Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

31 October 2023 / Quick Take

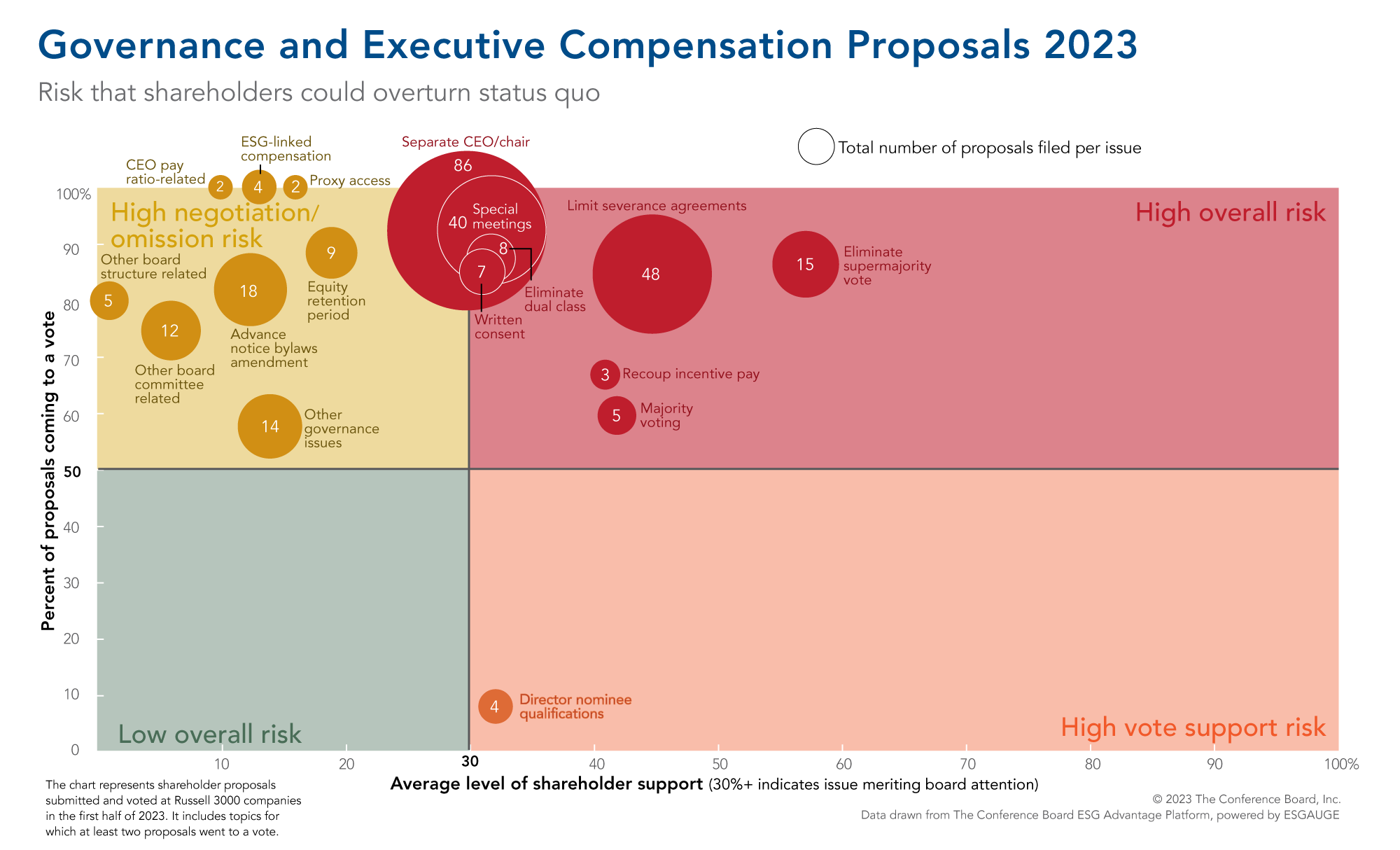

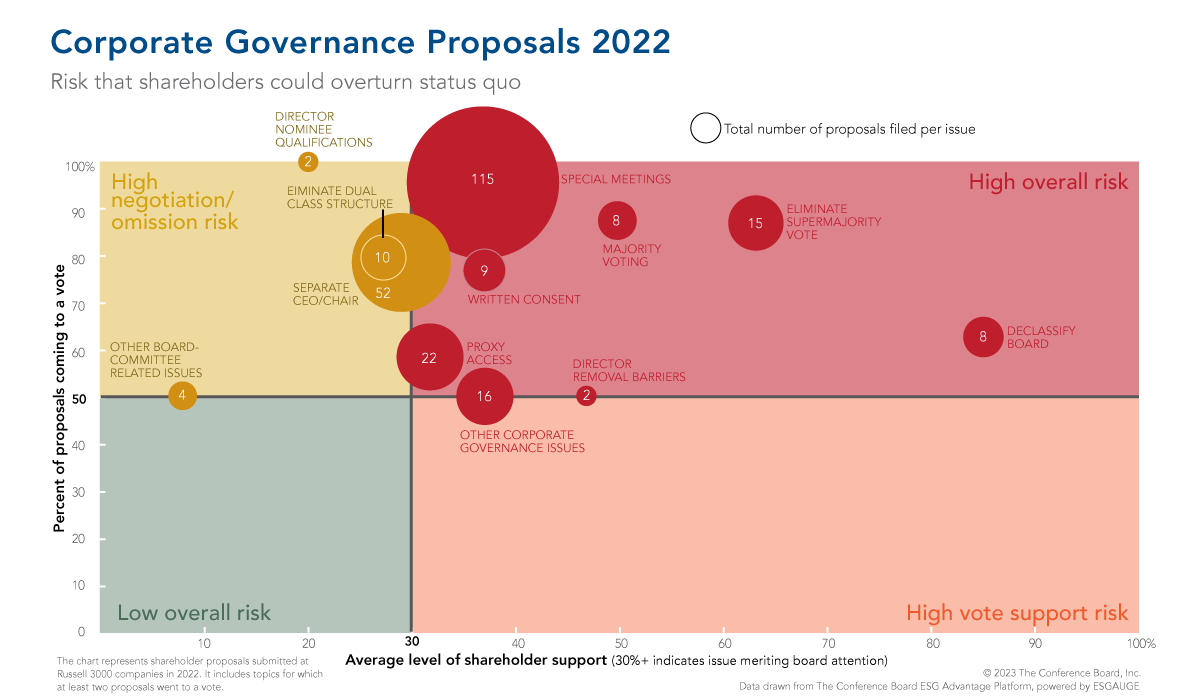

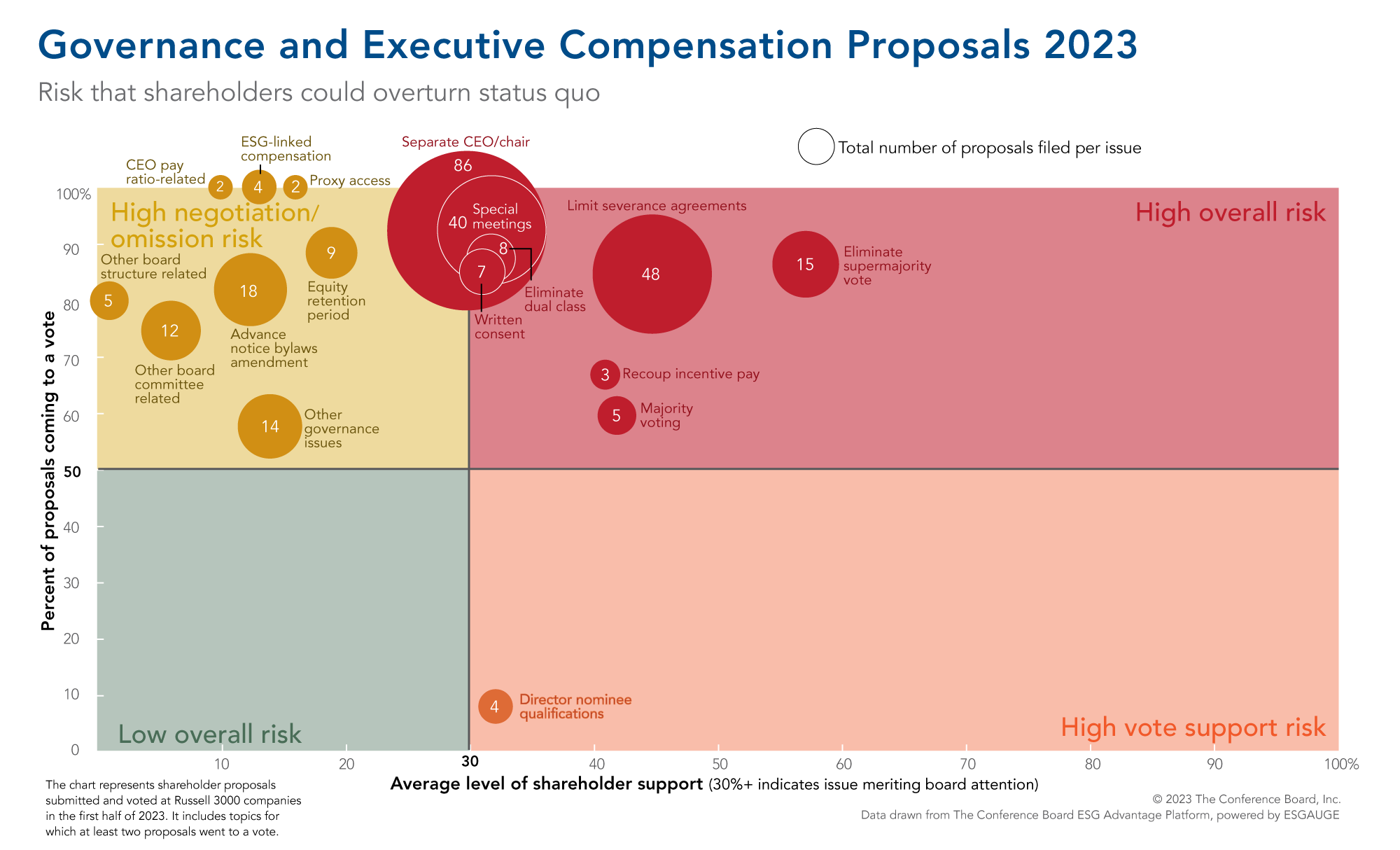

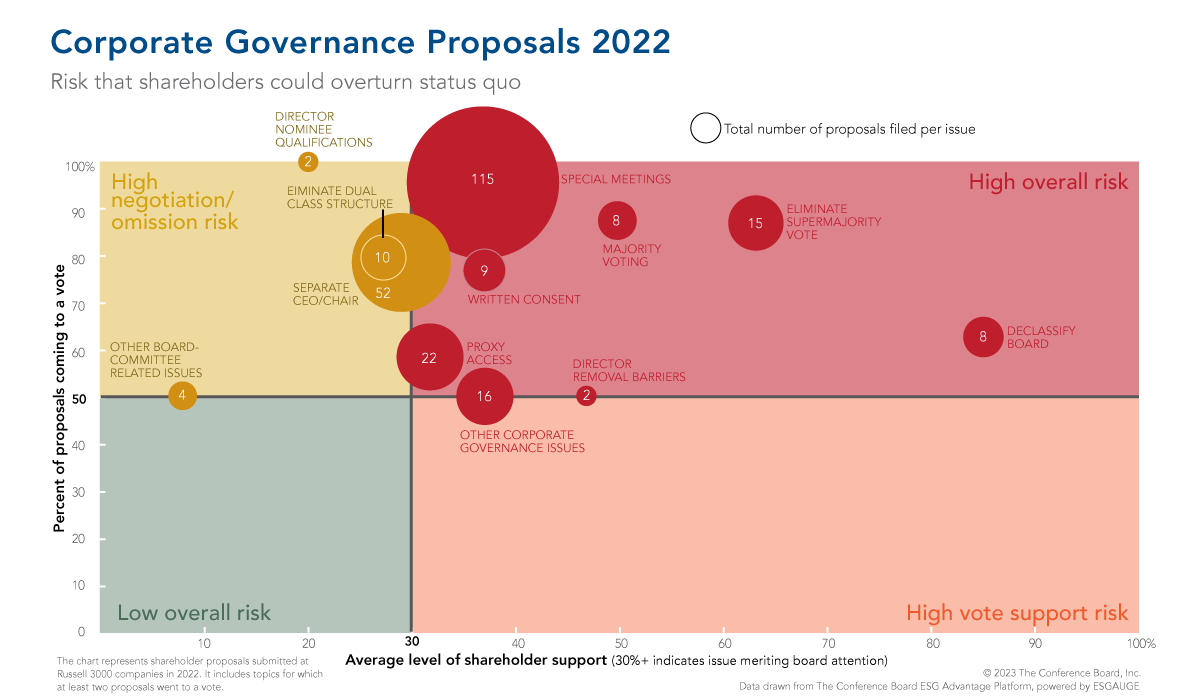

In the 2023 proxy season, shareholder proposals on governance topics once again fell into the “red zone,” where they are likely to come to a shareholder vote and receive more than 30% average support, continuing the trend we saw in 2022.

Insight for What’s Ahead: We can expect the vast majority of governance-related shareholder proposals to go to a shareholder vote in 2024. Most governance proposals are submitted by individual investors, who are often unwilling to compromise with companies and who change the focus of their activism each year. For example, in 2022, most governance proposals focused on the ability of shareholders to call special meetings, while separation of the chair and CEO positions was the top topic in 2023.

