-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

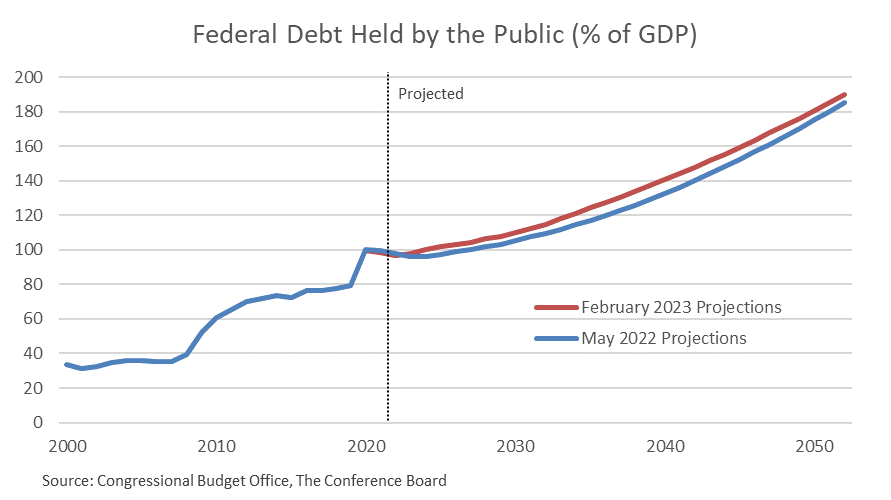

The finances of the US government are materially worsening as is the economic outlook. According to the just-released Congressional Budget Office (CBO) Budget and Economic Outlook, the federal government’s debt burden (the debt owed to the public, expressed as a percentage of the nation’s gross domestic product, or GDP) will rise to its highest level in history within 10 years from its current outsized level of 98 percent to 118 percent, and then continue to rise to almost double the size of the economy by 2053. Perhaps most troubling is how the servicing of the debt will absorb a significant portion of the budget, crowding out the nation’s ability to fund its national priorities. Net outlays for interest nearly double over the period in CBO’s projections, rising from $739 billion in 2024 to $1.4 trillion in 2033. This burden has the potential to severely hinder future economic growth and business activity. According to the CBO's new projections: Overall, these updated projections are more pessimistic than those published last summer and underscore the very dangerous and destabilizing path that US fiscal policy is on. The CBO expects the economy to continue wrestling with high interest rates and inflation for longer than previously anticipated, and for growth to falter in the short-term. On the budget outlook, the CBO’s projections for debt as a percentage of GDP have deteriorated. As noted above, the debt to GDP ratio is now projected to rise to 190% in 2052, as opposed to 185%, and further to 195% in 2053. In summary, the CBO’s already dour expectations about the future have become even worse. As a new CED Solutions Brief clearly details, reining in the ballooning public debt and returning it to a responsible debt-to-GDP level of 70 percent must start now. Driving the urgency is two-fold: rising interest rates are already significantly increasing the cost of servicing the debt and crowding out important national budget priorities, and it will take substantial time to accomplish this task. The analysis by CED forecasts that it will take 20 to 30 years of a sustained effort to draw the debt-to-GDP ratio down from 95% to a responsible 70% with the least draconian fiscal hardship. This analysis is part of CED’s latest Solutions Brief, Debt Matters: A Road Map for Reducing the Outsized US Debt Burden to 70% of GDP. Read the report, which also includes a series of CED recommendations for returning to a path of fiscal health and stability, including a mix of spending cuts, tax reform, saving Social Security and Medicare, and returning to a responsible and enforceable budget process. Join us tomorrow, February 16th @1:00PM ET for a CED Policy Watch Webcast with CBO Director Phill Swagel on Fiscal Health: Road Map For A Responsible Fiscal Budget During Economic Disruption. Register here.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024