-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

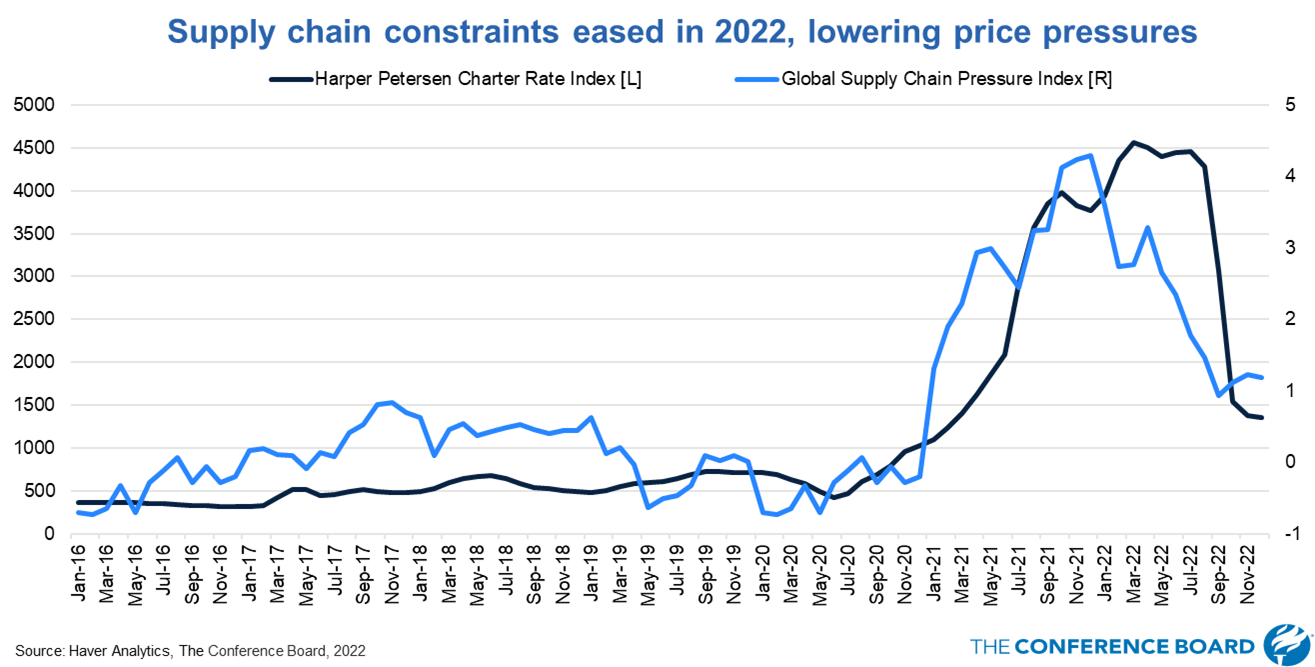

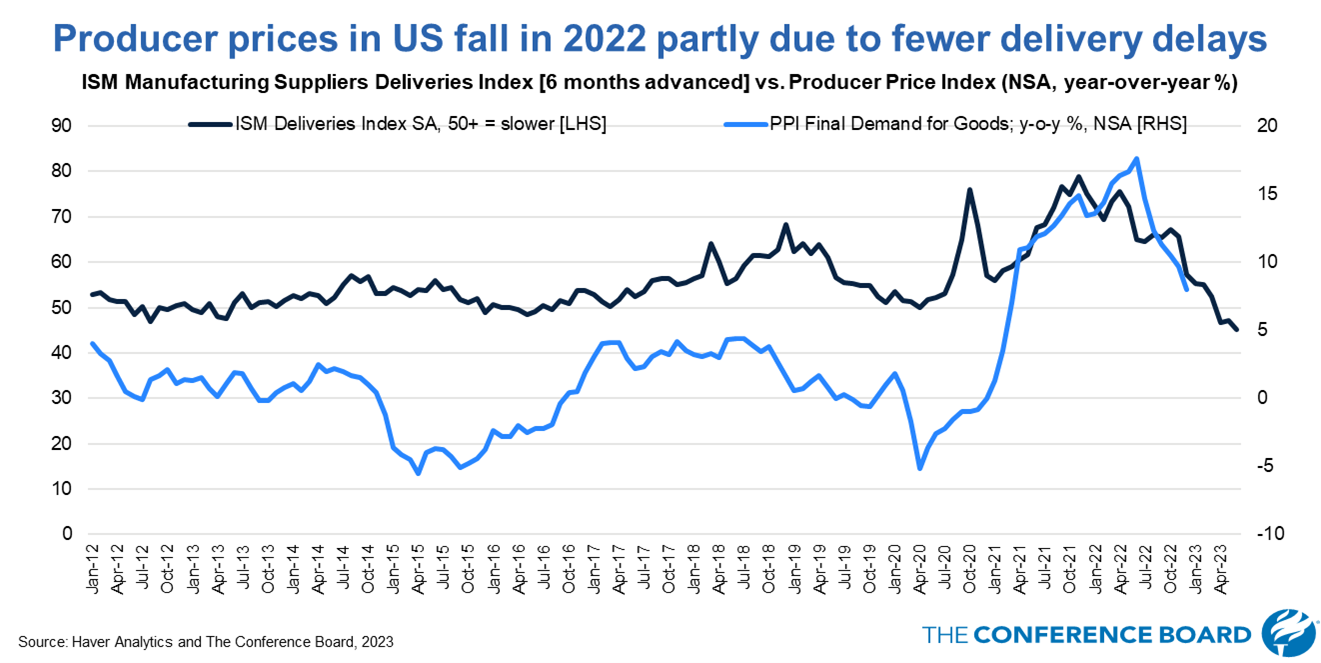

Supply chain disruptions were a main contributor to domestic inflationary pressures when they reached unprecedented peaks during the first year of the COVID-19 pandemic. The Global Container Freight Index spiked from roughly $1,500 in early 2020 to approximately $11,000 in the fall of 2021.[i] Cargo vessels experienced long delays at ports in China due to COVID lockdowns and those delays affected US ports as well. In the US, container lines had to contend with disruptions due to inefficiencies stemming from unavailable shipping vessels or vessels being inefficiently used below their available capacity.[ii] This resulted in significant delays before shippers could drop their containerized freight at either Los Angeles or Long Beach port facilities. In turn, domestic consumers experienced long wait times for goods manufactured overseas or for components needed for domestic production in the US. In recent months, however, the situation has markedly improved. US consumer demand has shifted back to services and away from goods. Partially as a result, shipping rates have fallen by more than 80 percent from their peak; some data sources even point to shipping rates being back to their pre-pandemic levels.[iii] Port congestion and delays along East and West Coast ports have been mostly resolved (Figure 1). In fact, as reported in late November, there is no longer a container vessels queue in the approach to the dual ports of Los Angeles and Long Beach.[iv] Moreover, the US ISM Manufacturing Deliveries Index, an indicator that measures if deliveries delays are improving or worsening, for December 2022 now stands at below pre-pandemic levels and wholesale prices for goods have slowed their ascent (Figure 2).