-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

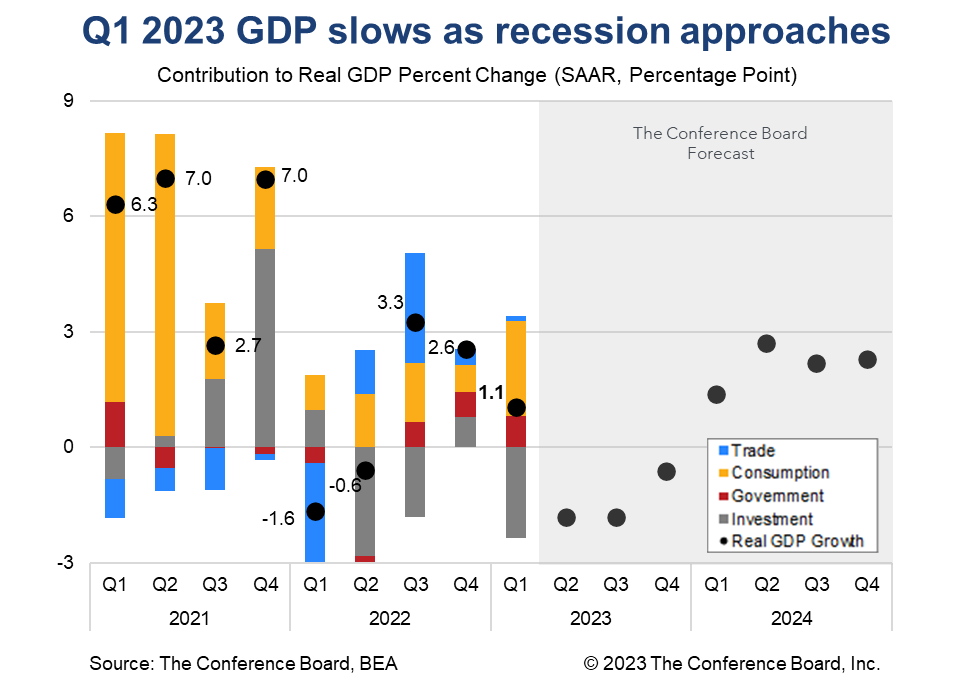

US Real Gross Domestic Product rose by 1.1 percent (annualized) during the first quarter of 2023, below the consensus forecast of 2.0 percent* and The Conference Board’s forecast. Consumption came in strong for the quarter, but weak investment and inventory data limited overall economic growth. We continue to expect the US economy to slip into recession in mid-2023. GDP data in Q1 2023 showed a number of important trends that we expect to continue to play out over the year. Consumer spending was robust for the full quarter, but according to monthly data that strength was isolated to January. February spending growth slipped into negative territory and these quarterly data suggested that March spending was even weaker. We’ll learn more about this in tomorrow’s Personal Income & Outlays report. The GDP data also showed that both residential and non-residential investment continued to struggle under the weight of high interest rates. Investment in Intellectual Property, which is associated with the tech industry, was the weakest it’s been since the COVID-19 lockdowns in early 2020. Inventories also played a large role in today’s data. The change in private inventories fell slightly for the quarter following a surge in late 2022. This resulted in a large drag on topline economic growth. We do not expect companies to restock over the coming quarters due to weakening consumer demand. Personal Consumption Expenditures (PCE) expanded by 3.7 percent for the quarter, vs. 1.0 percent in Q4. Demand for goods grew by 6.5 percent, while demand for services grew by 2.3 percent. Strong spending in January, especially on durable goods, was largely responsible for the uptick in these data. However, more recent data shows softening demand in February and March. On the investment side, nonresidential fixed investment grew by just 0.7 percent, vs. 4.0 percent in Q4, due largely to weak investment in equipment for the quarter (-7.3 percent). Residential investment grew by -4.2 percent, vs. -25.1 percent in Q4. This was the eighth consecutive quarter of negative growth and was associated with rising interest rates and elevated home prices. Private inventories contracted by $1.6 billion** - an unexpectedly large amount. This decrease from $136 billion in Q4 resulted in a drag to US GDP growth of -2.3 percentage points. Government spending was a positive contributor to overall economic growth for the quarter, rising 4.7 percent, vs. 3.8 percent in Q4. The recent strength to this component of GDP are associated with federal non-defense spending and investment – which is being augmented by infrastructure investment. Net exports contributed 0.1 percentage points to overall GDP. Exports grew by 4.8 percent for the quarter while imports grew by 2.9 percent. Today’s data are consistent with our expectation for one or two more 25 basis point hikes from the Fed, but tomorrow’s data on March consumer spending and inflation could change that. Stay tuned. * Survey conducted by Bloomberg. ** chained 2012 US$The individual components of GDP were mixed.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024