Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

02 November 2023 / Quick Take

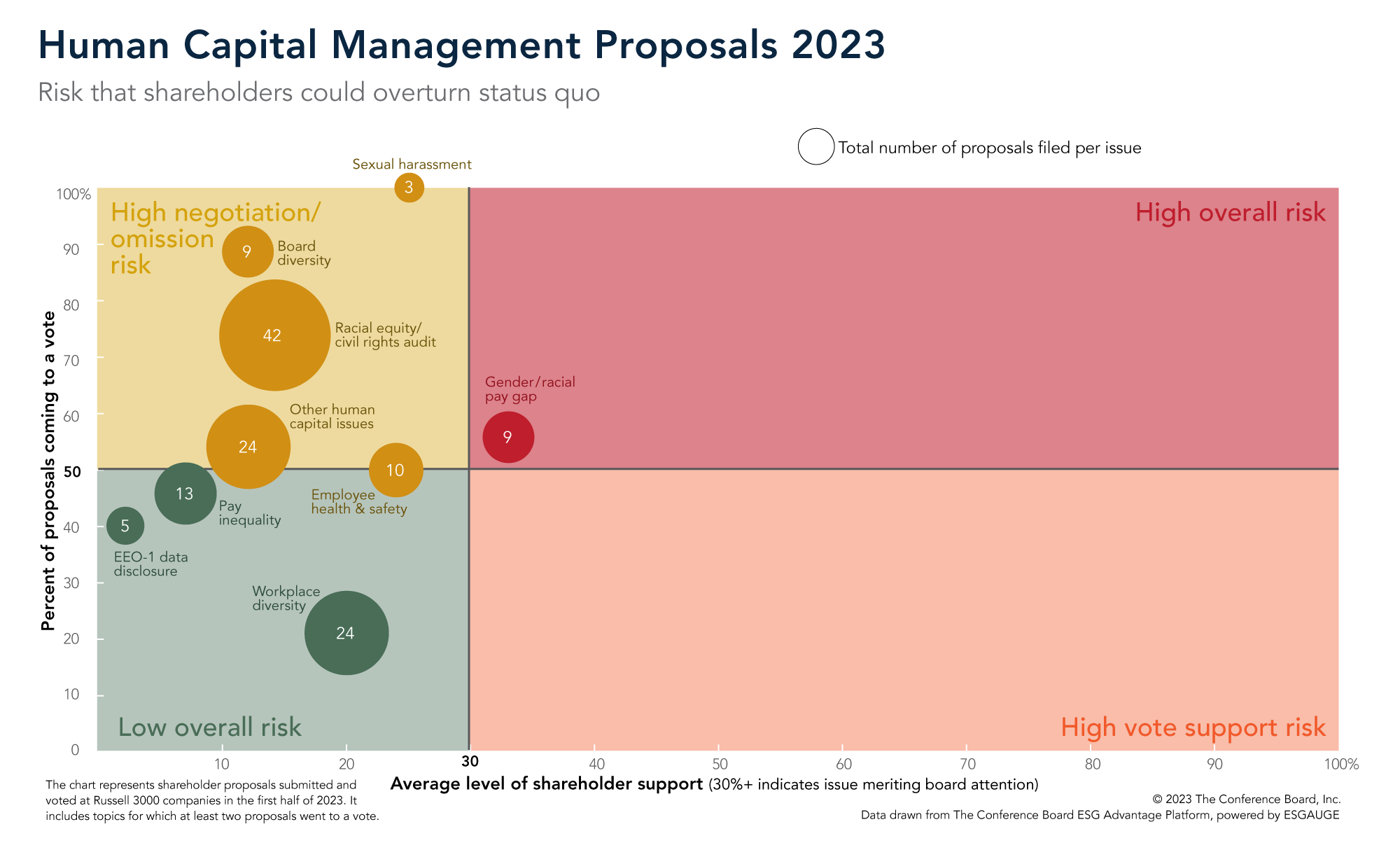

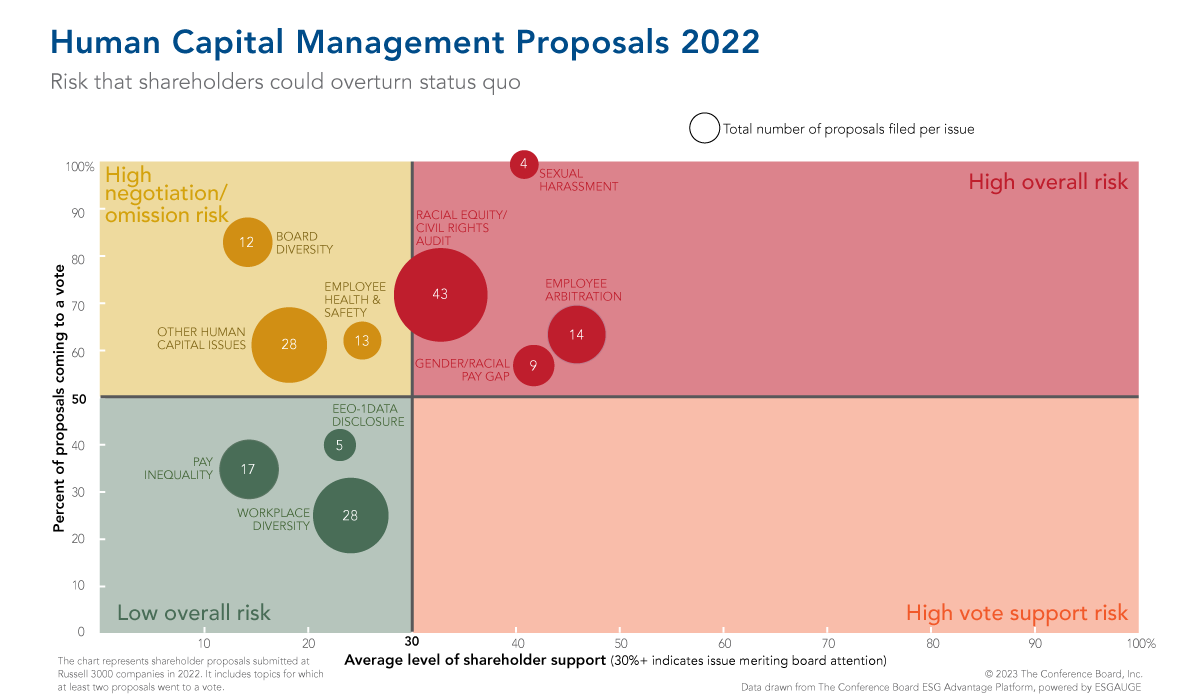

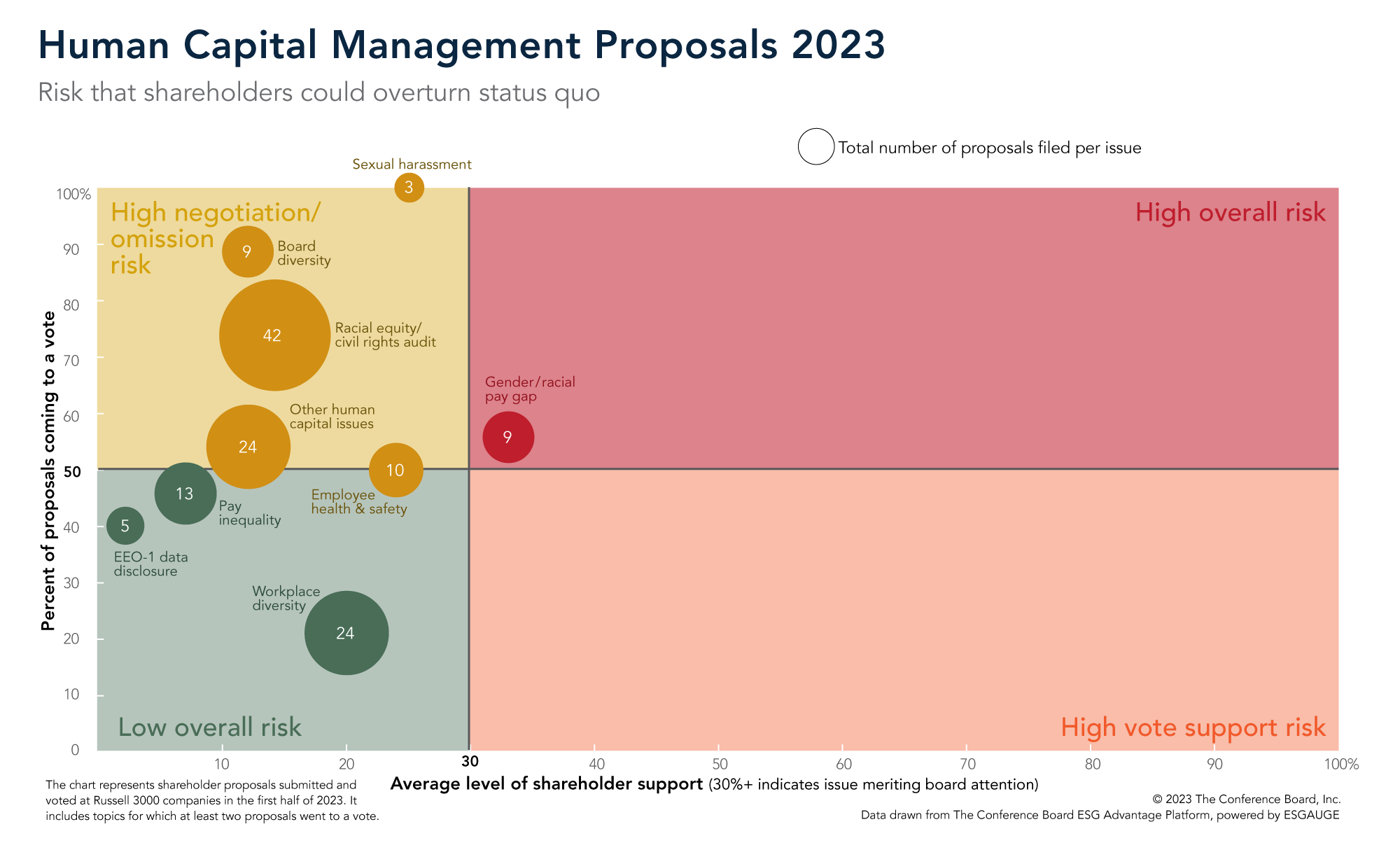

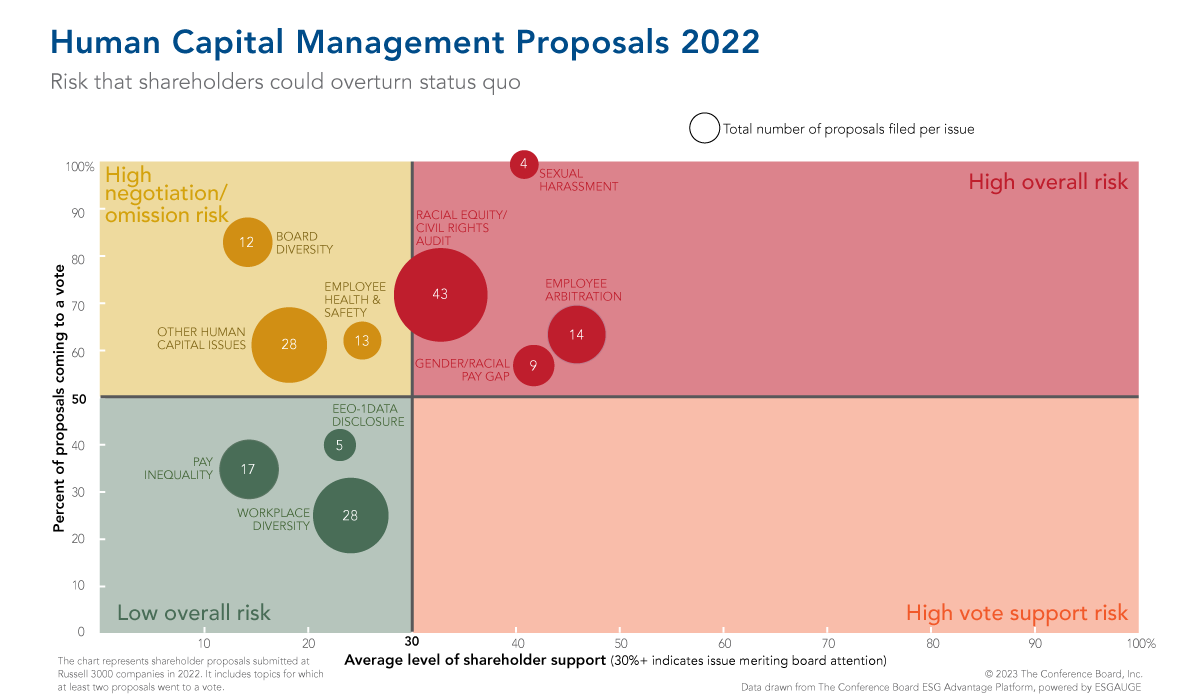

As in 2022, companies and shareholders this proxy season were often able to reach a compromise on shareholder proposals on human capital management (HCM), avoiding votes on topics such as workplace diversity, pay equity, and EEO-1 data disclosure. By contrast, shareholder proposals on governance and various environmental and social topics were far more likely to go to a vote at annual meetings. HCM proposals that did go to a shareholder vote in 2023 generally received far less support than in 2022.

Insight for What’s Ahead: The future landscape for other HCM proposals is likely to remain unsettled. While average support for HCM shareholder proposals declined from 28% in 2022 to 