Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

24 July 2023 / Quick Take

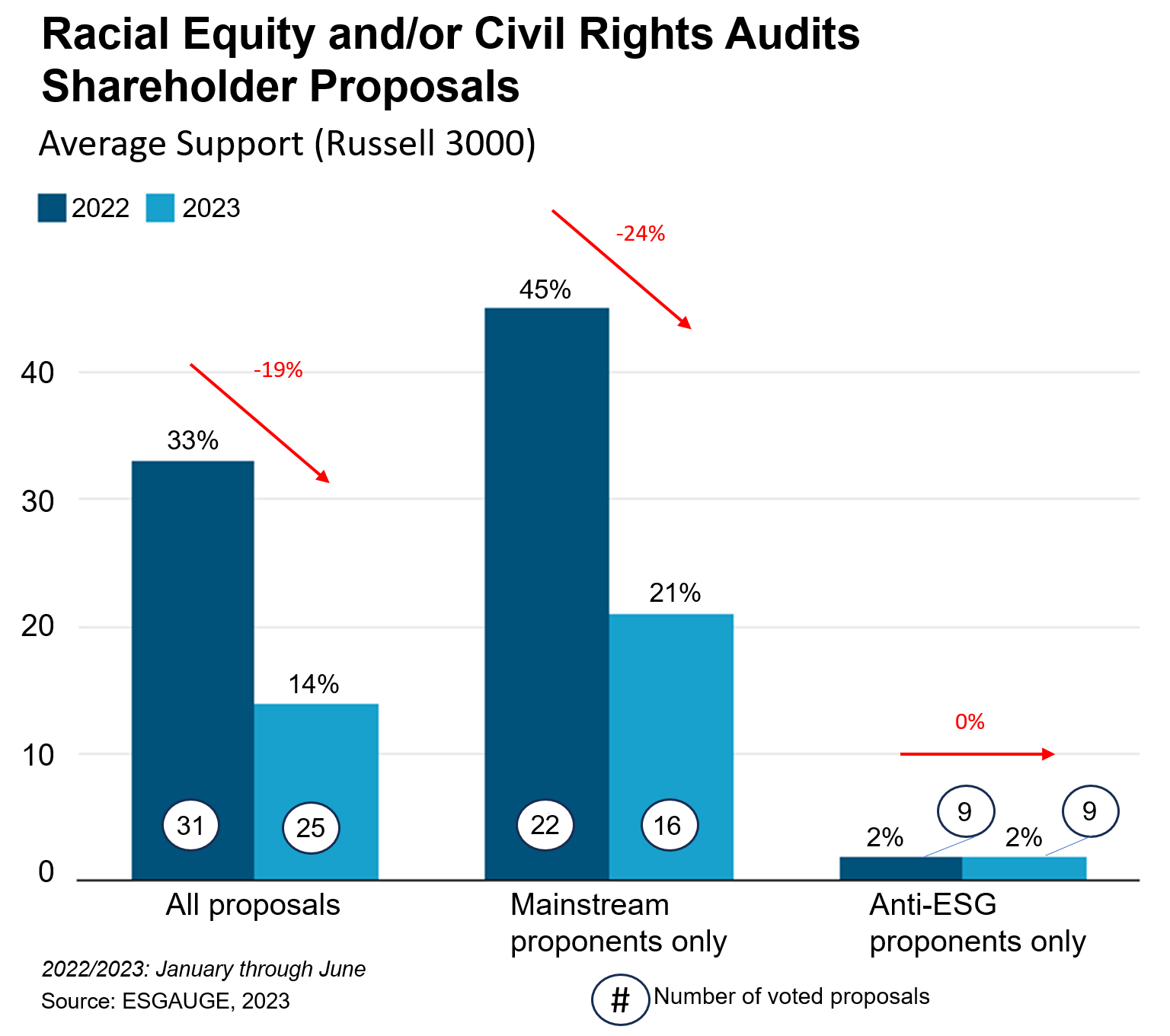

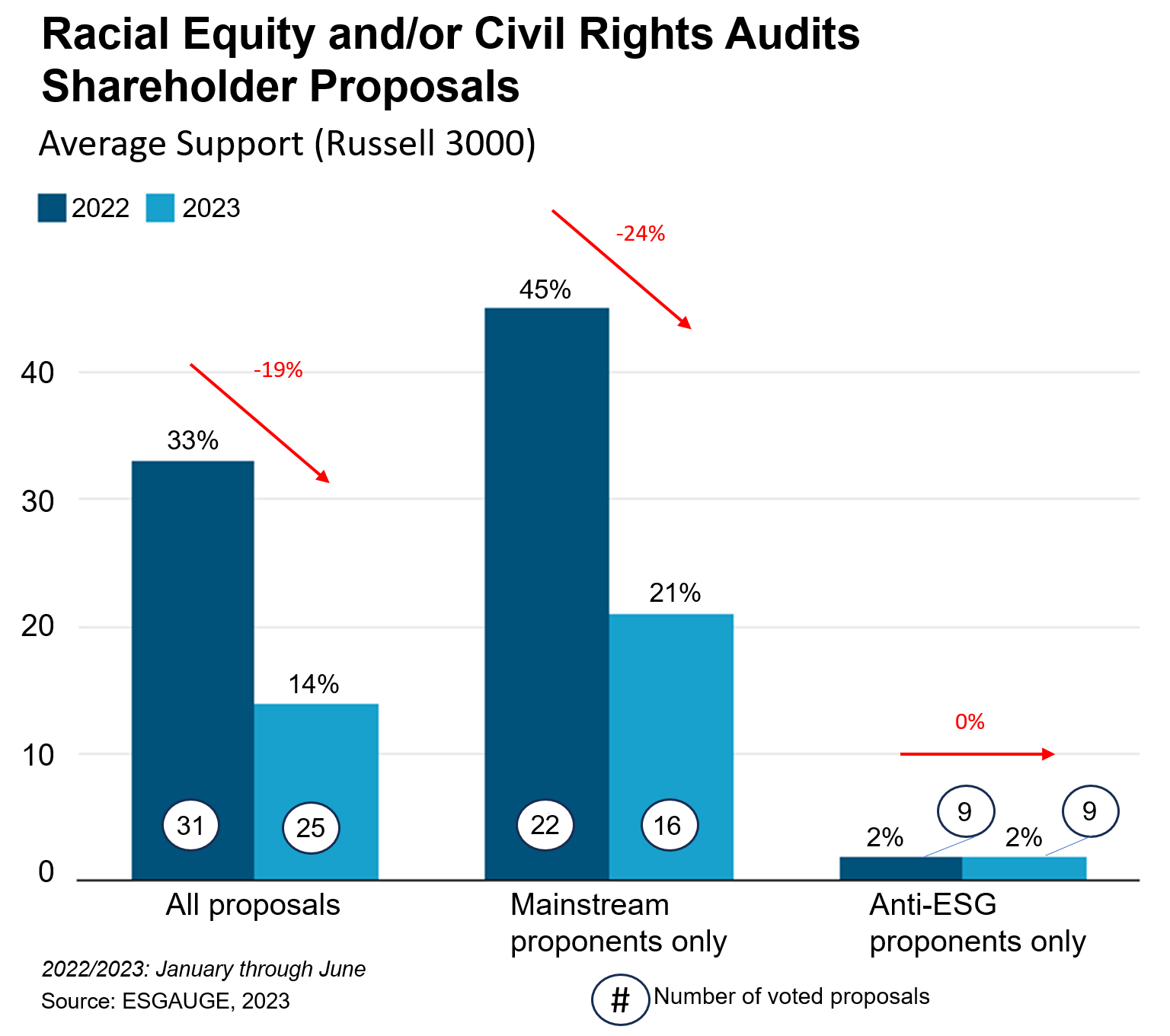

Average support for shareholder proposals on racial equity and civil rights audits fell 19 percentage points from 33 percent in the first half of 2022 to 14 percent in the first half of 2023. The drop isn’t due to the growing percentage of shareholder proposals on the topic from “anti-ESG” groups; rather, it appears to be cost related. Excluding such proposals, the decline in support for “mainstream” racial equity/civil rights audit proposals is even more pronounced, falling 24 percentage points from 45 percent in 2022 to 21 percent in 2023.

The drop reflects the fact that investors, whose votes are subjected to increased scrutiny, are evaluating the specific costs and benefits of each shareholder proposal at the target company—and finding that the costs often outweigh the benefits. On the cost side, the proposals are often broadly worded, asking for independent audits of the company’s full range of impacts on groups considered to have been subject to a history of discrimination. The benefits can be limited given that companies have already been taking significant steps to address racial, gender, and other forms of inequality.

Rather than the generic audits advocated in shareholder proposals, companies may wish to consider some form of review that is tailored to their circumstances and furthers their business priorities. This review can focus on the company’s own employees and/or workers in their supply chain, or on the impact of the company’s products and services on different populations. With proper legal guardrails, these reviews can serve useful business purposes in assessing a company’s practices, particularly if the company has come under scrutiny for, or has made a commitment to, addressing equality of opportunities.

We’re tracking and reporting on these—and other—shareholder voting trends in partnership with ESG data analytics firm ESGAUGE, leadership advisory and search firm Russell Reynolds Associates, and Rutgers University’s Center for Corporate Law and Governance. See the latest trends on our Shareholder Voting Dashboard. You can use this live dashboard to view, analyze, and create reports on the data by index, sector, and company size groups.

