Sustainability Features That Sway US Consumers Are Changing

April 17, 2022 | Report

Results from our US consumer survey to shape your sustainability strategy and story

See Part 1: US Consumers Want Business to Do More on Sustainability

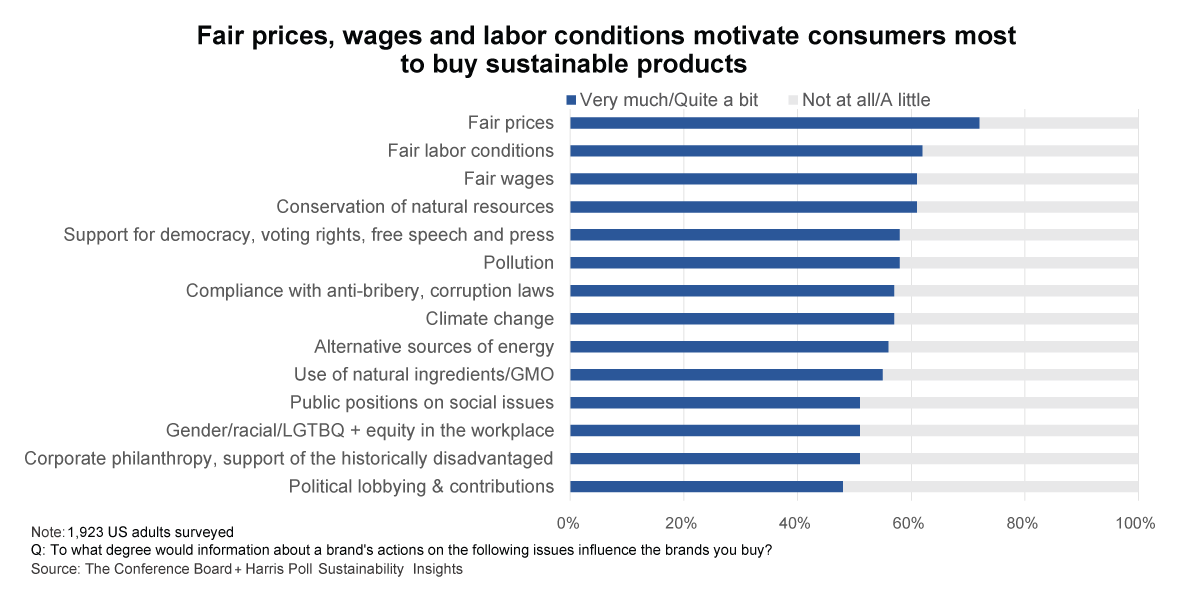

US consumers are most likely to think about the environment when it comes to sustainability, but the association isn’t necessarily what drives their purchases of sustainable products, our latest research shows. When it comes to buying, consumers are most attracted to brands that they connect to fair prices, fair working conditions, and fair wages, in addition to those with environmental benefits like conservation of natural resources.

The distinction carries implications for marketing sustainable products. Being fair can be a real marketing asset. Yet challenges remain. Sustainability features continue to trail basic purchasing criteria such as product performance, quality, price, and convenient access, even as consumers increasingly value sustainable products and services. This is what the Hierarchy of Consumer Needs from our prior research illustrates.1 The premium price of sustainable products is a particular barrier for consumers2—a challenge for companies as they try to recover the cost of their sustainability initiatives.

How can marketers better position sustainable products and services? Focusing more on “fair” attributes and communicating them better, targeting more receptive customer segments, and using non-traditional pricing and payment models are ways to generate a positive response from consumers and to yield returns from investments in corporate sustainability.

These findings are based on a survey of 1,923 US adults from September 3-5, 2021. Part 1 of our research explores US consumer perceptions of the impacts of industry sectors and policymakers on sustainability.

While equity, climate, and brands’ social stance have been prominent topics, corporate action on these issues has relatively little impact on brand choice when compared to, for example, fair prices, fair labor conditions and wages, and conservation of natural resources. Marketing strategies with reputational objectives and brand building can indirectly impact a brand’s value and financial health.

Insights for what’s ahead

- Communicating about policies and actions that benefit employees can pay off. Apart from conservation of natural resources, two types of motivations for buying a sustainable product rise to the top for consumers: whether a company’s products are seen as fairly priced, and whether the company treats its workforce fairly in terms of labor conditions and wages. Thebiggest reason consumers say they do not purchase brands with better labor practices is their lack of awareness about a company’s employee-friendly policies. Having high standards for worker welfare and getting this message across to customers could yield incremental purchases—and greater willingness to pay a price premium. Communications can include messages about worker welfare and labor conditions on packaging and product labels, as well as pictures and videos of workers to create a human connection.

