-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

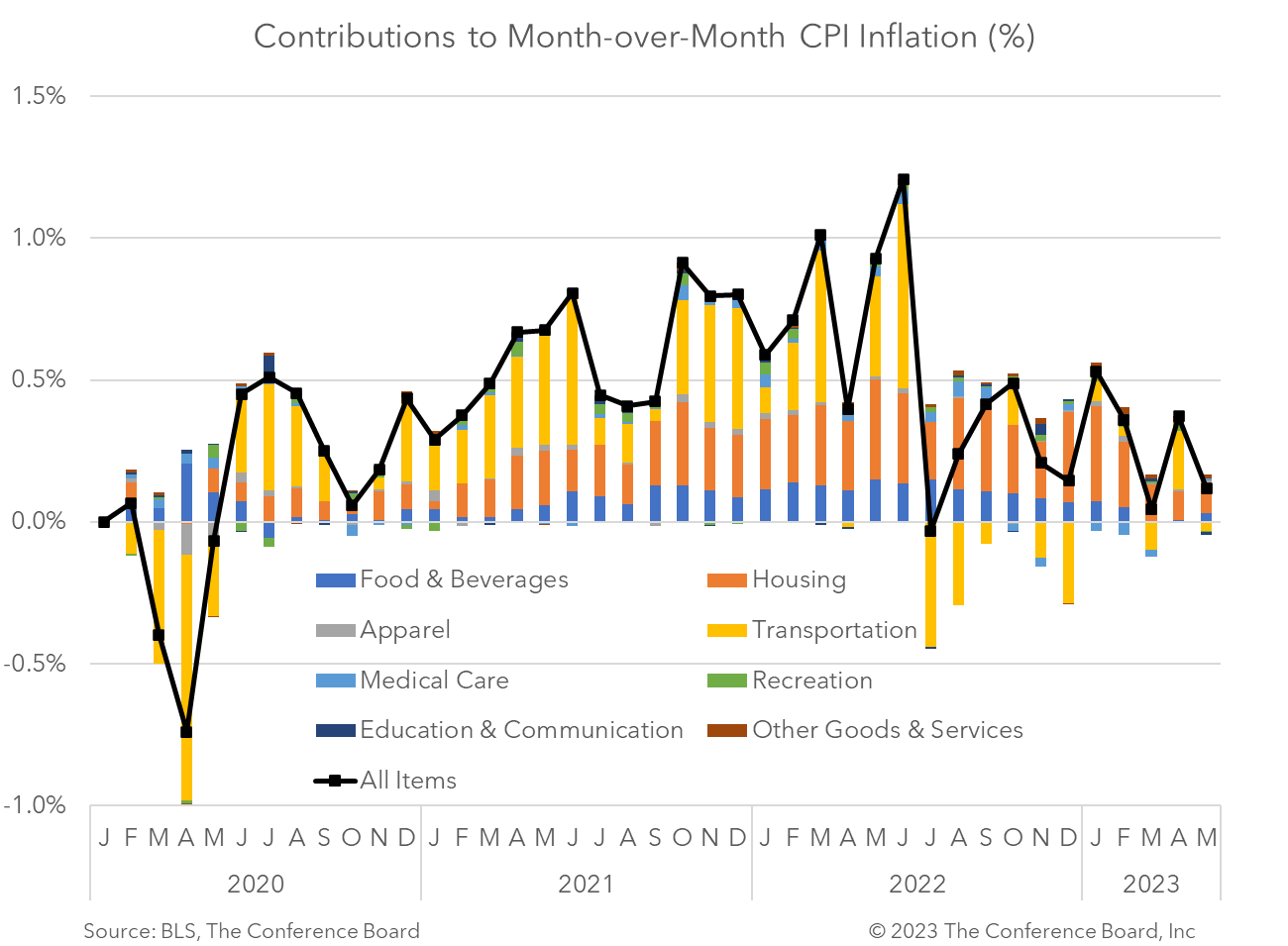

The May Consumer Price Index (CPI) showed that inflation rose 0.1 percent month-over-month (vs. 0.4% in April) and core inflation, which excludes food and energy, rose 0.4 percent month-over-month (vs. 0.4% in April). Year-over-year CPI dropped 0.9 percentage points to 4.0 percent largely due to base effects while year-over-year Core CPI dropped 0.2 percentage points to 5.3 percent. The CPI’s components were mixed in month-over-month terms, with some increasing and some decreasing. At the conclusion of June’s FOMC meeting tomorrow we expect the Fed to pause tightening to allow already high interest rates to continue to weigh on the economy. May CPI data showed mixed progress across a variety of goods and services. Energy prices dropped sharply from the previous month while food rose 0.2 percent. Thus, much of the difference between topline and core inflation was due to energy. Shelter prices, which rose 0.6 percent and are heavily weighted in CPI, remained the largest contributor to both overall and core inflation. However, further relief in this key component of inflation is on the way as housing and rental markets continue to cool. These inflation data, while unacceptably high, are unlikely to spur another rate hike at the conclusion of the June Federal Reserve meeting tomorrow. While some progress in topline inflation was seen in today’s report, the core reading increased by 0.4 percent for the third consecutive month. This persistence in core inflation is troubling, but we expect the FOMC to pause tightening to allow the high interest rates that have already been implemented to work through the economy. If inflation continues to cool, as we forecast, we may not see another rate hike this cycle, but we do not expect any rate cuts from the Fed until 2024. Headline CPI slowed to 4.0 percent year-over-year in May, vs. 4.9 percent in April, partially due to large base effects. In month-over-month terms this topline inflation metric slowed to 0.1 percent, vs. 0.4 percent the month prior. According to the BLS, the index for shelter was the largest contributor to the monthly all items increase, followed by increases in the index for used cars and trucks. The energy index declined for the month and the food index rose slightly. Large base effects will also impact the June CPI and likely drive the headline year-over-year reading even lower. Core CPI, which is total CPI less volatile food and energy prices, slipped to 5.3 percent year-over-year in May, vs. 5.5 percent in April. The core index rose 0.4 percent month-over-month in May, as it did in April. As was the case with topline CPI, the increases in the core CPI was driven by shelter prices.Insights for What’s Ahead

May Inflation Highlights

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024