Companies whose governance practices don’t align with investor expectations and prevailing practices among large companies should be prepared for many such proposals to pass—or come close to passing—in the 2024 proxy season, and also for investors to use their votes on director elections to express their concerns. Moreover, some governance topics that garnered only low double-digit support (e.g., a new proposal requiring shareholder approval of advance notice bylaw amendments which averaged 12% support) may receive more support next year as proponents improve the quality and focus of their proposals.

Our latest report—featuring data from analytics firm ESGAUGE and produced with the support of Russell Reynolds Associates and the Rutgers Center for Corporate Law and Governance—provides further guidance on how companies can prepare for the 2024 proxy season.

In the 2023 proxy season, shareholder proposals on governance topics once again fell into the “red zone,” where they are likely to come to a shareholder vote and receive more than 30% average support, continuing the trend we saw in 2022.

Insight for What’s Ahead: We can expect the vast majority of governance-related shareholder proposals to go to a shareholder vote in 2024. Most governance proposals are submitted by individual investors, who are often unwilling to compromise with companies and who change the focus of their activism each year. For example, in 2022, most governance proposals focused on the ability of shareholders to call special meetings, while separation of the chair and CEO positions was the top topic in 2023.

Companies whose governance practices don’t align with investor expectations and prevailing practices among large companies should be prepared for many such proposals to pass—or come close to passing—in the 2024 proxy season, and also for investors to use their votes on director elections to express their concerns. Moreover, some governance topics that garnered only low double-digit support (e.g., a new proposal requiring shareholder approval of advance notice bylaw amendments which averaged 12% support) may receive more support next year as proponents improve the quality and focus of their proposals.

Our latest report—featuring data from analytics firm ESGAUGE and produced with the support of Russell Reynolds Associates and the Rutgers Center for Corporate Law and Governance—provides further guidance on how companies can prepare for the 2024 proxy season.

Former Senior Researcher, Governance & Sustainabil…

The Conference Board

You already have an account with The Conference Board.

Please try to login in with your email or click here if you have forgotten your password.