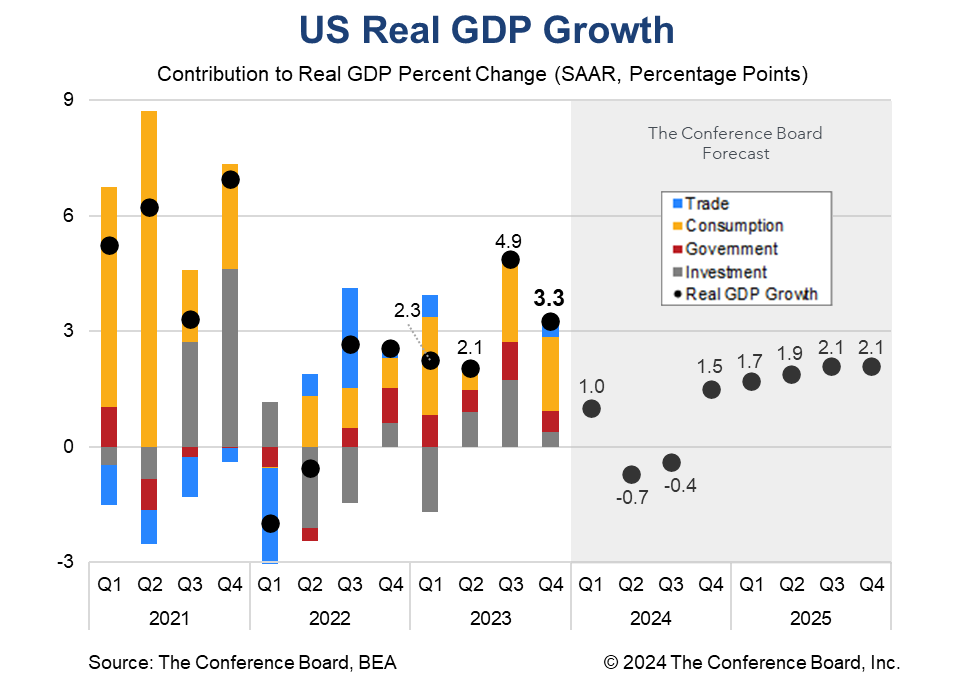

US Real Gross Domestic Product rose by 3.3% (annualized) during the fourth quarter of 2023, well above the consensus forecast of 2.0%* and The Conference Board’s forecast. Consumption growth drove the expansion in the quarter but was also supported by government spending and net exports. For the full year, Real GDP expanded by 2.5%. GDP data in Q4 2023 showed a number of important trends. Following a lull earlier in 2023, consumption continued to expand at robust pace of 2.8% in Q4. Spending growth, which was driven by consumption of both goods and services in the quarter, was supported by an increase in real disposable income of 2.5%, vs. the prior quarter’s 0.3%. This trend, if it continues to hold in 2024, could make consumer spending growth more sustainable. However, the recent rise in household debt levels and low savings are a cause for concern. Over the coming year labor market dynamics and wage growth will be a key determinant of consumption and overall GDP growth. Investment growth came in softer in Q4 than in Q3 as high interest rates continued to weigh on the economy. Business investment ticked up slightly for the quarter on stronger intellectual property and equipment investment. However, investments in structures cooled substantially following several quarters of robust growth. Residential investment growth also cooled following a pop in Q3. Finally, private inventories saw a small expansion in Q4, which contributed just 0.1 percentage point to overall GDP growth. Today’s data showed better than expected net exports. Export growth outpaced import growth for the quarter, helped by strong foreign demand for US petroleum and financial services according to the Bureau of Economic Analysis. Meanwhile government spending continued to grow in Q4 (albeit at a lower rate than in Q3) due to rising compensation at the state and local level, and investment in structures. Today’s report makes interest rate cuts by the Federal Reserve less likely in the near-term. However, as inflation rates continue to cool over the coming months we expect the Fed to begin making cuts starting in June 2024. Personal Consumption Expenditures (PCE) expanded by 2.8% for the quarter, vs. 3.1% in Q3. Demand for goods grew by 3.8% (vs. 4.9% in Q3), while demand for services expanded by 2.4% (vs. 2.2% in Q3). Additionally, as we already have monthly spending data for October and November, these quarterly data imply that consumer spending was strong in December. We’ll learn more about this in tomorrow’s Personal Income & Outlays report. On the investment side, nonresidential fixed investment grew by 1.9 percent, vs. 1.4 percent in Q3, due largely to stronger investment in equipment (1.0%) and intellectual property products (2.1%) for the quarter. Residential investment grew by just 1.1%, vs. 6.7% in Q3. Private inventories expanded by $5 billion. Government spending was also a positive contributor to overall economic growth for the quarter, rising 3.3%, vs. 5.8% in Q3. The deceleration from the prior quarter was due to slower growth in both federal defense and nondefense spending. Net exports contributed 0.4 percentage point to overall GDP. Exports grew by 6.3% for the quarter while imports grew by 1.9%. Finally, it is important to note that GDP data have undergone large revisions in recent quarters. For example, the advance estimate for Q1 2023 data was 1.1 percent, but was gradually revised up by more than a full percentage point to 2.2 percent. It is very likely that the final data for Q4 2023 will be different from these advance estimates. * Consensus data from Bloomberg

KEY TAKEAWAYS FROM TODAY’S REPORT

THE INDIVIDUAL COMPONENTS OF GDP WERE MIXED.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023