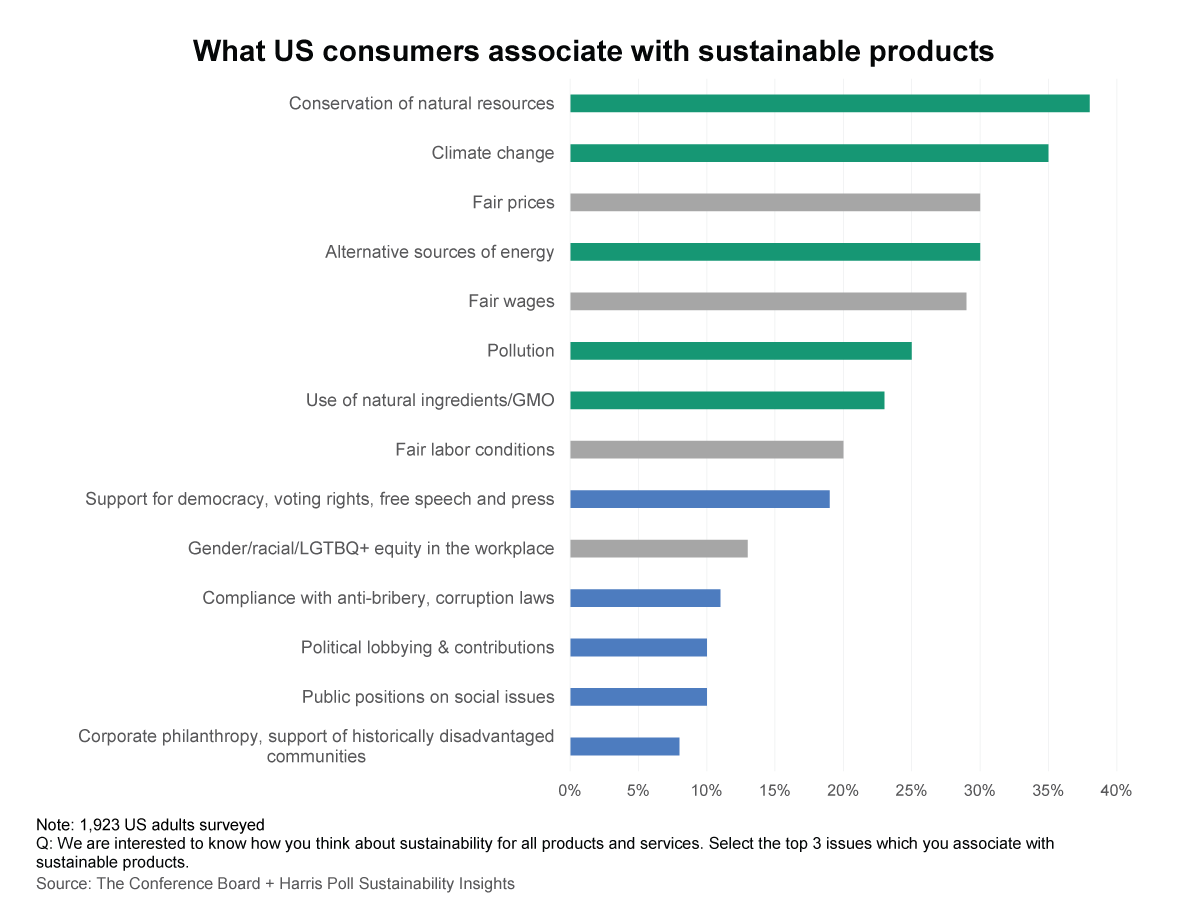

- Specific and descriptive labeling for sustainability initiatives can help reach target audiences more effectively. People’s associations with sustainability tend to cluster around environmental and employee-related issues. For example, 38 percent of respondents associate the term with conservation of natural resources. Conversely, relatively few associate a company’s public position on social issues (10 percent) or support for democracy and voting rights (19 percent) with sustainability. What is talked about most in the media doesn’t necessarily mirror the sustainability features that motivate purchases. These findings suggest companies may want to move away from lumping all their sustainability efforts together under the umbrella term “sustainability”. Rather, they can consider sharpening their labeling to target initiatives in distinct ways to fully reap the benefits.

