-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

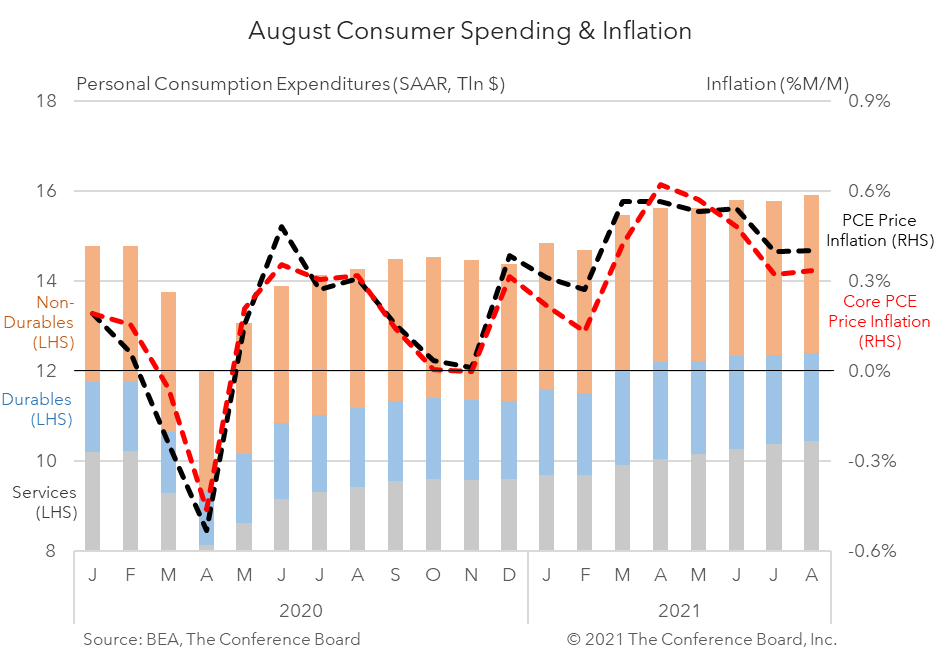

August Personal Income & Outlays data, released this morning, show an economy that continues to grow despite the impact of the Delta variant. According to the Bureau of Economic Analysis (BEA), American incomes and spending continued to expand in August, and inflation held relatively steady. As the severity of the current wave of COVID-19 ebbs, we expect consumer spending to continue to grow, especially on in-person services. The tight labor market should also benefit personal income in the months ahead, although the expiration of some federal unemployment benefits in early September may result in a temporary dip. While year-over-year (y/y) inflation rose to a 30 year high in August the month-over-month readings held steady. We anticipate continued moderation in many of the pressures driving prices higher in the coming months. Overall personal income rose 0.2 percent (in nominal terms) month-over-month (m/m) in August, driven by gains in wages and rental income. While employment growth moderated for the month, wage growth continued to expand. Looking ahead, personal income may temporarily dip due to the recent expiration in the Federal government’s enhanced unemployment benefits, but should rebound on the back of stronger wage growth and improved employment readings toward the end of the year. Personal consumption expenditures rose 0.8 percent m/m in August following a 0.1 percent m/m decrease in July. Spending on services rose by just 0.6 percent m/m while spending on goods rose by 1.2 percent m/m. The slowdown in service spending corresponds with August retail sales data and is associated with elevated consumer hesitancy about consuming in-person services due to the Delta variant. Meanwhile, spending on durable goods fell by 0.4 percent m/m (driven by weak motor vehicle sales) while spending on non-durable goods rose by 2.1 percent m/m. The overall strength seen in spending on goods mirrors the pattern seen last year, when previous waves of COVID-19 channeled consumer spending toward things that they could consume at home. Looking forward, we expect spending on in-person services to strengthen as the threat of Delta wanes. Headline PCE price inflation came in at a 30 year high of 4.3 percent year-over-year (y/y), vs. 4.2 percent y/y in July. The BEA also reported that Core PCE Inflation, excluding food and energy prices, was stable from the previous month at 3.6 percent y/y. Critically, the month-over-month growth rates for these key inflation metrics both held steady. Headline PCE inflation was 0.4 percent m/m in August, vs. 0.4 percent m/m in July and Core PCE inflation was 0.3 percent m/m in August, vs. 0.3 percent m/m in July. Durable goods prices continued to be the driving force behind much of the inflation seen in these data. As supply chain bottlenecks gradually abate prices for certain goods should ebb. However, some price increases associated with things like higher wages and semiconductor shortages may be more persistent.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Consumer Confidence Declined for Second Consecutive Month in February

LEARN MORECharts

Omicron, Inflation, and Fed Dampen US Growth Prospects

LEARN MORECharts

Almost two years after the COVID-19 pandemic plunged the United States and the world into economic and social disruption, the nation is recovering.

LEARN MORECharts

High demand for labor is resulting in rapid hiring of the unemployed.

LEARN MORECharts

The Conference Board’s Salary Increase Budget Survey indicates that the average annual raise for current employees is accelerating.

LEARN MORECharts

The Conference Board Consumer Confidence Index® declined in November, following an increase in October. The Index now stands at 109.5 (1985=100), down from 111.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORECharts

America’s recent decline in global competitiveness raises concerns about the nation’s future economic stability and national security

LEARN MORECharts

Firms are struggling mightily to hire workers.

LEARN MORECharts

Crypto tokens--or cryptocurrencies---have a notional market value of more than $2.5 trillion today and are on pace to expand exponentially.

LEARN MOREFilter By Center

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

PRESS RELEASE

Stagnant Productivity Growth Returns

April 29, 2022