-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

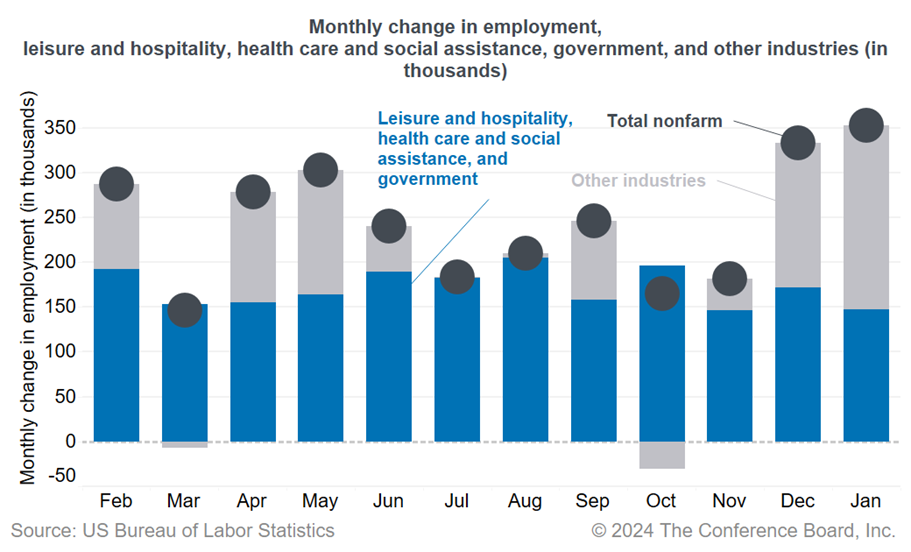

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report Today’s jobs report revealed that the US labor market continued to be resilient with a remarkable addition of 353,000 jobs in January, following an upwardly revised 333,000 jobs added in December 2023. Wage growth remained robust as well, with average hourly wages increasing by 4.5% over the past year. Although this marks a decrease from the peak in early 2022, wages are still growing significantly faster than prepandemic rates. Chart: Employment gains were economywide in January unlike the second part of 2023 when three industries accounted for jobs added The unemployment rate remained at 3.7% in January, staying under 4% for the 24th consecutive month, while the labor force participation rate for individuals aged 16 and above remained flat at 62.5%. These figures reaffirm the continued strength of the labor market, aligning with expectations that the Federal Reserve might look for further evidence that inflation is fully under control and wait until June before it implements interest rate reductions. The three sectors that drove employment gains in the second part of 2023 continued to add jobs in January, with healthcare and social assistance (+100,400), government (+36,000), and leisure and hospitality (+11,000) accounting for 42% of jobs added in the month (see Chart). Other notable industries that added jobs in January included professional and business services (+74,000), retail trade (+45,200), manufacturing (+23,000), transportation and warehousing (+15,500), information services (+15,000), and construction (+11,000). Temporary help services—often considered a leading indicator for hiring trends—added 3,900 jobs, reversing the declines observed since April 2022. Moreover, revisions to the data revealed that job growth in 2023 was stronger than initially reported, with 359,000 more jobs created than previously estimated. However, revisions for 2022 showed a decrease of 266,000. One major weakness in today’s report was the average weekly hours worked, which declined to 34.1 in January from 34.3 in December, its lowest level since March 2020. The decline in average weekly hours was driven by service-providing industries. They were particularly visible in construction, where average weekly hours declined from 39.2 in December to 38.6 in January, and in retail trade, where average weekly hours fell from 29.8 in December to 29.1 in January—the lowest level ever recorded. This suggests that employers chose to reduce hours rather than resort to layoffs for the moment.

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023