- Companies may be better off focusing on sustainability enthusiasts rather than trying to convert naysayers. For now, the most receptive segments, namely younger, urban consumers, may be the most productive targets. There may be less to gain (cost versus incremental revenue) in trying to convince skeptical consumers about the benefits of sustainable products; they are likely less accepting of a sustainability price premium. To reach such skeptical consumers, companies need to mix their communications about their sustainability initiatives with messaging about other benefits that have more universal appeal such as quality, healthier ingredients, or unique features, including design and customer experience.

- Companies can broaden measurement of ROI of corporate sustainability initiatives by considering intangibles such as employee engagement and attraction to investors in addition to revenue from sustainable products. This different perspective offers an alternative to passing the full amount of higher cost due to sustainability initiatives on to consumers.Apart from satisfying consumers’ higher expectations regarding corporate sustainability, companies can reap benefits with other stakeholders, including employees, investors, and suppliers. For example, employee productivity could be higher because of meeting desires to work for a “good” company.

- Nontraditional pricing and payment models give consumers more options. They can include spreading the price premium for sustainable products over time or pay per use. Renting and sharing options, subscriptions, and pay-as-you-go models and micropayments are additional ways to lower price per use and spread expenses over time. Pay-as-you-wish models with a minimum price can yield target margin while letting customers self-select based on their financial situation and appreciation of sustainability. The more customers participate and the more they repeat, the lower the per unit cost over time. Loyalty discounts for repeat purchases of sustainable products can also enhance participation and thus volume.

- Take the lead from transparent communications about inflationary impacts on pricing and product. Surginginflation has attuned consumers to transparent explanations of the causes, including increased labor and shipping costs, higher energy prices, and shortages of materials. Brands can apply that same level of transparency to explain pricing for sustainable products and how the higher cost is shared between the company, consumers, and investors. This shouldn’t just be a one-time message but ongoing communication to keep consumers updated.

The core findings

Tell your customers about your workforce initiatives

While equity, climate, and brands’ social stance have been prominent topics, corporate action on these issues has relatively little impact on brand choice when compared to, for example, fair prices, fair labor conditions and wages, and conservation of natural resources. Marketing strategies with reputational objectives and brand building can indirectly impact a brand’s value and financial health.

