-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

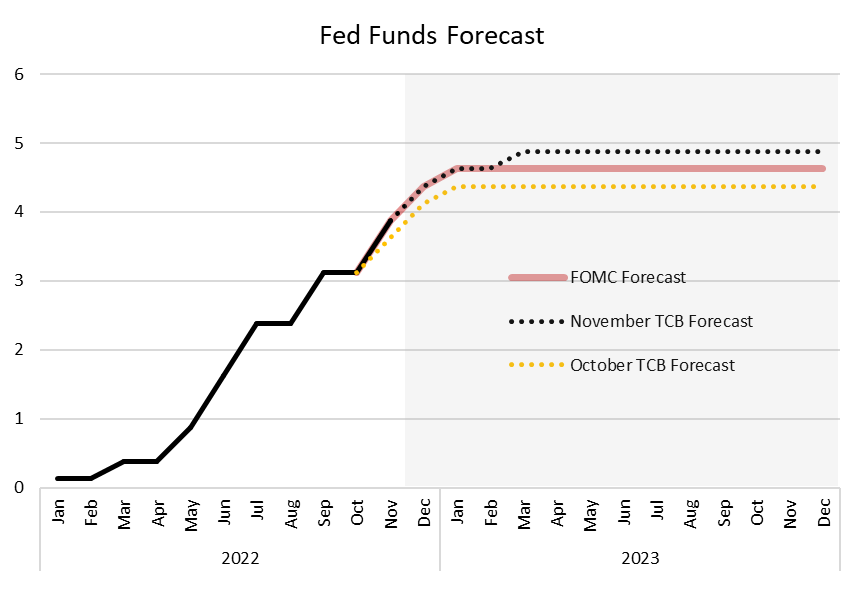

The Fed hiked by another 75 basis points in November and pushed the Fed Funds window to 3.75 – 4.00 percent. This increase raises the rate further into ‘restrictive’ territory (anything above 3 percent). The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet (currently $95 bln per month), which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee. The Federal Reserve’s actions today were widely anticipated, but its tone about the future shifted somewhat. In the policy statement, the FOMC said it will “take into account the cumulative tightening in monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This new language suggests that this may be the last 75 basis point rate increase seen this tightening cycle. Indeed, Chair Powell said that a downward shift to a 50 basis point hike will be discussed at the December FOMC meeting. However, Powell also said that the terminal rate this tightening cycle is likely to be higher than the one the Fed forecast in September (4.50 – 4.75, with a midpoint of 4.625 percent). As a function of this, The Conference Board now expects rates to rise to 4.75 – 5.00, with a midpoint of 4.875, in March 2023. We do not expect to see the Fed lower rates next year. Since tightening started in March 2022, the Fed Funds rate has risen by a total of 375 basis point. As a function of this, interest rates throughout the economy have risen rapidly. Tighter policy has begun to cool the overall economy – though with a lag. While the labor market remains exceptionally tight, other parts of the economy have begun to slow (like consumption and business fixed investment) while other parts have begun to contract (like residential investment). As the full impact of this year’s Fed Funds hikes continue to weigh on businesses and consumers, economic activity will slow further – tipping the economy into a broad, but shallow, contraction. This recession should begin around the end of 2022 and is expected to last for three quarters.Insights for What’s Ahead

What were the Fed’s actions?

What does this mean for the US economy?

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024