-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

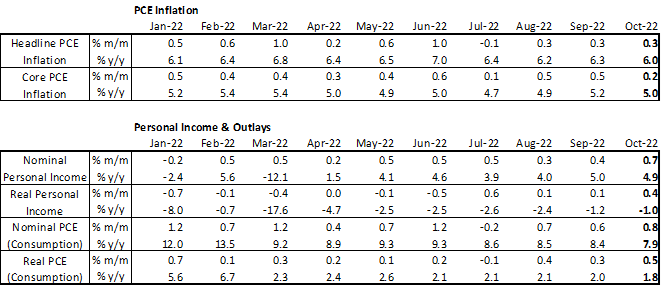

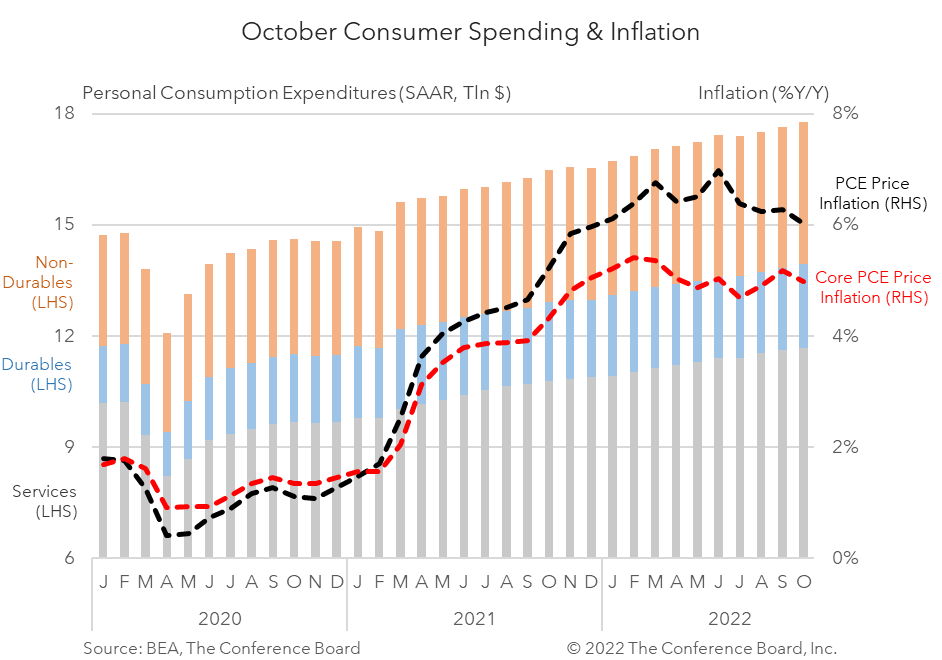

October Personal Income & Outlays data showed more progress on inflation and a resilient consumer. While higher energy prices kept month-over-month PCE inflation flat at 0.3 percent, core PCE inflation dipped to 0.2 percent. Additionally, both headline and core PCE inflation dropped in year-over-year terms. While these rates remain far too high, it does appear that progress is being made. Personal incomes expanded in October, in both nominal and inflation-adjusted terms, as did personal consumption expenditures. These data will likely encourage the Fed to make a 50 basis point increase in the Fed Funds rate next week. Inflation: Headline PCE price inflation fell 0.3 percentage points to 6.0 percent y/y in October and core PCE price inflation (which excludes food and energy) fell 0.2 percentage points to 5.0 percent y/y. On a month-over-month basis headline PCE inflation rose by 0.3 percent again, but core PCE inflation fell from 0.5 percent to 0.2 percent. Energy prices were a major driver of inflation for the month. While these readings remain well above the Fed’s 2 percent y/y target, there appears to be real progress being made. Incomes: Overall personal income growth rose 0.7 percent m/m (in nominal terms), vs. 0.4 m/m percent in September. However, the increase was partially offset by rising prices. In inflation-adjusted terms, personal income rose 0.4 percent from September. While real personal income growth was consistently negative in the first half of 2022, wage gains have been outpacing price increases in recent months. Spending: Personal consumption expenditures rose by 0.8 percent m/m (in nominal terms) in October, vs. 0.6 m/m percent in September. Spending on services rose by 0.5 percent m/m while spending on goods rose 1.4 percent m/m. However, after accounting for inflation, real consumer spending rose by 0.5 percent m/m in October with spending on goods rising 1.1 percent m/m and spending of services rising 0.2 percent m/m. We expect personal consumption expenditure growth to slow over the coming months as tighter monetary policy drives interest rates higher. Note: nominal means non-inflation adjusted, while real means inflation adjusted.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024