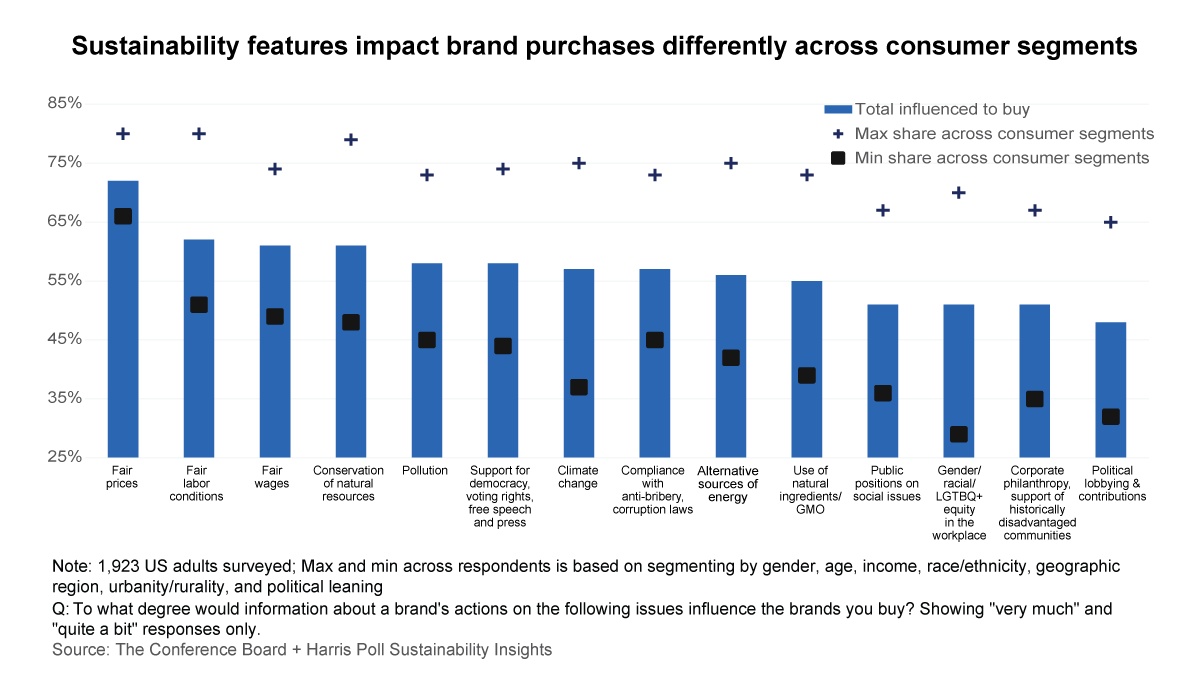

Sustainability features are not swaying consumers’ purchases alike

There can be wide variation across consumer demographics on the sustainability features that influence purchasing. Divisions widen the most on climate change and on gender/racial/LGTBQ+ equity issues in the workplace. Conversely, the gap is most narrow on fair pricing−this is an important purchasing influence across consumer segments.

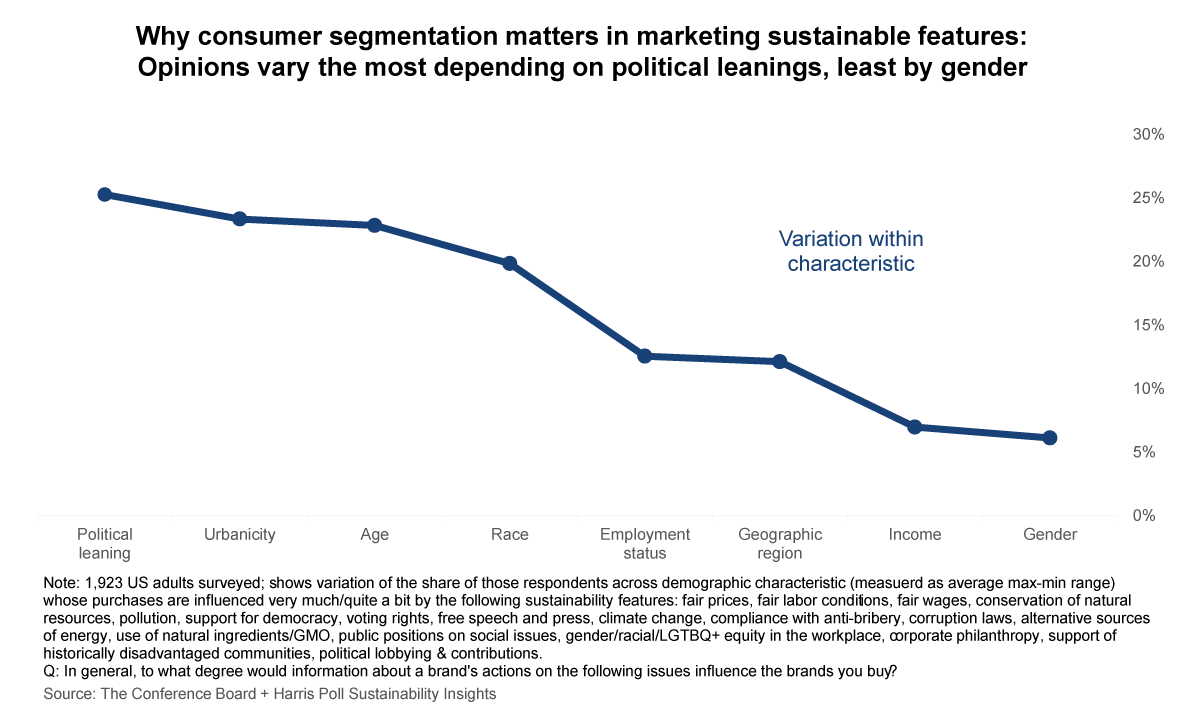

Sustainability is not a passion just of higher income groups or a specific gender

If you market to a diverse customer base, especially where there are differences in political attitudes, residential settings or age, our research shows that interest in purchasing sustainable brands will vary widely among these groups. Conversely, purchasing interest by gender or income are less likely to see as much distinction.

