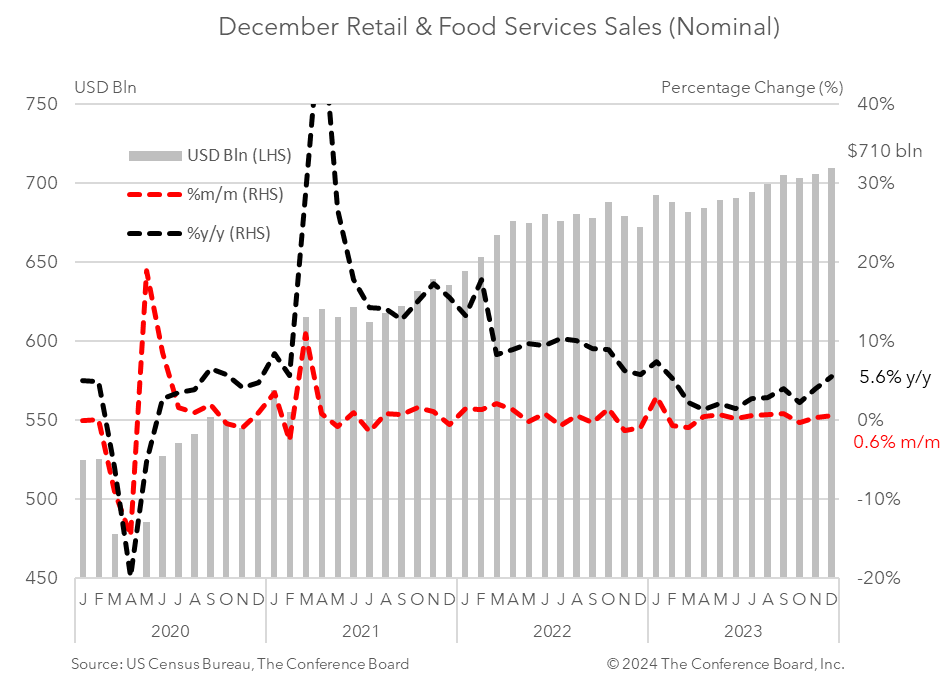

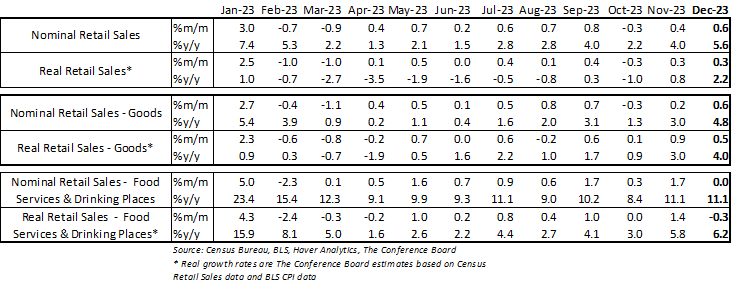

Retail sales were robust in December, closing out a year in which US consumer spending continually surprised to the upside. Retail spending rose by 0.6% m/m in December, vs. 0.4% m/m in November and a decrease of 0.3% m/m in October. After adjusting for inflation using CPI data, real December spending growth was up 0.3% from November.* Real retail sales were up 1.1 percent annualized in Q4 2023 compared to 3.2 percent annualized in Q3 2023. These data show that US consumers did not pull back on spending activity over the holiday period. While not quite as robust as spending over the summer, these data will help secure a healthy expansion in GDP in Q4 2023. Looking into 2024 we expect these data to cool as US consumers contend with high interest rates, elevated prices, rising debt, and falling savings. These headwinds to consumption coupled with a pullback in business investment associated with decades-high interest rates may tip the economy into a recession later this year. Regarding the drivers of retail sales this month: Consumer demand for goods rose 0.6% from the month prior in nominal terms. Spending on motor vehicles and parts rose by 1.1% in December from November, while retail sales excluding motor vehicles rose by 0.5%. Spending at gasoline stations fell 1.3% from the month prior due to further declines in oil prices. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 0.8% from the previous month. Nonstore retail sales rose 1.5% from the month prior and spending at department store rose 3.0%. When adjusting goods spending for CPI inflation, the real growth rate was about 0.5%.* Meanwhile, spending at food services and drinking places rose by 0.0% month-over-month in December. After adjusting for CPI inflation the real growth rate was about -0.3%.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023