-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

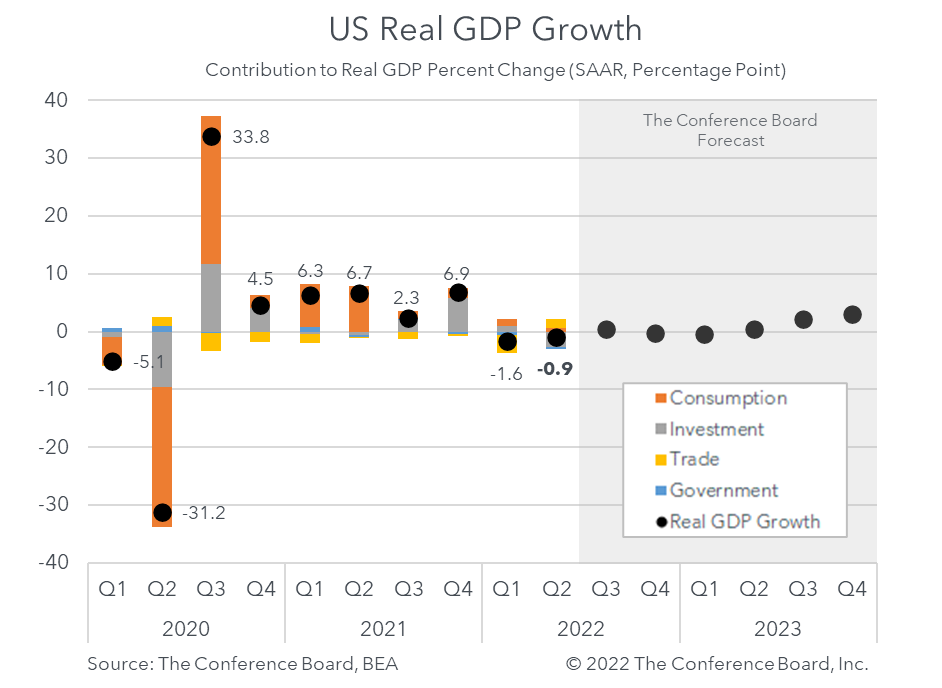

US Real Gross Domestic Product declined by -0.9 percent (annualized) during the second quarter of 2022, missing the consensus forecast of 0.4 percent* and The Conference Board’s forecast. While negative, this quarterly annualized growth rate was an improvement from the -1.6 percent rate seen in Q1 2022. While two quarters of negative topline GDP growth are sometimes interpreted as a recession, there are a variety of economic indicators that suggest that the US economy is not presently in a broad-based recession - as defined by the National Bureau of Economic Research (NBER)**. Indeed, at yesterday’s FOMC meeting Chair Powell said that the US labor market is simply too strong for the US economy to be in a recession now. That being said, The Conference Board believes the US economy is exhibiting stagflationary characteristics (weak growth and high inflation) and forecasts that a full recession will emerge before yearend. Individual components of GDP were quite mixed. Personal Consumption Expenditures expanded by 1.0 percent for the quarter – while demand for goods declined by 4.3 percent, demand for services grew by 4.1 percent, reflecting an expected shift in consumer spending patterns. Thus, consumers continued to spend over the quarter despite declines seen in consumer confidence. On the trade side, exports rose by 18.0 percent fueled by strong demand for both US goods and services overseas. However, volatility in other components pushed overall growth into negative territory. Paradoxically, changes in private inventories limited growth despite expanding by US$ 81.6 billion***. This step down from US$ 189 billion in Q1 resulted in a drag on US GDP growth of 2 percentage points. On the investment side, non-residential investment fell by 0.1 percent and residential investment declined by 14 percent. The drop in residential investment was associated with rising interest rates and high home prices. Finally, government spending also hurt growth for the quarter, growing by -1.9 percent, reflecting a drop in nondefense outlays. Again, these data do not necessarily mean that the US economy was in recession in H1 2022. US consumers, which constitute about two-thirds of the economy, continued to drive growth in the first half of the year despite hurdles like high inflation and rising interest rates. Furthermore, the US labor market remains exceptionally tight and many services sectors are performing well. However, the current economic climate is stagflationary - as high inflation continues to limit economic activity. Furthermore, the Federal Reserve’s increasingly aggressive stance on monetary policy is likely to induce a broad-based recession by the end of 2022. * Survey conducted by Bloomberg ** The NBER is the organization that makes official calls on the start and end dates of US recessions. In addition to observing topline GDP growth to make these determinations, the NBER looks at the depth, duration and diffusion of economic weakness. Thus, a topline contraction in GDP growth for two consecutive quarters does not necessarily constitute a recession – especially if the weakness is not seen broadly throughout the US economy. We believe that this is currently the case. ** chained 2012 US$

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024