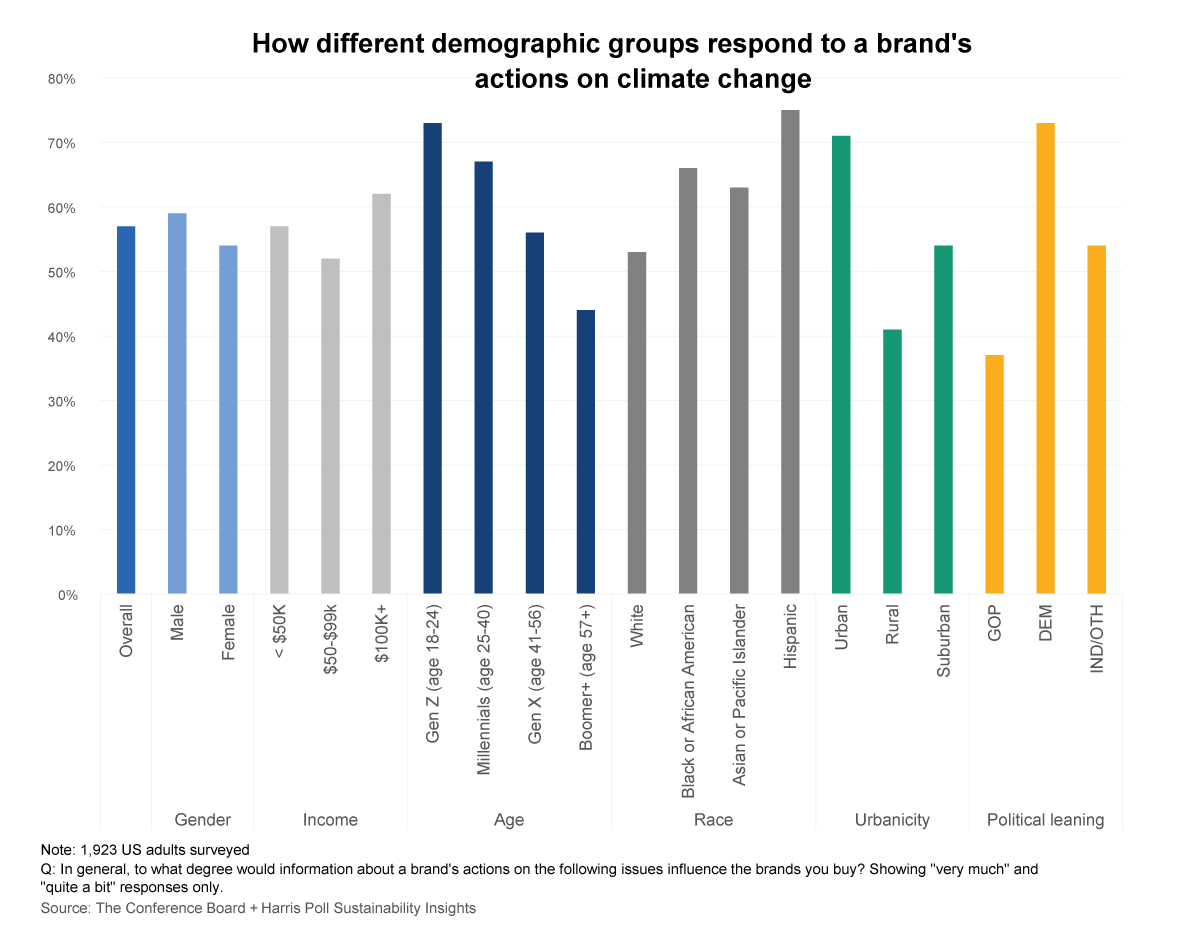

Deep dive on climate change views show why segmentation by topic and demographic groups matter in marketing sustainable products

There can be substantial disagreement across consumer segments as to how much corporate climate efforts sway their purchases. Gen Z and urban consumers are the most receptive to brands with climate initiatives. For now, companies may be best off highlighting their climate initiatives—and differentiating themselves—to those most receptive segments.

Consumers have a range of associations with sustainable products. Given this, specific labels for individual sustainability initiatives may be more effective. Environmental concerns are—and may continue to be—people’s top association.

The increase in extreme weather events and their impact on people and businesses, as well as the prominence of climate topics in public discussion, may further foster ecological concerns going forward.

