-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

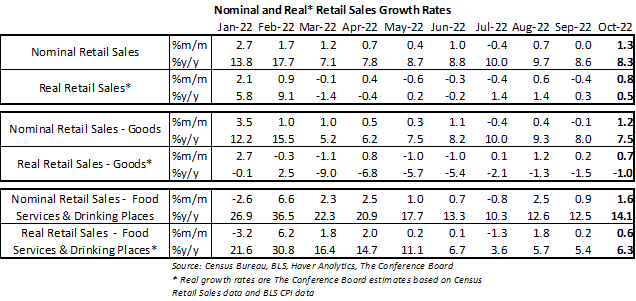

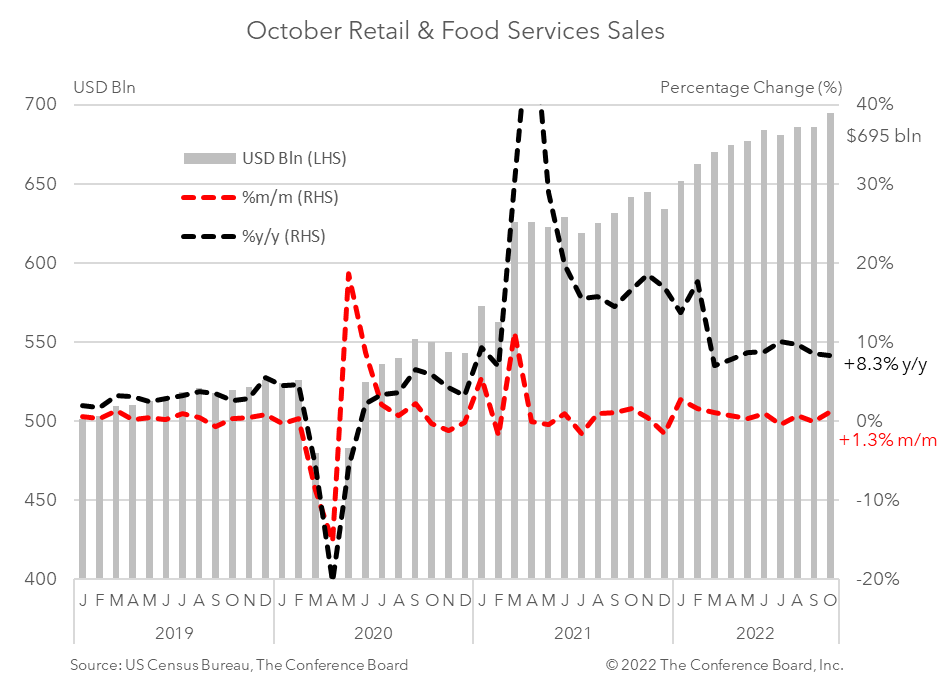

Retail sales were unexpectedly strong in October, rising 1.3 percent month-over-month and 8.3 percent from a year earlier in nominal terms. While gasoline sales led the increase, spending ticked up in many categories—including auto dealers, grocery stores and non-store retailers. Even when adjusted for inflation, sales were the strongest seen since February, rising 0.8 percent from the previous month.* It is unclear whether the spike is associated with early holiday shopping. Looking ahead, we do not expect this strength to continue as inflation and interest rates continue to weigh on consumers. Consumer demand for goods jumped in October—rising by 1.2 percent from the previous month in nominal terms. Spending on motor vehicles and parts rose by 1.3 percent in October from September, while retail sales excluding motor vehicles and parts rose by 1.2 percent. Spending at gasoline stations rose 4.1 percent for the month on higher crude oil prices. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose 0.7 percent from the previous month. Online sales at non-store retailers rose 1.2 percent in October. When adjusting goods spending for CPI inflation the real growth rate was about 0.7 percent from the previous month.* Meanwhile, spending at food services and drinking places rose by 1.6 percent month-over-month, vs. 0.9 percent in September. However, after adjusting for CPI inflation, the real growth rate rose by about 0.6 percent from the previous month.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024