20% in 2023, this category was more successful than environmental and social proposals in terms of receiving majority support: five HCM proposals passed, compared to one environmental and one social proposal. In addition, companies should expect an increase in shareholder proposals on diversity and other hot-button topics that are a growing focus of anti-ESG groups and may become even more contentious as we head into a federal election year.

As the decline in support for shareholder proposals on racial equity and/or civil rights audit indicates, investors are willing to listen to what the company is already doing to address the issue, including the cost-benefit analysis of such proposals.

Our latest report—featuring data from analytics firm ESGAUGE and produced with the support of Russell Reynolds Associates and the Rutgers Center for Corporate Law and Governance—provides further guidance on how companies can prepare for the 2024 proxy season.

As in 2022, companies and shareholders this proxy season were often able to reach a compromise on shareholder proposals on human capital management (HCM), avoiding votes on topics such as workplace diversity, pay equity, and EEO-1 data disclosure. By contrast, shareholder proposals on governance and various environmental and social topics were far more likely to go to a vote at annual meetings. HCM proposals that did go to a shareholder vote in 2023 generally received far less support than in 2022.

Insight for What’s Ahead: The future landscape for other HCM proposals is likely to remain unsettled. While average support for HCM shareholder proposals declined from 28% in 2022 to 20% in 2023, this category was more successful than environmental and social proposals in terms of receiving majority support: five HCM proposals passed, compared to one environmental and one social proposal. In addition, companies should expect an increase in shareholder proposals on diversity and other hot-button topics that are a growing focus of anti-ESG groups and may become even more contentious as we head into a federal election year.

As the decline in support for shareholder proposals on racial equity and/or civil rights audit indicates, investors are willing to listen to what the company is already doing to address the issue, including the cost-benefit analysis of such proposals.

Our latest report—featuring data from analytics firm ESGAUGE and produced with the support of Russell Reynolds Associates and the Rutgers Center for Corporate Law and Governance—provides further guidance on how companies can prepare for the 2024 proxy season.

Former Senior Researcher, Governance & Sustainabil…

The Conference Board

You already have an account with The Conference Board.

Please try to login in with your email or click here if you have forgotten your password.