-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

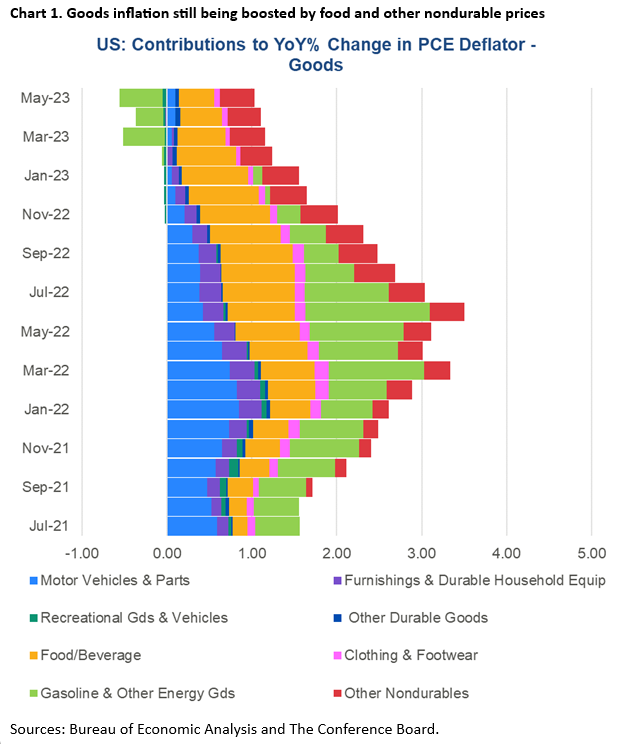

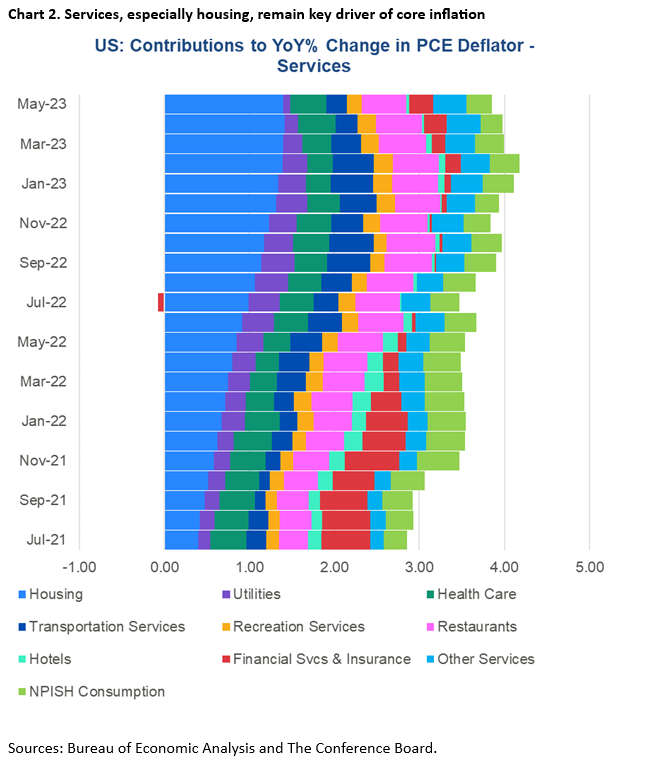

Nominal personal income rose in May, and real incomes continued to rise year-over-year supporting continued spending by US consumers in the month. Although nominal personal consumption expenditures (PCE) increased, real spending was unchanged in May signaling slower momentum in consumer spending in the second quarter of 2023 following the first quarter surge. Nonetheless, the spending that did occur was largely for services, a space the Fed is struggling to calm. While headline PCE inflation continued to slow (to 3.4 percent year-over-year), the core measure was roughly unchanged at 4.6 percent year-over-year, a pace well above the Fed’s 2-percent target. Core services inflation continued to keep PCE inflation less food and energy notably elevated. Nominal personal consumption expenditures rose by just 0.1 percentage point in May after a sizable 0.6 percentage point increase in April. All the increase in nominal spending was on services, consistent with the swing in household demand from primarily goods during the pandemic, to more services postpandemic. In real terms (i.e., after adjusting for inflation) consumer spending was flat in the month, and between April and May suggest slowing real spending in Q2 following the 4.2 percent annualized surge in Q1 of this year. The nominal spending in May was supported by a 0.4 percent increase in nominal income. Wages and salaries were up 0.5 percentage point in the month and supplements to wages and salaries increased by 0.4 percentage point. Real income increased by 0.3 percent in the month, as was real disposable income (i.e., total income less taxes). Compared to last year, real personal income increased by 1.6 percent marking five months of positive year-over-year income growth after spending much of the prior two years in negative territory. Headline PCE inflation continue to slow in May, reflecting less pressure from gasoline, but also food prices. Total PCE inflation rose by just 0.1 percent month-over-month after a 0.4 percent increase and slowed from 4.3 percent to 3.4 percent year-over-year. Energy prices fell by 3.4 percent month-over-month and fell from -6.3 percent to -13.5 percent year-over-year. Food prices ticked up by 0.1 in the month but slowed dramatically from 6.9 to 5.8 percent year-over-year. However, core inflation, which excludes food and energy remained sticky at 4.6 percent year-over-year. The gauge has remained in a tight range of 4.6 to 4.7 percent year-over-year for the last six months. This is because month-over month changes have continued to exceed 0.3 percentage points. Housing costs, in the form of rents, continue to contribute to monthly and year-over-year increases in inflation. Behaviors in rent prices tend to lag that of new and existing home prices by about 18 months. The good news is that within a few months cooling home prices that has already occurred will start to be reflected in consumer price indexes for rents. Even away from rents, food and other nondurable goods continue to boost goods price inflation, and in-person services like hotels, restaurants, and health care continued to buoy services inflation. Services inflation away from housing (i.e., ‘super core’) are particularly difficult for the Fed to address with interest rate hikes, because consumers do not usually finance services. Indeed, even credit card use is difficult to curb as interest rates on credit do not move with the federal funds rate.Highlights: Consumer Spending Showing Signs of Slowing, But Incomes and Inflation Remain Elevated

Insights for What’s Ahead

Spending Potentially Losing Some Momentum

Rising Real Incomes Still Lending Support

Falling Energy, Slower Food Price Increases Taming Total Inflation

Core Inflation Remains Challenged by Stubborn Services Prices

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Fed Keeps Cutting Bias amid “Transitory” Tariff Inflation

March 19, 2025

Retail Sales Show Consumers Are More Frugal amid Uncertainty

March 17, 2025

The EU's Retaliatory Tariffs Will Hit Beef, Bourbon and More

March 14, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024