September 24, 2020 | Chart

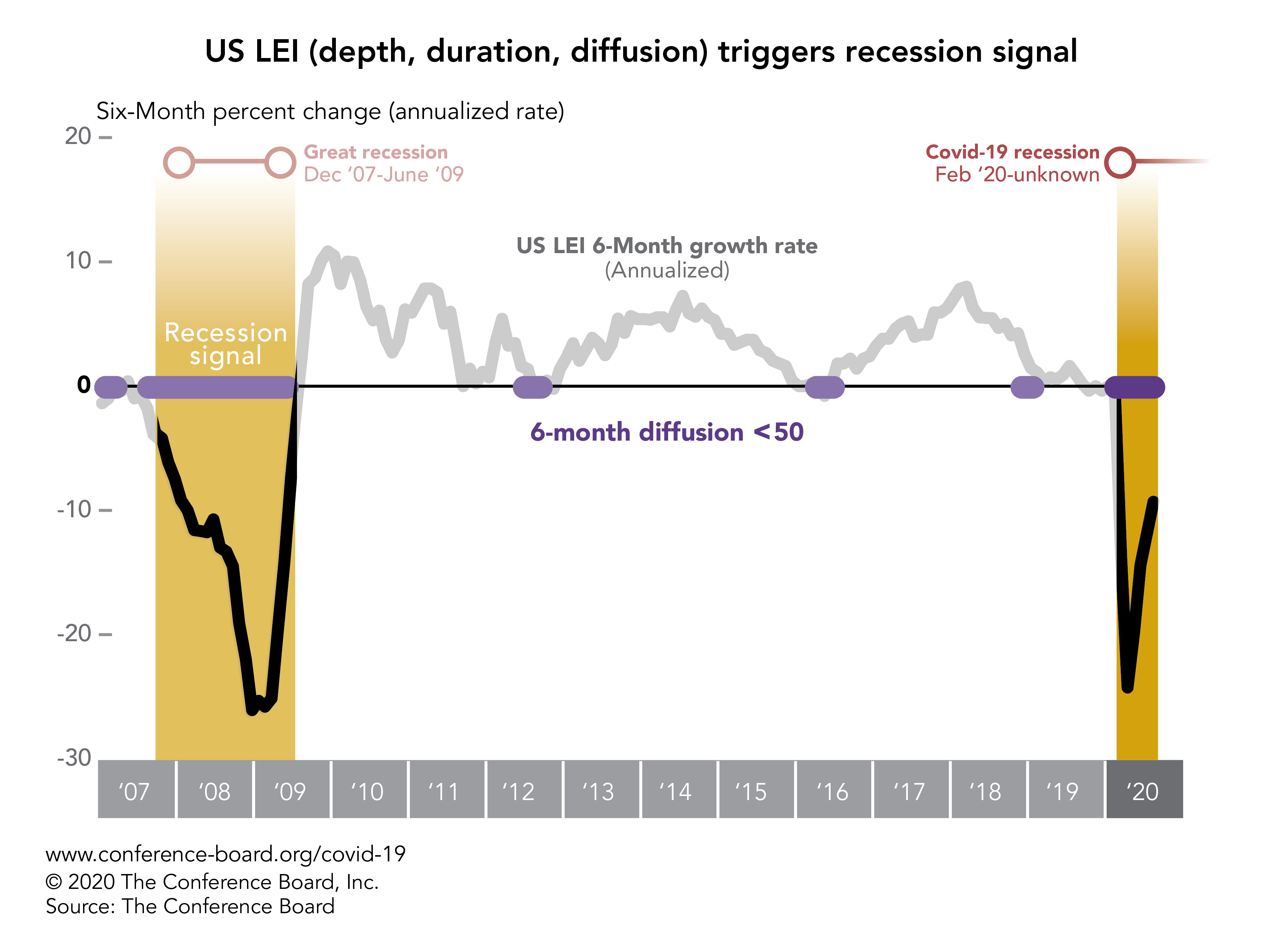

The Conference Board Leading Economic Index® (LEI) for the United States continued to improve in August, but a recession signal derived from the index has continued to flash since March. This signal, generated using the “3Ds” rule (depth, duration, and diffusion), is activated when certain criteria in the overall LEI and its many components are met. A large decline (depth) in the six-month growth rate (duration) of the LEI is an early indication of a turning point in the economy (black line). A third key metric, diffusion, indicates whether the majority of the LEI’s components are helping or hurting the overall index (purple dots in chart). Though there’s a tight relationship between past LEI recession signals and the official recession chronology,* it can be difficult to pinpoint when a recession will end in real time. However, business leaders can use the LEI’s recession signal as a guide: when that warning light goes off, the US may be on the cusp of exiting the COVID-19 recession.

*As defined by the National Bureau of Economic Research

PRESS RELEASE

US Leading Economic Index® Fell Further in February

March 20, 2025

PRESS RELEASE

US Leading Economic Index® Declined in January

February 20, 2025

PRESS RELEASE

US Leading Economic Index® Decreased in December

January 22, 2025

PRESS RELEASE

US Leading Economic Index® Increased in November

December 19, 2024

PRESS RELEASE

US Leading Economic Index® Fell in October

November 21, 2024

PRESS RELEASE

US Leading Economic Index® Declined in September

October 21, 2024

All release times displayed are Eastern Time

Charts

The Conference Board Leading Economic Index® (LEI) for the US rose sharply in August and remains on a rapidly rising trajectory. The strengths among the leading indic…

LEARN MORECharts

The Conference Board Leading Economic Index®(LEI) for the US dropped 4.4 percent in April, following a decline of 7.4 percent in March.

LEARN MORETechnical Notes for the US LEI

March 20, 2025 | Guide & Reference

August US leading index points to continued economic growth

September 23, 2021 | Chart

US LEI improving, but recession signal remains

September 24, 2020 | Chart

LEI points to a deep recession with no sign of fast rebound

May 21, 2020 | Chart

The Long-term Economic Outlook for the US, Europe, and China

December 11, 2024 11:00 AM ET (New York)

The Evolving Economic Outlook for Europe

July 10, 2024 11:00 AM ET (New York)

What Are The Conference Board LEIs Telling Us About the Future?

April 10, 2024 11:00 AM ET (New York)

Inflation, Labor Markets, and the Fed

May 11, 2022 11:00 AM ET (New York)