-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

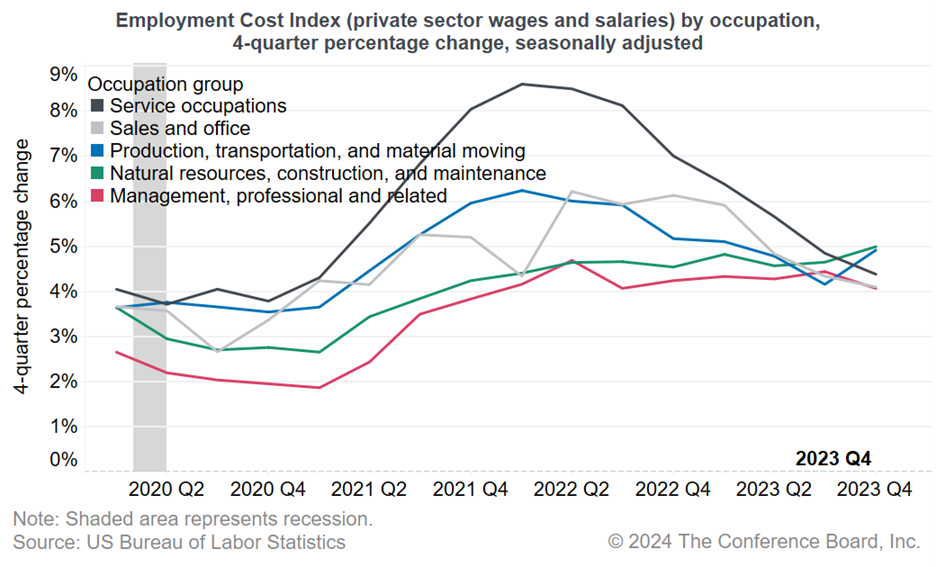

Today’s ECI report revealed that wages and benefits continued to exhibit elevated growth above historical trends in the fourth quarter of 2023, but the rate of growth decelerated from earlier in the year. An earlier report from the Bureau of Labor Statistics showed that job openings remained high and layoffs were still below historic norms at the end of 2023, but companies slowed hiring suggesting pressure on wage growth might ease later in 2024. However, the ECI report also showed wage growth reaccelerated for some occupations in the goods producing where in-person work is required. Chart: Wage growth reaccelerated for some occupation groups in Q4 2023 Highlights from the Compensation Report The ECI report indicated that wage growth (year-over-over) for in-person service workers (including food services, cleaning, and personal care) decelerated to 4.5% year-over-over in Q4 2023, notably lower than the peak of 7.9% in Q2 2022. Similarly, wage growth for management and professional workers declined to 4.2% in Q4 2023 (from 4.5% in Q3 2023). Wage growth for sales and office workers also declined to 4.2% in Q4 2023 (from 4.4% in Q3 2023). Conversely, wage growth for construction, natural resource, and maintenance workers, as well as production and transportation workers, reaccelerated to 4.9% year-over-year in Q4 2023, up from 4.6% and 4.2%, respectively, in Q3 2023. What Should We Expect for the Wage Outlook? While we anticipate a slowdown in the labor market in 2024 and foresee some job losses in the H2 2024, we project that the unemployment rate will only rise to 4.3 percent. Many industries will continue to grapple with recruitment and retention difficulties in the coming years. Although the labor market slowdown might somewhat decelerate wage growth, we anticipate elevated wage growth for the next year as 71% of CEOs expect to increase wages by 3% or more over the next year according to The Conference Board Measure of CEO Confidence™.

Wage growth in the private sector stood at 4.1% year-over-year in Q4 2023, slightly lower than the 4.3% rate in Q3 2023 and markedly reduced from 5.1% in Q4 2022. The growth in benefits costs decelerated to 3.6% in Q4 2023 from 3.9% in Q3 2023 and was significantly below the 4.8% growth observed in Q4 2022.

While we may have passed the peak increases in wage growth witnessed over the last couple of years, there are signs of reacceleration for certain occupations. Furthermore, even for occupations that experienced declaration, wage growth is still above historic norms, and the rate of deceleration is slow.

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023