Average support for shareholder proposals on racial equity and civil rights audits fell 19 percentage points from 33 percent in the first half of 2022 to 14 percent in the first half of 2023. The drop isn’t due to the growing percentage of shareholder proposals on the topic from “anti-ESG” groups; rather, it appears to be cost related. Excluding such proposals, the decline in support for “mainstream” racial equity/civil rights audit proposals is even more pronounced, falling 24 percentage points from 45 percent in 2022 to 21 percent in 2023.

The drop reflects the fact that investors, whose votes are subjected to increased scrutiny, are evaluating the specific costs and benefits of each shareholder proposal at the target company—and finding that the costs often outweigh the benefits. On the cost side, the proposals are often broadly worded, asking for independent audits of the company’s full range of impacts on groups considered to have been subject to a history of discrimination. The benefits can be limited given that companies have already been taking significant steps to address racial, gender, and other forms of inequality.

Rather than the generic audits advocated in shareholder proposals, companies may wish to consider some form of review that is tailored to their circumstances and furthers their business priorities. This review can focus on the company’s own employees and/or workers in their supply chain, or on the impact of the company’s products and services on different populations. With proper legal guardrails, these reviews can serve useful business purposes in assessing a company’s practices, particularly if the company has come under scrutiny for, or has made a commitment to, addressing equality of opportunities.

We’re tracking and reporting on these—and other—shareholder voting trends in partnership with ESG data analytics firm ESGAUGE, leadership advisory and search firm Russell Reynolds Associates, and Rutgers University’s Center for Corporate Law and Governance. See the latest trends on our Shareholder Voting Dashboard. You can use this live dashboard to view, analyze, and create reports on the data by index, sector, and company size groups.

Former Senior Researcher, Governance & Sustainabil…

The Conference Board

You already have an account with The Conference Board.

Please try to login in with your email or click here if you have forgotten your password.