-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

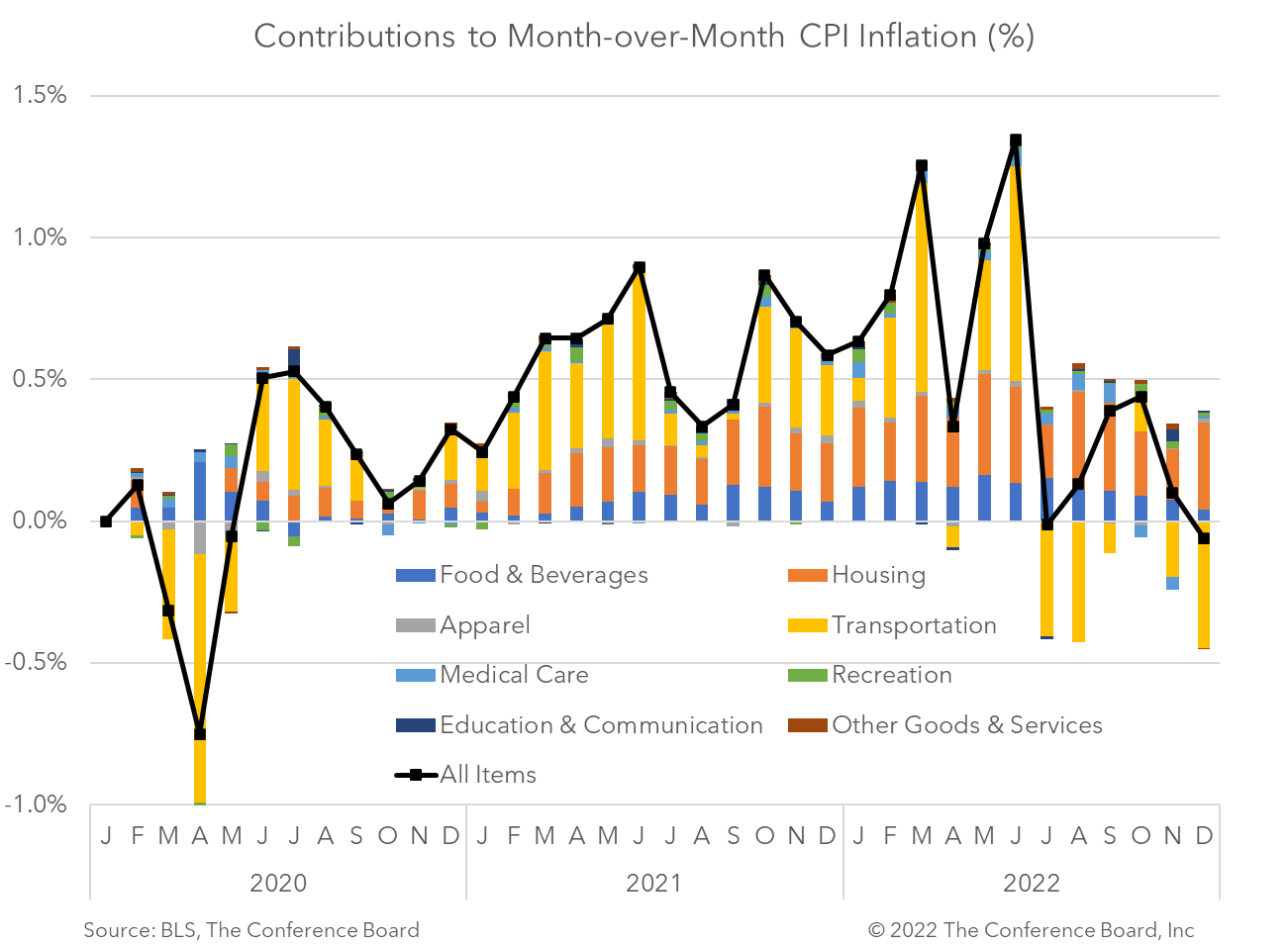

The headline Consumer Price Index (CPI) eased again in December while Core CPI, which excludes food and energy, rose somewhat. Lower energy prices were a large factor in lowering the headline December print. While this is mostly welcome news, much work remains to be done to bring inflation closer to 2 percent. We expect two more 25 bp interest rate hikes in February and March, and a recession to begin early this year. Headline CPI slowed to 6.5 percent year-over-year in December, vs. 7.1 percent in November. In month-over-month terms, this topline inflation metric fell to -0.1 percent, vs. 0.1 percent the month prior. This was the first month-over-month decline recorded since May 2020. Many index components saw price gains moderate for the month, and some (including energy, and both new and used vehicles) saw prices decline. However, shelter price gains remained high. However, Core CPI rose somewhat in December. The core index, which is total CPI less volatile food and energy prices, rose by 0.3 percent month-over-month in December, vs. 0.2 in November, 0.3 in October, and 0.6 percent in September. Despite this uptick, year-over-year core CPI slowed to 5.7 percent from 6.0 percent in October due to base effects.Insights for What’s Ahead

December Inflation Highlights

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024