-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

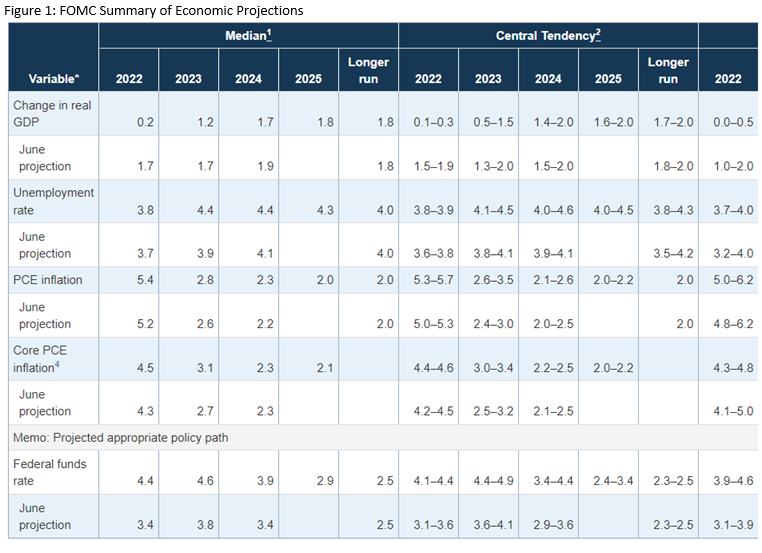

The Fed made another large 75 basis point rate hike in September and pushed the Fed Funds window to 3.00 – 3.25 percent. This increase elevates rates above the ‘neutral’ range of two to three percent and into ‘restrictive’ territory. FOMC participants also materially raised inflation projections and significantly increased the number of interest rate hikes it expects in 2022 and 2023. While Chair Powell said that monetary policy decisions will continue to be made on a meeting-by-meeting basis, he acknowledged that the likelihood of achieving a “soft landing” for the economy is diminished. In terms of the Fed’s balance sheet reduction plans, no changes were made. The Federal Reserve’s Summary of Economic Projections (SEP) anticipates significantly slower real GDP growth over the forecast horizon (Figure 1). The FOMC projects 4q/4q 2022 GDP growth of 0.2 percent and 4q/4q 2023 GDP growth of 1.2 percent. These are large downgrades from the growth expectations that were released in June. The FOMC also raised its expectations for inflation. The FOMC projects 4q/4q 2022 PCE inflation of 5.4 percent now compared to 5.2 percent at the June meeting. For 4q/4q 2023, it forecasts 2.8 percent. These growth expectations are too optimistic, in our view. Our base case assumption was that the Fed Funds rate would rise to a mid-point of 3.6 percent at the end of 2022 and 3.9 percent in 2023, vs. the September SEP’s 4.4 percent and 4.6 percent. If the SEP’s Fed Funds projections are accurate, then there will be even greater headwinds to US economic growth than our base case projections. According to a recent set of scenarios conducted by The Conference Board (see StraightTalk® – Wide Bands of Uncertainty) a terminal Fed Funds rate of 5 percent could shave as much as half a percentage point off of our 2023 Real GDP growth forecast of 0.3 percent year-on-year. Given the Fed’s guidance today, we will likely be downgrading our 2023 forecast soon.Fed Policy May Trigger a More Severe Recession than Previously Forecasted

Insights for What’s Ahead

What were the Fed’s actions?

What does this mean for the US economy?

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024