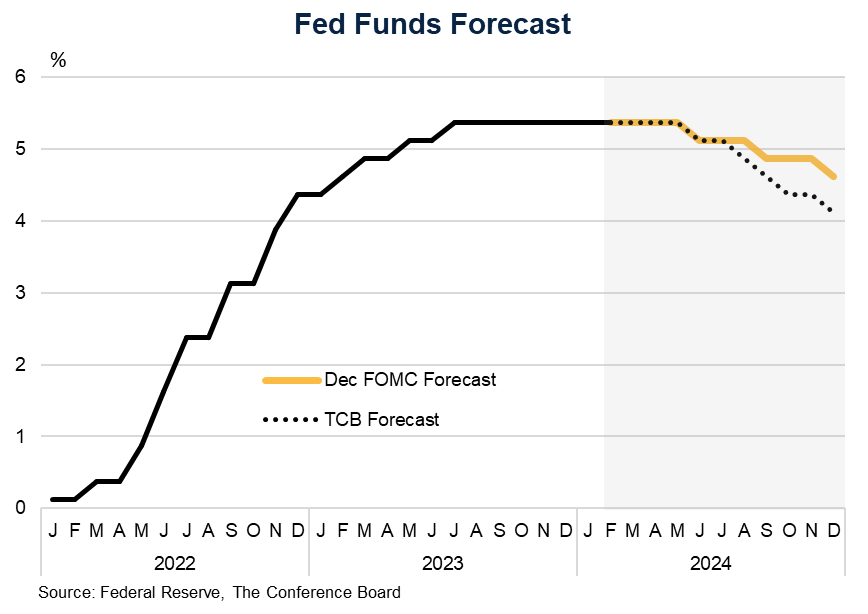

Insights for What’s Ahead On the economy, Chair Powell said that growth was “solid to strong” in 2023 but that he expects it to moderate. Overall, he sounded pleased about developments in the labor market, which he described as softening but strong. Powell said that the 12 month inflation rate remains well above where it needs to be, but that it has slowed substantially over the last six months. He stated that the Fed is confident that inflation is moving toward 2%. Even with this progress the Fed is not ready to begin scaling back tight monetary policy. Chair Powell said that the decision to begin making cuts is highly consequential and the Fed is in “risk management” mode. The Fed is concerned that loosening policy too soon or too quickly could hamper additional progress on inflation or even reverse it. Indeed, the FOMC statement said that the Fed needs “greater confidence that inflation is moving sustainably toward 2 percent” before it begins to make cuts. On timing, no clear guidance was provided about when policy will begin to loosen. The Fed remains data dependent, per Powell. However, he did say that it is unlikely that the FOMC would decide to cut rates at its next meeting in March. Powell also said that the Fed’s balance sheet runoff would continue, but that an “in-depth discussion” of the balance sheet would occur at the next meeting. Today’s actions were unanimously approved by the members of the Federal Open Market Committee.

Highlights

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023