhone prices in response to a record weak yen relative to the US dollar. Citing sustainability benefits can help reduce resistance to secondhand buying.

Fostering sustainable products’ uptake through new pricing models and transparent price communications

- Considering how important price is to customers, novel pricing systems for sustainable products, especially during this inflationary and recessionary time, can buoy demand. Pricing decisions should take into account other corporate benefits that come with offering sustainable products, including higher productivity from committed employees motivated by a company’s sustainability agenda, employees’ acceptance of lower pay in return for a meaningful job and lower turnover, and improved ability to attract desirable investors and suppliers. This broader approach to pricing could help keep prices down which, in turn, could foster product adoption and long-term scale-based cost efficiencies, further helping customer-friendly prices in the future.

Inflation and recession are obstacles for sustainable products’ further adoption, prompting the question about new pricing approaches

- In tight financial conditions, customers may appreciate payment models that spread charges over time or that offer flexible prices. Pay-as-you-go and micropayment programs allow per-use payments, spreading expenses over time. For example, an alternative to monthly or yearly subscriptions could be to allow use for a day or for a certain occasion or a single item.

- Breaking down cost components and margins for sustainable products as compared to traditional ones can make prices more plausible, potentially fostering price acceptance and lowering negative reactions. It could help customers understand what their payment is covering and in what portions, including the sustainability features, and what companies are earning. Some airlines break down taxes and airport and security fees in flight fares, showing that airlines often only receive a fraction of the total price paid. The transparency about usually behind-the-scenes information can help strengthen trust.In fact, research shows that transparency around pricing and underlying costs can be financially beneficial for brands: a natural field experiment with leather wallets produced higher sales for items displaying their cost breakdown. Other experiment-based research with fashion items shows that price transparency can positively influence brand equity and purchase intention. An example of full price disclosure is fashion brand Everlane, whose radical transparency principle includes revealing the breakdown of each item’s materials, labor, and transportation costs.

Methodology and Collaboration of The Conference Board with The Harris Poll

This report is the second of four reports from our survey of US consumer perceptions on corporate sustainability. The other reports cover US consumers’ consumption cuts to protect the environment; which sustainability features drive US consumers’ purchases and how they compare to previous years; and what US consumers think of companies’ sustainability action and communications, related to both environmental and social dimensions.

The survey is a collaboration between The Conference Board and The Harris Poll. It builds on related research in 2021, as covered in Sustainability Features That Sway US Consumers Are Changing and US Consumers Want Business to Do More on Sustainability. The current survey ran in the US from September 2 to 4, 2022, and yielded responses from 2,025 adults. Results are weighted to represent the US adult population.

We greatly appreciate the ongoing partnership with Rob Jekielek, Managing Director at The Harris Poll, who made this research possible.

According to our survey of more than 2,000 US respondents conducted jointly with The Harris Poll, 60 percent of respondents—and 58 percent of people with $100,000+ incomes—report a declining propensity to buy sustainable products because of inflation. An even larger share (75 percent) believe people’s interest in buying sustainable products will wane in an economic decline.

Insights for What’s Ahead

- Record inflation—especially in the energy and food categories—is shifting consumer preference toward less pricey alternatives and away from more expensive sustainable products. Products with environmental or social sustainability benefits are usually priced higher than traditional versions—by almost 30 percent in 2021 and the first half of 2022. Although this substitution effect—as a product’s price rises, its sales fall as people switch to cheaper alternatives—is not unique to the current downturn, it does pose marketing and pricing challenges for sustainable goods and services.

- The segments of the population that tend to be most enthusiastic about sustainability (such as consumers who are millennial, urban, or Hispanic) are also very sensitive to price inflation. To avoid losing inflation-battered sustainability enthusiasts as customers and “influencers,” companies could consider special promotions such as loyalty and quantity discounts or rewards for gaining new customers.They could keep these customers loyal and maintain their potential positive impact on peer consumers in economically challenging times. In addition, such special offers could create long-term goodwill with these segments by signaling a brand’s appreciation of and commitment to them as customers during tougher economic times.

- Providing incentives to customers to promote sustainable behaviors and to help the company save operational costs can serve the dual goals of sustainability and more customer-friendly prices. Customers could be rewarded with discounts or vouchers for behaviors that help companies save costs and contribute to sustainable operations. Examples are price-off rewards for bringing one’s own bag to the store or one’s own coffee mug to a café, reusing towels and linens during a hotel stay, or accepting a flexible delivery date for an online order to make a retailer’s delivery schedule more efficient.

- Novel pricing approaches are needed if companies want to promote demand for sustainable products, especially during this inflationary and recessionary time. This may mean not just passing higher input costs onto consumers but setting prices in a way that takes into account longer-term, multistakeholder benefits of sustainable products and services such as greater employee commitment, longer tenure, and more interest from investors. Ultimately, a wide adoption of sustainable products and services can only be achieved if they are offered at the same price as their nonsustainable equivalents.