[v] Figure 1 Nevertheless, some supply chain disruptions caused by crop issues, Russian sanctions, or impacts from the war in Ukraine will likely continue. Additionally, the collapse of demand in China late in 2022 and slowdown in economies around the world could also result in additional adverse impacts for the shipping industry in 2023. Historically, shipping has been sensitive to swings in economic activity, and with a global slowdown likely this year, these impacts will directly be felt by container lines and beneficial cargo owners in the US. Figure 2 Note: For the ISM Manufacturing Suppliers Deliveries Index a reading of greater than 50 indicates slower deliveries, a reading of less than 50 indicates faster deliveries. The data in the graph has been advanced by 6 months to illustrate the delay in the relationship between deliveries and producer prices. Over the coming months, we expect that the reductions in transportation prices and logistics costs will be beneficial for domestic goods prices overall. While these trends will not be significant enough to counter all inflationary pressures, especially when including prices of services, they will without a doubt provide a cushion for inflation throughout the US economy. [1][1] Freightos Data Index, https://fbx.freightos.com/ [1] Lee Bridget “Container shipping situation worsens due to congestion, delays, and empty containers” S&P Global Commodity Insights, May 30, 2022. [1] Shanghai Containerized Freight Index, https://en.sse.net.cn/indices/scfinew.jsp [1] Paul Berger “Southern California’s Container Ship Backup Ends” The Wall Street Journal, November 22, 2022. [1] ISM Report on Business, https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/december/

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

US Leading Economic Index® (LEI) Fell in March

April 18, 2024

PRESS RELEASE

US Consumer Confidence Little Changed in March

March 26, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Inched Up in February

March 21, 2024

PRESS RELEASE

US Consumer Confidence Retreated in February

February 27, 2024

PRESS RELEASE

US Leading Economic Index® (LEI) Fell Further in January

February 20, 2024

PRESS RELEASE

CEO Confidence Improved in Q1 2024

February 08, 2024