-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

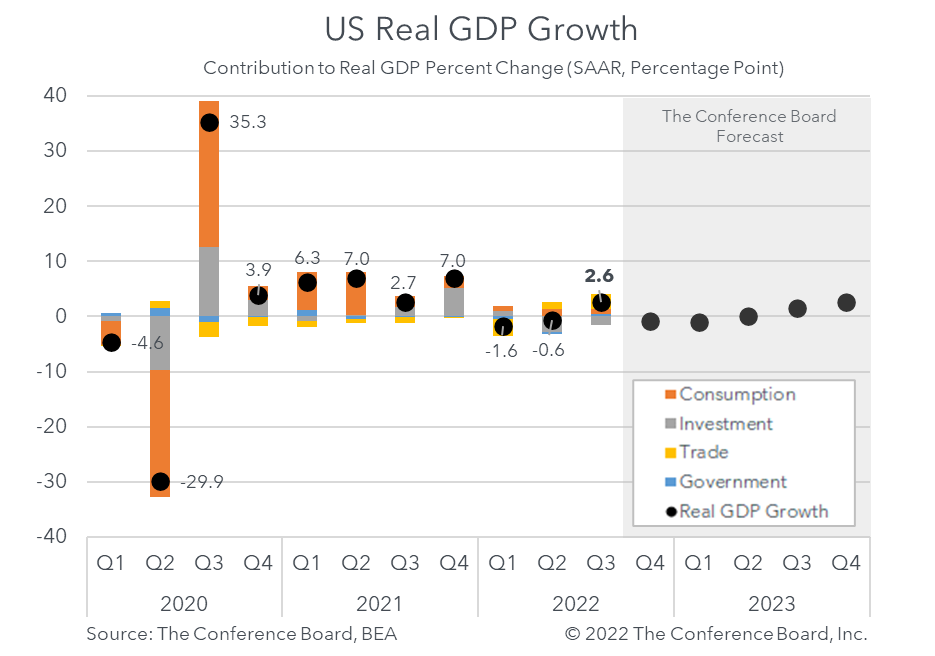

US Real Gross Domestic Product rose by 2.6 percent (annualized) during the third quarter of 2022, exceeding the consensus forecast of 2.3 percent* and The Conference Board’s forecast. While this topline growth rate was a large increase from the Q2 reading of -0.6 percent it masks deeper weaknesses in the economy. Following two consecutive quarters of negative readings, the improvement in topline Q3 GDP should not be interpreted as a turnaround for the US economy. Today’s GDP print showed continued softening in consumer spending and further deterioration in residential investment, which was obscured by strength in net exports and a rebound in government spending. Indeed, growth in final sales to private domestic purchasers fell to just 0.1 percent (the weakest reading since Q2 2020). This core weakness will intensify in the coming months as inflation continues to batter US consumers and businesses, and interest rates continue to rise. Looking ahead, the stagflationary characteristics of the US economy are likely to give way to a mild recession beginning in Q4 and extending into early 2023. The individual components of GDP were mixed. Personal Consumption Expenditures expanded by 1.4 percent for the quarter, vs. 2.0 percent in Q2. Demand for goods fell by 1.2 percent, while demand for services grew by 2.8 percent, reflecting an ongoing shift in consumer spending patterns. Nonresidential fixed investment rose to 3.7 percent, vs. 0.1 percent in Q2, fueled primarily by a rebound in equipment investment. Government spending was also a large contributor to growth for the quarter, rising 2.4 percent following five consecutive quarters of negative growth. However, volatility in other components drove GDP lower. Changes in private inventories curtailed growth despite expanding by US$ 62 billion**. This step down from US$ 110 billion in Q2 resulted in a drag on US GDP growth of -0.7 percentage points. On the investment side, residential investment fell to -24.6 percent, vs. -17.8 percent in Q2. The drop in residential investment was associated with rising interest rates and elevated home prices. Net exports contributed 2.8 percentage points to overall GDP. This outsized contribution was fueled by a 14.4 percent increase in exports and a -6.9 contraction in imports. Absent these trade distortions***, GDP would have clocked in at -0.2 percent for the quarter. Again, these data do not mean that the US economy is on the mend. US consumers, which constitute about two-thirds of the economy, exhibited softening demand in the third quarter as they grappled with hurdles like high inflation and rising interest rates. Moreover, both consumer and CEO sentiment have recently worsened pointing to weaker economic activity at yearend. A mild recession is likely to begin in Q4 and extend into early 2023. * Survey conducted by The Wall Street Journal. ** chained 2012 US$ *** Gross domestic purchases is GDP less "exports of goods and services" plus "imports of goods and services".

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024