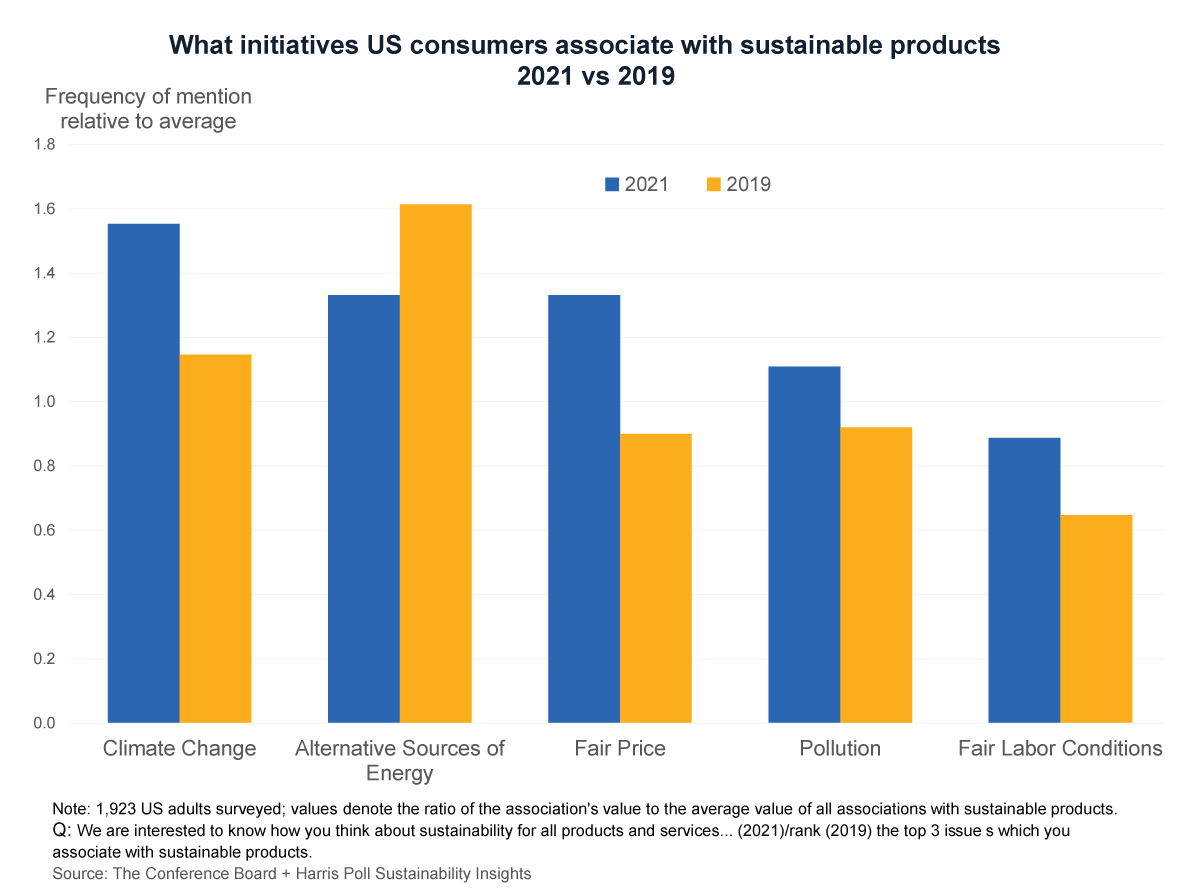

Consumers increasingly think of corporate sustainability as being all-around corporate citizenship. This marks a change from two years ago when consumers thought of sustainable products and services primarily as being environmentally friendly.

Consumers now associate sustainable products increasingly with “being fair” as well as being related to environmental actions. This understanding of sustainability encompassing social dimensions could turn current sustainability-related differentiators into new expected standards. Strategy and innovation teams may want to collaborate closely with sustainability and marketing teams to find new differentiators.

Methodology & The Conference Board + Harris Poll Collaboration

This report is the second of two reports from our survey of US consumer perceptions around corporate sustainability. In the first report, we explore people’s perceptions of certain industry sectors and policy makers regarding their positive impact on sustainability and change needed for each of them to become sustainable.

The survey is a collaboration between The Conference Board and The Harris Poll. It ran in the US from September 3-5, 2021, and yielded responses from 1,923 adults. Results are weighted to represent the US adult population.

We greatly appreciate the ongoing collaboration with Rob Jekielek, Managing Director at The Harris Poll, who made this research possible.

[1] Denise Dahlhoff, How Sustainability Features Influence Consumers' Choices, The Conference Board, 2022, pp. 23-24 and 17.

[2] See Dahlhoff, How Sustainability Features Influence Consumers' Choices, pp. 8, 10, and 18 in particular.

AUTHOR

-

Complimentary.