-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

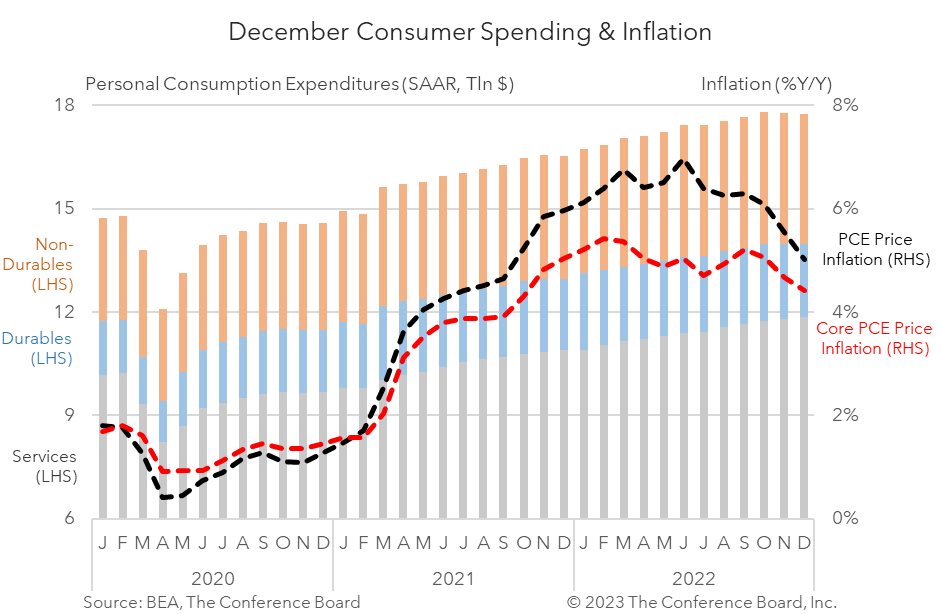

December Personal Income & Outlays data showed a cooling economy. Real consumer spending dropped by -0.3 percent month-over-month (m/m) – its second consecutive month of outright contraction. Meanwhile, inflation metrics continued to cool. Headline PCE price inflation slowed to 5.0 percent from a year earlier and cooled a touch in month-over-month terms. Personal incomes rose by 0.2 percent from the month prior. Collectively, these data will likely be interpreted by the Fed as a sign that monetary policy is working, and we expect it to hike by 25 basis points on February 1st following December’s 50 basis point hike. Headline PCE price inflation fell from 5.5 to 5.0 percent year-over-year (y/y) in December and core PCE price inflation (which excludes food and energy) fell from 4.7 to 4.4 percent y/y. On a month-over-month basis, headline PCE inflation rose by just 0.1 percent, but core PCE inflation rose by 0.3 percent (vs. 0.2 percent in November). While these readings remain well above the Fed’s 2 percent y/y target, progress is clearly being made. Overall personal income rose 0.2 percent m/m (in nominal terms) in December, vs. 0.3 m/m percent in November. Muted month-over-month inflation kept the real growth rate at about 0.2 percent as well. While real personal income growth was consistently negative in the first half of 2022, wage gains have been outpacing price increases for six consecutive months. Personal consumption expenditure dropped by -0.2 percent m/m (in nominal terms) in December, vs. -0.1 m/m percent in November. Spending on services rose by 0.5 percent m/m while spending on goods dropped -1.6 percent m/m. However, after accounting for inflation, real consumer spending fell to -0.3 percent m/m in December with spending on goods falling to -1.6 percent m/m and spending of services rising 0.5 percent m/m. We expect personal consumption expenditure growth to fall deeper into negative territory in the coming months driving the US economy into a recession. Note: nominal means non-inflation adjusted, while real means inflation adjusted.Inflation

Incomes

Spending

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024