-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

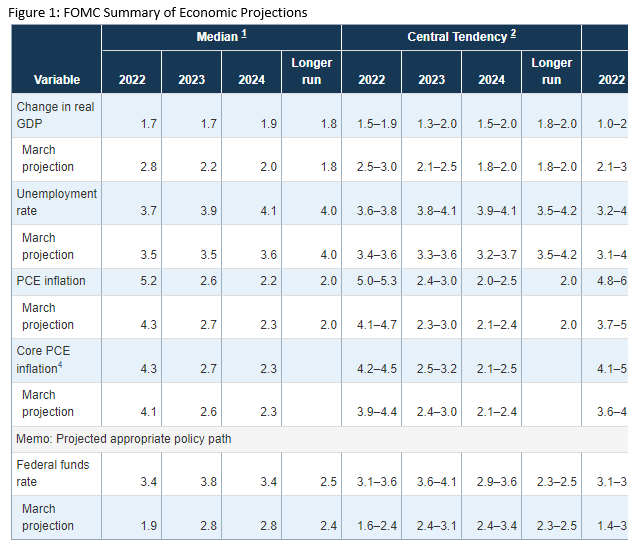

Insights for What’s Ahead What Were the Fed’s Actions? The Fed is raising rates even more aggressively than previously anticipated. FOMC participants materially raised inflation projections and the number of interest rate hikes in 2022 and 2023. Chair Powell indicated that the FOMC currently foresees the Fed Funds rate rising to 3.0 to 3.5 percent by the end of 2022, and 3.5 to 4.0 percent by the end of 2023. These rates are well above the “neutral” rate range of 2.0 to 3.0 percent and are well into “restrictive territory.” Furthermore, Chair Powell indicated that the rate hikes will be front-loaded and that the July meeting would likely see another rate hike of 50 to 75 basis points. However, the Fed did not accelerate its plans on balance sheet reduction. Quantitative tightening, launched on June 1st, will continue as planned. What does this mean for the US economy? The Federal Reserve’s Summary of Economic Projections (SEP) anticipates slower real GDP growth over the forecast horizon (Figure 1), but no recession. The FOMC projects 4q/4q 2022 GDP growth of 1.7 percent and 4q/4q 2023 GDP growth of 1.7 percent. These are significant downgrades from the growth expectations that were released in March. The FOMC also raised its expectations for inflation. The FOMC projects 4q/4q 2022 PCE inflation of 5.2 percent now compared to 4.3 percent at the March meeting. For 4q/4q 2023, it forecasts 2.6 percent. These expectations are too optimistic, in our view. While our current outlook for economic growth in the United States is currently above the SEP’s, today’s developments will significantly change our forecast (expect an update to our forecast over the coming days). In our view, there are two potential paths forward. Clearly, the Fed’s priorities have evolved from what they were in 2021. A year ago, the Fed’s priorities ranked employment, growth and then inflation. Today the priorities are inflation, employment, and then GDP. Looking ahead, a slower growth environment appears certain and a recession appears likely. May Retail Sales Growth Declined May retail sales growth fell 0.3 percent from April as consumers pulled back on spending on some big ticket items. Spending on motor vehicles and parts dropped 3.5 percent from the previous month, and spending on electronics and appliances dropped 1.3 percent. Meanwhile, sales at gasoline stations rose 4.0 percent - in large part due to higher prices at the pump. Excluding spending on vehicles and gasoline, overall retail growth rose 0.1 percent for the month. The data, which are published in nominal terms, are even weaker when adjusted for inflation. When factoring in the latest CPI reading, real retail sales data fell by 1.2 percent in May. While these data are clearly weaker, they may not be fully capturing strength in the services sector. Retail sales data are more focused on goods, as opposed to services. While food services and drinking places are included in retail sales data (and were up 0.7 percent month-over-month), spending on things like nail salons or hotel bookings are not. Thus, as US consumers pivot back to spending on in-person services as COVID-19 becomes less of a threat, the true trend in consumer spending may be a bit healthier than seen in these retail sales data. Fortunately, Personal Consumption Expenditures data offer a broader view of consumer spending dynamics and will be released later this month.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024