Price above all

Price has always been a significant obstacle for sustainable products to gain market share. Our research shows how much more of an impediment price can be in financially challenging times. Notably, even consumer segments that our prior research has identified as most enthusiastic about sustainability such as millennial, urban, and Hispanic consumers now seem to be buying sustainable products less because of inflation.

It’s sustainability enthusiasts, such as millennial, urban, and Hispanic consumers, who seem to be most sensitive to price and inflation

- While key consumer segments favor products and services from companies that pay wages in line with market rates, price is often still more important in decision-making for those same consumer groups. Ultimately, while people want sustainability, price can outweigh the appeal of sustainability features: our research shows that the segments most attracted to brands paying wages in line with market rates (see the red bars in the chart below) are also those who prioritize price over market rate wages the most. This includes US Asian, Hispanic, urban, higher-income, and millennial consumers—again, segments that tend to be more supportive of sustainability, including its social dimensions. This shows just how important the price is, especially during economically challenging times.

Even consumer segments that are most attracted to sustainable products for their fair wages for employees still focus on price in their purchase decisions

How the economic downturn could spur innovations to save both cost and the environment—and enable more accessible prices

- Innovative production and delivery processes and policies can increase eco-friendliness and reduce cost. For example, recycling remnants of older products to create new ones, making operationsmore efficient, using wastewater for heating and cooling, replacing virgin with recycled materials, and using less packaging can save money—and even add revenue by reaching additional buyers to whom such products and practices appeal. If passed on, these cost reductions could help keep prices down for customers.

- Novel business models such as renting, sharing, and secondhand provide consumers with more price points, while benefiting sustainability. These consumption models help reduce production by increasing the use and reuse of existing items and objects, including cars, home and garden tools, electronics, furniture, apparel, and accessories. Secondhand sales in the US grew 15 percent in 2021 and are projected to grow by 80 percent over the next five years, with higher-income shoppers contributing to the growth. In Japan, where tech devices are popular and the secondhand smartphone penetration is at only 5 percent compared to 20 percent in the US, secondhand sales rose by 15 percent last year with further growth projected. This is partly due to increasing iPhone prices in response to a record weak yen relative to the US dollar. Citing sustainability benefits can help reduce resistance to secondhand buying.

Fostering sustainable products’ uptake through new pricing models and transparent price communications

- Considering how important price is to customers, novel pricing systems for sustainable products, especially during this inflationary and recessionary time, can buoy demand. Pricing decisions should take into account other corporate benefits that come with offering sustainable products, including higher productivity from committed employees motivated by a company’s sustainability agenda, employees’ acceptance of lower pay in return for a meaningful job and lower turnover, and improved ability to attract desirable investors and suppliers. This broader approach to pricing could help keep prices down which, in turn, could foster product adoption and long-term scale-based cost efficiencies, further helping customer-friendly prices in the future.

Inflation and recession are obstacles for sustainable products’ further adoption, prompting the question about new pricing approaches

- In tight financial conditions, customers may appreciate payment models that spread charges over time or that offer flexible prices. Pay-as-you-go and micropayment programs allow per-use payments, spreading expenses over time. For example, an alternative to monthly or yearly subscriptions could be to allow use for a day or for a certain occasion or a single item.

- Breaking down cost components and margins for sustainable products as compared to traditional ones can make prices more plausible, potentially fostering price acceptance and lowering negative reactions. It could help customers understand what their payment is covering and in what portions, including the sustainability features, and what companies are earning. Some airlines break down taxes and airport and security fees in flight fares, showing that airlines often only receive a fraction of the total price paid. The transparency about usually behind-the-scenes information can help strengthen trust.In fact, research shows that transparency around pricing and underlying costs can be financially beneficial for brands: a natural field experiment with leather wallets produced higher sales for items displaying their cost breakdown. Other experiment-based research with fashion items shows that price transparency can positively influence brand equity and purchase intention. An example of full price disclosure is fashion brand Everlane, whose radical transparency principle includes revealing the breakdown of each item’s materials, labor, and transportation costs.

Methodology and Collaboration of The Conference Board with The Harris Poll

This report is the second of four reports from our survey of US consumer perceptions on corporate sustainability. The other reports cover US consumers’ consumption cuts to protect the environment; which sustainability features drive US consumers’ purchases and how they compare to previous years; and what US consumers think of companies’ sustainability action and communications, related to both environmental and social dimensions.

The survey is a collaboration between The Conference Board and The Harris Poll. It builds on related research in 2021, as covered in Sustainability Features That Sway US Consumers Are Changing and US Consumers Want Business to Do More on Sustainability. The current survey ran in the US from September 2 to 4, 2022, and yielded responses from 2,025 adults. Results are weighted to represent the US adult population.

We greatly appreciate the ongoing partnership with Rob Jekielek, Managing Director at The Harris Poll, who made this research possible.